🏌️♀️⛳

I wanna see a video of you golfing with her.

https://twitter.com/WeThePeople021/status/1749080573576929450?t=HA6IkabeEmGCds2rPdFuBg&s=19

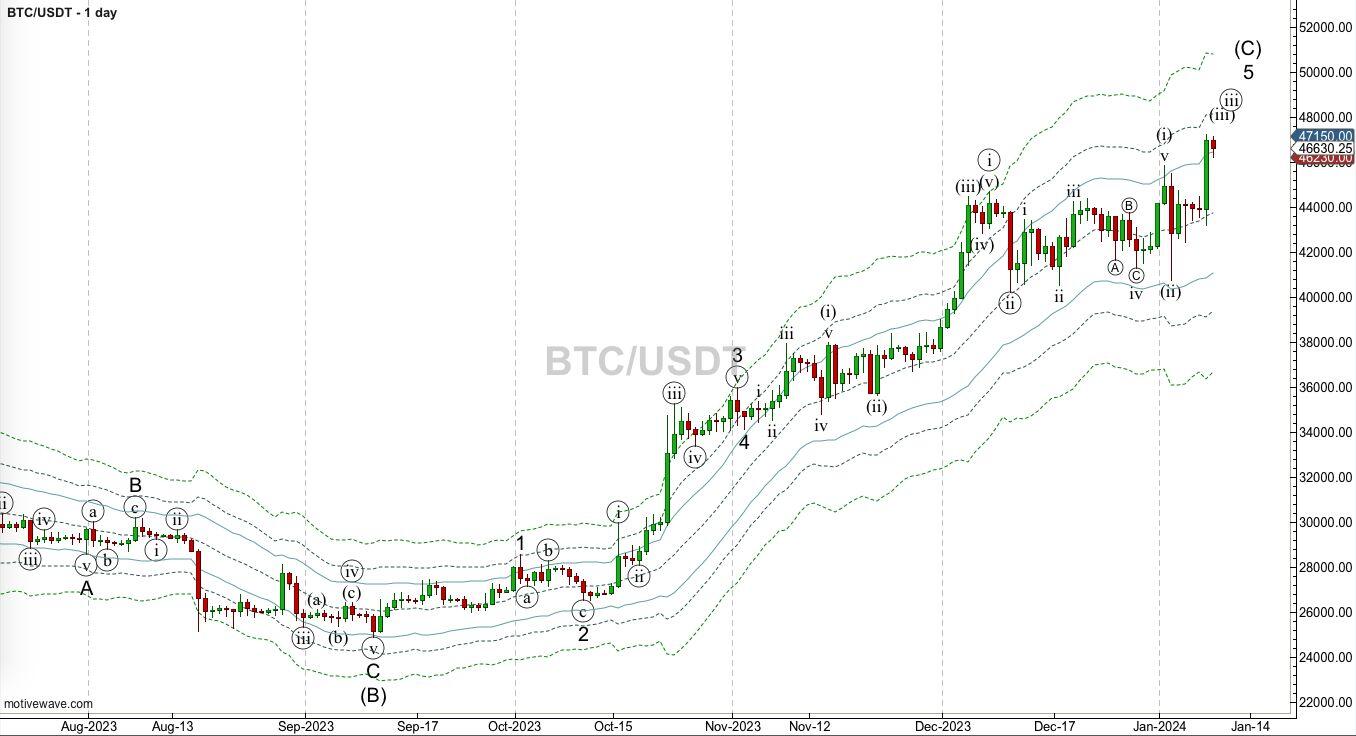

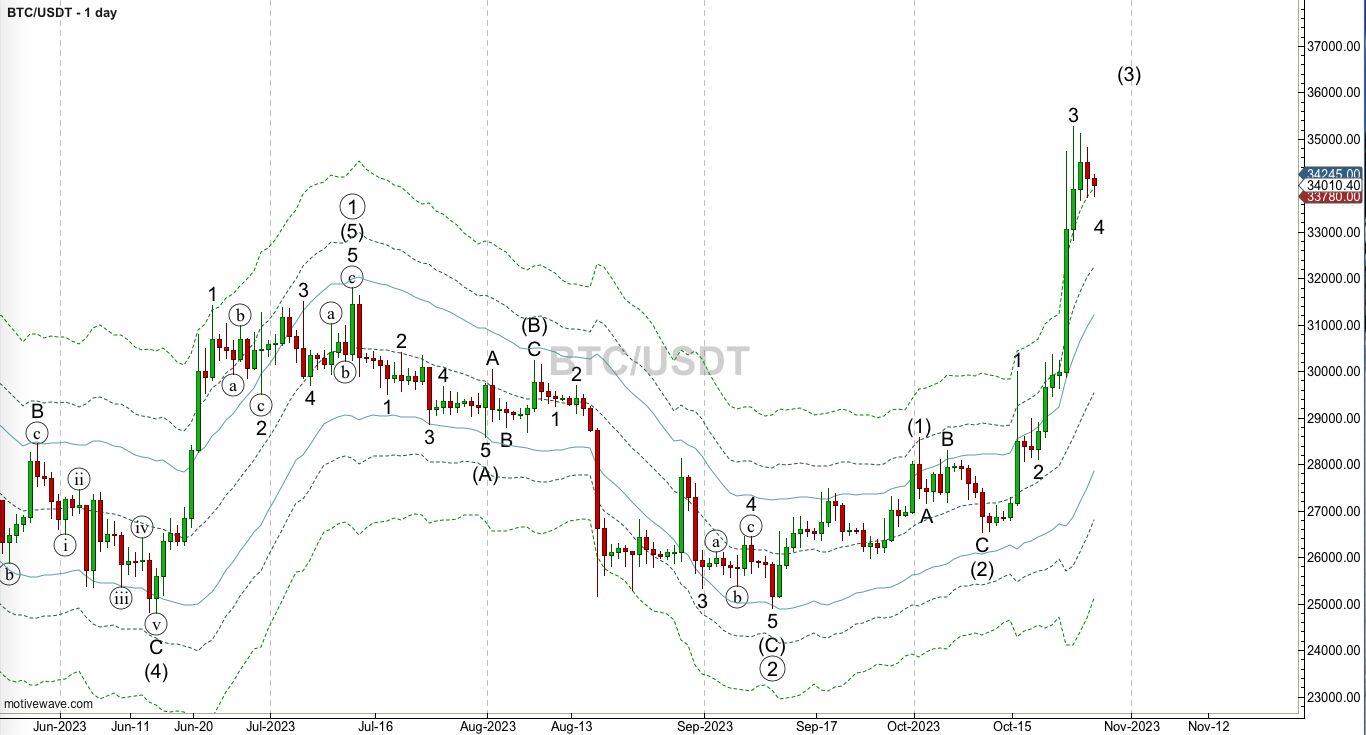

#Bitcoin

$BTC #ElliottWave #BollingerBands

#m=image%2Fjpeg&dim=1353x736&blurhash=i5S%24ov%25MIUt7D%25t7M%7BxuE1%7EX-%3BM%7BWBoMaxWBayoL%2539FRjxvkBayWAWCoLxuIUxuRjIUt7aej%5BWBIU-%3BofInxbjbWUWBV%5B&x=8a5b6e8c2a264a4c411b4cdfa71c13b8c53cfadee9e5da1f6e21cf1021260f8c

#m=image%2Fjpeg&dim=1353x736&blurhash=i5S%24ov%25MIUt7D%25t7M%7BxuE1%7EX-%3BM%7BWBoMaxWBayoL%2539FRjxvkBayWAWCoLxuIUxuRjIUt7aej%5BWBIU-%3BofInxbjbWUWBV%5B&x=8a5b6e8c2a264a4c411b4cdfa71c13b8c53cfadee9e5da1f6e21cf1021260f8c

[ Day ]

#Bitcoin #Fibonacci

1.618 → 2.272 Theory (update)

#m=image%2Fjpeg&dim=1920x1206&blurhash=rBR%7Bx%25J7%24Qo%7Cx%5Drspc%24kxvDO_N-VRio%7Dn4OpMxR*%5E%2C.8IUD%25RjniWCRPW.-%3DDhE1s%3Bj%3Fo%7DxHx%5Dt6.SH%3FkX-qV%40Oqa0bvRipvMdkqt6VYX9n4o%23nj&x=b5cf7dfb1523dbb612c62dcfe5f4d497a5018381bd8c049d3010925c17937e4f

