Regarding the MiCA, the Travel Rule, and other ongoing EU regulations, I see two immediate consequences. The first, related to users who will seek to circumvent these regulations, is the increased use of P2P platforms and the exponential emergence of new platforms. The second concerns companies in the EU that either do not want to or cannot comply with the regulations. We will witness an exodus of companies, a flight of human capital, and a migration of Bitcoin and bitcoiners to freer jurisdictions where they can innovate and conduct business without dealing with intrusive governmental actors who require them to provide all customer data and store it for five years at their own expense and time.

Europe, as it stands now, is lost, there is no way for it to regenerate from within. There simply aren’t enough people opposing the status quo—there are not enough voices, no leaders. It’s every person for themselves, we are responsible for our own survival.

Bitcoiners are inventive individuals, each will find their own solution to avoid the deeply corrupt and vile system. Some will bow down and conform, losing their backbone along with their anonymity and the rights they have relinquished.

#TravelRule #MiCA #DORA #Bitcoin

¡Maravilloso, Jona! ¡Muchas gracias!

Realmente es algo que me interesa, tal vez hablemos más sobre esto cuando nos veamos.

Hice modificaciones en el proyecto y cambio hasta la URL 😅

La nueva URL demo es: https://llamout.vercel.app/

✅ ✅ ✅ 😎

¡Funciona!

Oh là là!

The French Senate is proposing a tax that would mandate #Bitcoin hodlers to pay annual taxes, regardless of whether they sell their "unproductive" assets or not. 🤣🤣🤣

Subject

This amendment aims to replace the "real estate" wealth tax (IFI) with a tax on "unproductive" wealth.

Indeed, the calculation base of the IFI, which includes real estate assets that are unused in the owner's professional activity, seems economically incoherent.

On one hand, "paper stones" and real estate investments are included in the scope of the IFI, while they constitute productive investments that contribute to growth and meet the needs of households and businesses. From this perspective, it is incorrect to consider real estate as unproductive investments.

On the other hand, the IFI excludes from its base assets that do not evidently contribute to the dynamism of the French economy. Limiting the current base of the IFI to real estate assets leads to the exemption of certain heritage elements, such as liquidities and consumer goods, which represented a significant part of the ISF base and are hard to consider "productive."

Paradoxically, an "anti-economic" strategy that consists of selling a currently rented apartment to leave the obtained sum in a current account or to buy a yacht currently allows for the avoidance of the IFI.

Through this amendment, the following would be included in the base of this reformed IFI:

Unbuilt land (e.g., buildable land) when not used for economic activity;

Liquidities and equivalent financial investments (current accounts, savings, money market funds, etc.);

Tangible movable assets (valuable items, cars, yachts, airplanes, furniture, etc.);

Digital assets (e.g., bitcoins);

Rights of literary, artistic, and industrial property when the taxpayer is not the author or inventor.

With this base, economic incentives would align with the original objective of encouraging productive investments. For example:

A person who decides to mobilize buildable land to make an investment in a rental property would be exempt from tax on that apartment, unlike the current situation under the IFI;

A taxpayer who decides to invest in a small or medium-sized enterprise (PME) would be treated more favorably for tax purposes than one who leaves savings in a current account, which is not the case under the current IFI.

Compared to the current IFI, the tax threshold would be raised to avoid taxing households that, without being considered wealthy, have become taxable due to accumulated inflation.

We remind that this amendment had already been adopted by the Senate, at the initiative of the former general rapporteur of the finance committee, Albéric de Montgolfier, during the examination of the budget bill for 2020, with a delayed application (January 1, 2021).

This amendment also provides for the replacement of the real estate wealth tax with a tax on unproductive wealth starting in 2025.

This amendment was adopted by the Senate during the examination of the budget bill (PLF) and the first rectifying budget bill (PLFR) for 2022, as well as within the PLF for 2023 and 2024.

Source:

https://www.senat.fr/amendements/2024-2025/143/Amdt_I-128.html

Thieves broke into the Drents Museum in Assen, Netherlands, stealing valuable items from the exhibition 'Dacia - Realm of Gold and Silver', which showcases treasures from the ancient kingdom of Dacia.

The theft happened just a day before the exhibition's closure.

https://nltimes.nl/2025/01/25/ancient-gold-artifacts-stolen-drents-museum-robbery

The Dutch police were only alerted when the thieves' car caught fire, half an hour after the robbery, not when the museum wall was breached.

There was no security guard present.

Welcome to Schengen Area, Romania!

I don't know... It seems that security was non-existent. Not even a damned guard.

Thieves broke into the Drents Museum in Assen, Netherlands, stealing valuable items from the exhibition 'Dacia - Realm of Gold and Silver', which showcases treasures from the ancient kingdom of Dacia.