#m=image%2Fjpeg&dim=1920x1206&blurhash=rBR%7Bx%25J7%24Qo%7Cx%5Drspc%24kxvDO_N-VRio%7Dn4OpMxR*%5E%2C.8IUD%25RjniWCRPW.-%3DDhE1s%3Bj%3Fo%7DxHx%5Dt6.SH%3FkX-qV%40Oqa0bvRipvMdkqt6VYX9n4o%23nj&x=b5cf7dfb1523dbb612c62dcfe5f4d497a5018381bd8c049d3010925c17937e4f

Comparing the recovery and extension of the 2011, 2014 and 2018 bearmarkets, the following repeating structure is observed.

🟢 First Struggle to overcome the 0.618-0.786 before ATH.

🔴 Second Struggle to overcome the 1.618 extension resistance.

When breaking through the 🔴 1.618 resistance, previous 2 times price flew within 1-3 months to its next cycle top at around the 2.272 extension.

Guess what, the 2.272 extension of the 2018 bearmarket lies at $205k.

source:

https://twitter.com/GertvanLagen/status/1746111542100164721?t=PFF3DLIFa-vT5Pg-xvNlhg&s=19

#Bitcoin

$BTC #ElliottWave #BollingerBands

#m=image%2Fjpeg&dim=1361x736&blurhash=i5S%24ovxvIUkBIUoyM%7Bt7IU%7EX-%3BM%7BWBoMWBWBayoMt79YRj%25MWBayWBWVj%5Bt7InxuRjIUt7ayj%5BayRP-qofIUxuj%5BWBRjWB&x=abd4fda78385bee14a469bbc10c61307f097e9f9d6931727be65451e05925b54

#m=image%2Fjpeg&dim=1361x736&blurhash=i5S%24ovxvIUkBIUoyM%7Bt7IU%7EX-%3BM%7BWBoMWBWBayoMt79YRj%25MWBayWBWVj%5Bt7InxuRjIUt7ayj%5BayRP-qofIUxuj%5BWBRjWB&x=abd4fda78385bee14a469bbc10c61307f097e9f9d6931727be65451e05925b54

[ Day ]

coast⚡

tin⚡

nit⚡

in⚡

#StackSats

1 sat, 2 sats, 3 sats, 4

1 sat is currently valued at about $0.0002616 USD. Still early.

#Bitcoin

$BTC #ElliottWave #BollingerBands

#m=image%2Fjpeg&dim=1356x736&blurhash=i3Ss87-%3BIBt69GxuIUxu9F%7Eq%7EXD%25M%7Bt7RjWBj%40juoMD%25D%25%3FbogRjRja%7DWB-%3B4-t7f84-%25Mf6ofkBxbxu-%3BE0Rj%25NM%7BIUt7&x=eab35d3a316e58fc6c0063aaaed20be0da7924f2ea1083abf3b46744d02455f9

#m=image%2Fjpeg&dim=1356x736&blurhash=i3Ss87-%3BIBt69GxuIUxu9F%7Eq%7EXD%25M%7Bt7RjWBj%40juoMD%25D%25%3FbogRjRja%7DWB-%3B4-t7f84-%25Mf6ofkBxbxu-%3BE0Rj%25NM%7BIUt7&x=eab35d3a316e58fc6c0063aaaed20be0da7924f2ea1083abf3b46744d02455f9

[ Day ]

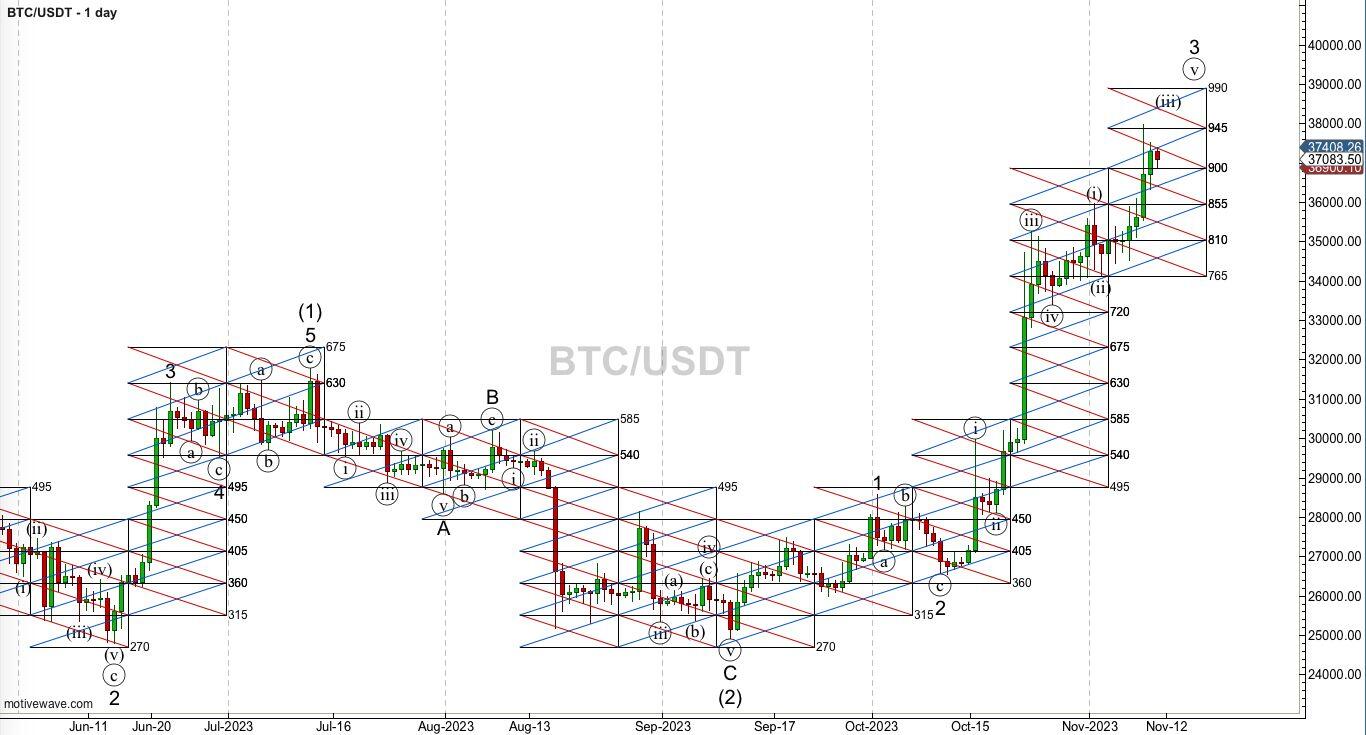

#Bitcoin

$BTC #ElliottWave

#m=image%2Fjpeg&dim=1362x733&blurhash=i3Ss4%7ED%249FtQ9Fxu4n%25g4-%7EqM%7B9Fxuozt8ayRQV%5B_N-%3D%25NRPM%7BoMxuV%5BjaIU%25M%25MIUjZInIUxut79FE0D%25-%3Ba%23R*ofM_WB&x=5018864e1d08f2c9c444cd3f9863edb7f75be6bc9e93d63db95c44e934a04226

#m=image%2Fjpeg&dim=1362x733&blurhash=i3Ss4%7ED%249FtQ9Fxu4n%25g4-%7EqM%7B9Fxuozt8ayRQV%5B_N-%3D%25NRPM%7BoMxuV%5BjaIU%25M%25MIUjZInIUxut79FE0D%25-%3Ba%23R*ofM_WB&x=5018864e1d08f2c9c444cd3f9863edb7f75be6bc9e93d63db95c44e934a04226

[ Week ]