The theft happened just a day before the exhibition's closure.

https://nltimes.nl/2025/01/25/ancient-gold-artifacts-stolen-drents-museum-robbery

Proof of steak > ̶P̶r̶o̶o̶f̶ ̶o̶f̶ ̶s̶t̶a̶k̶e̶

Bonus: Fernet Cola

🇦🇷 🇦🇷 🇦🇷

It's mind-blowing to see people with 0.0001 BTC on Coinbase celebrating the concept of a governmental Bitcoin strategic reserve. 💥

Senator Cynthia Lummis will serve as the chair of the Senate Bank Digital Assets Committee.

💯 %

I consider myself lucky to have experienced both worlds. I feel sorry for today's children who have no idea what it means to be free in nature, or simply put, offline.

Oh, the irony... How many Ledger users were attacked due to their Data Breach? How many people are at risk of being kidnapped from now on because of Ledger?

It would be interesting to know how many kidnappings have happened precisely because of Ledger. That would be an interesting news story.

Ross Ulbricht Is Free! ✌️

How long do you think it will take until he comes to nostr?

You know you're in a swamp when even the reverend at Trump's inauguration has created his own scam coin.

Buy $LORENZO and go straight to Heaven!

Amen!

https://news.bitcoin.com/pastor-lorenzo-sewell-launches-his-own-meme-coin/

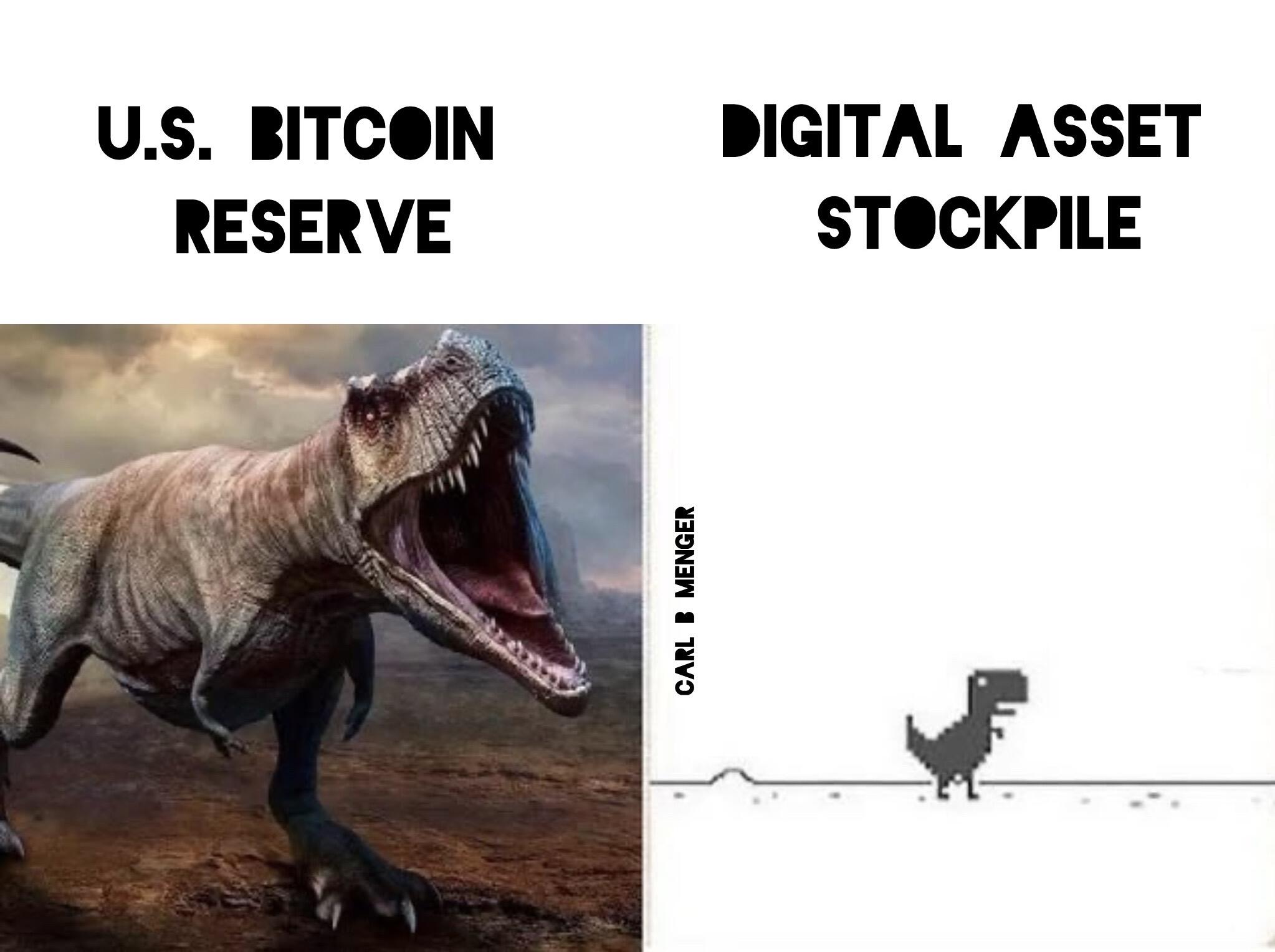

#Bitcoin #StrategicShitcoinReserve 🤡 🤡 🤡