#Bitcoin

#m=image%2Fjpeg&dim=1920x1206&blurhash=rNH3%24_U_8xIo8_M_QnxGa*.mi%7BRjWBRiRjenn%24of00b%5Ex%5Boexut7o%7DWXWAQ.ofoykCkWbIkCjtfiE2WAjYa%7DoMj%5Dj%3Fa%7Cf6D4kUo%7DkDozoMkVbEj%3F&x=b16dff6aa2566bba7a0a8416a62e864c851fb4ac07cb9df17dfa8f4ebe2bccb3

#m=image%2Fjpeg&dim=1920x1206&blurhash=rNH3%24_U_8xIo8_M_QnxGa*.mi%7BRjWBRiRjenn%24of00b%5Ex%5Boexut7o%7DWXWAQ.ofoykCkWbIkCjtfiE2WAjYa%7DoMj%5Dj%3Fa%7Cf6D4kUo%7DkDozoMkVbEj%3F&x=b16dff6aa2566bba7a0a8416a62e864c851fb4ac07cb9df17dfa8f4ebe2bccb3

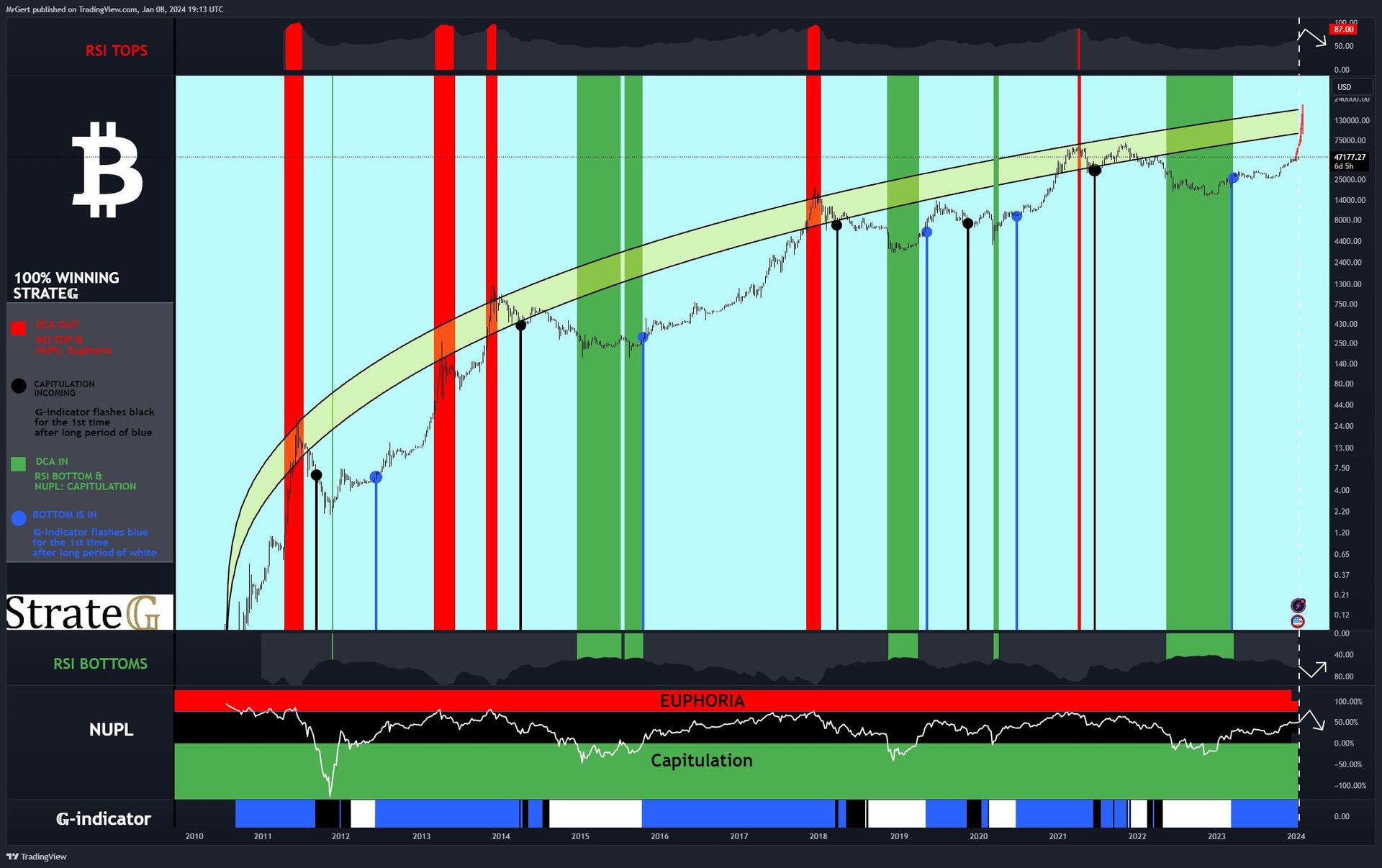

STRATE𝔾

Update -

📢 Bull market intact, aiming for the upper yellow band at ~$200k.

100% Winning STRATE𝔾 for #Bitcoin :

🟩 DCA IN

RSI Bottom, NUPL: Capitulation

🔵 BOTTOM IS IN (all-in)

𝔾-indicator flashes blue after long time white

🟥DCA OUT

RSI Top, NUPL: Euphoria

⚫️CAPITULATION INCOMING (all-out)

source:

https://twitter.com/GertvanLagen/status/1744437376934359373?t=iDQT3TAsDGlL-kipgXTeBA&s=19

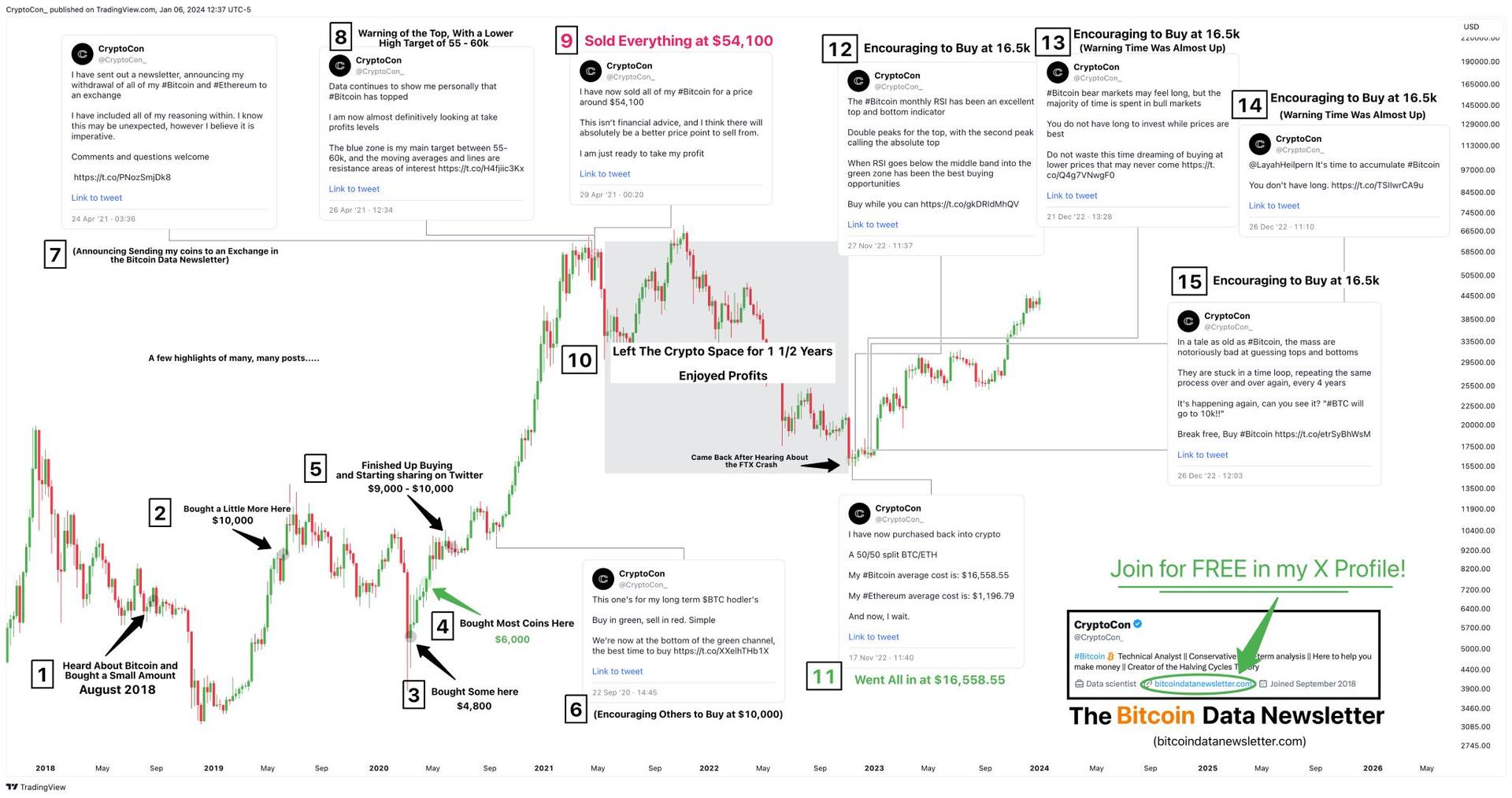

#Bitcoin

The Bitcoin Data Newsletter

#m=image%2Fjpeg&dim=1920x1013&blurhash=i2SPX_-p_2k9RQ0J%7EWI-M%7BIDR*-%3BR-Ri-pNF%25MkDMyog4nE0%7EqRQ9GkWxtD%24DiM_Rj-%3B-%3BD%25ITMx%3FItR%3FboeIUaM%25fs%3BIU&x=0745dafa0bc902844188711ee3db130911563bd901157483b1d23e963828bd00

#m=image%2Fjpeg&dim=1920x1013&blurhash=i2SPX_-p_2k9RQ0J%7EWI-M%7BIDR*-%3BR-Ri-pNF%25MkDMyog4nE0%7EqRQ9GkWxtD%24DiM_Rj-%3B-%3BD%25ITMx%3FItR%3FboeIUaM%25fs%3BIU&x=0745dafa0bc902844188711ee3db130911563bd901157483b1d23e963828bd00

Last cycle I bought all my #Bitcoin below 10k.

Then I sold it all at 54k in April 2021.

Now I'm all in from 16.5k Nov 2022.

My only mission is to help you succeed.

The best way is my newsletter, which you can join for free in my profile!

source:

https://twitter.com/CryptoCon_/status/1743688882862903748?t=O9l1s3k6iy3B3egn6vWtoQ&s=19

#Bitcoin ETF

Investing in a Bitcoin ETF offers several benefits, including:

Regulated Investment Structure:

A Bitcoin ETF provides a regulated and well-known investment structure, allowing investors to track changes in the price of Bitcoin within established confines.

Diversification and Simplified Investing:

ETFs often hold a basket of Bitcoin, allowing for diversification, and they enable daily buying and selling of shares, similar to other publicly-traded securities.

Exposure Without Ownership Expenses or Risk:

Investing in a Bitcoin ETF provides exposure to Bitcoin without the additional ownership expenses or exposure to the risks associated with holding the cryptocurrency directly.

Liquidity and Market Stability:

ETFs offer liquidity and transparency, and their approval can lead to market stability around Bitcoin, contributing to a more mature and stable market.

Increased Adoption and Mainstream Confidence:

The introduction of a Bitcoin ETF, such as the anticipated BlackRock Bitcoin ETF, could increase the legitimacy of Bitcoin as a form of investment and attract more institutional adoption, providing confidence to investors.

In summary, investing in a Bitcoin ETF offers regulated exposure, diversification, simplified investing, and potential market stability, making it an attractive option for investors seeking to gain exposure to Bitcoin.

source: Perplexity.ai

#Bitcoin 2024 🎉

Happy New Year!

#BTC /USD #ElliottWave #GannPyrapoints

Day

#Bitcoin

Harder Than #Gold, Faster Than #Fiat

https://www.zerohedge.com/crypto/harder-gold-faster-fiat

JUST IN: #Bitcoin to hit $750K-$1 MILLION by 2026 - Bitmex founder Arthur Hayes

#BTC /USD #ElliottWave #BollingerBands

Day

#Bitcoin #SatoshiNakamoto