What is your plan if nuclear war starts?

#Nostr #Plebchain #Plebs #Bitcoin #Sats #Zapathon

nostr:npub1dergggklka99wwrs92yz8wdjs952h2ux2ha2ed598ngwu9w7a6fsh9xzpc

Großartiger Auftritt bei der Bitcoin Doku!

Everidai

#Bitcoin

Gm frens

🖕 🖕

🖕🖕🖕🖕🖕🖕

🖕 🖕 🖕 🖕

🖕 🖕 🖕 🖕

🖕 🖕 🖕 🖕

🖕🖕🖕🖕🖕🖕

🖕 🖕 🖕 🖕

🖕 🖕 🖕🖕

🖕 🖕 🖕🖕

🖕🖕🖕🖕🖕🖕

🖕 🖕

#Bitcoin

When my kids gets older I want to tell them that I took part in saving the world from blood thirsty Central Bankers by holding my #bitcoin in cold storage. What will you tell your kids/grandkids when they get older?

It's almost 2024 and still nobody knows why Ethereum, Cardano or Ripple exists.

#bitcoin only.

The most difficult part of the cycle is here.

If you played your cards well, you will have filled up quality bags by now. Hold on tight.

With everything starting to move, sticking to the plan will become infinitely harder.

Do not fall for the FOMO. Do NOT overtrade.

#Bitcoin

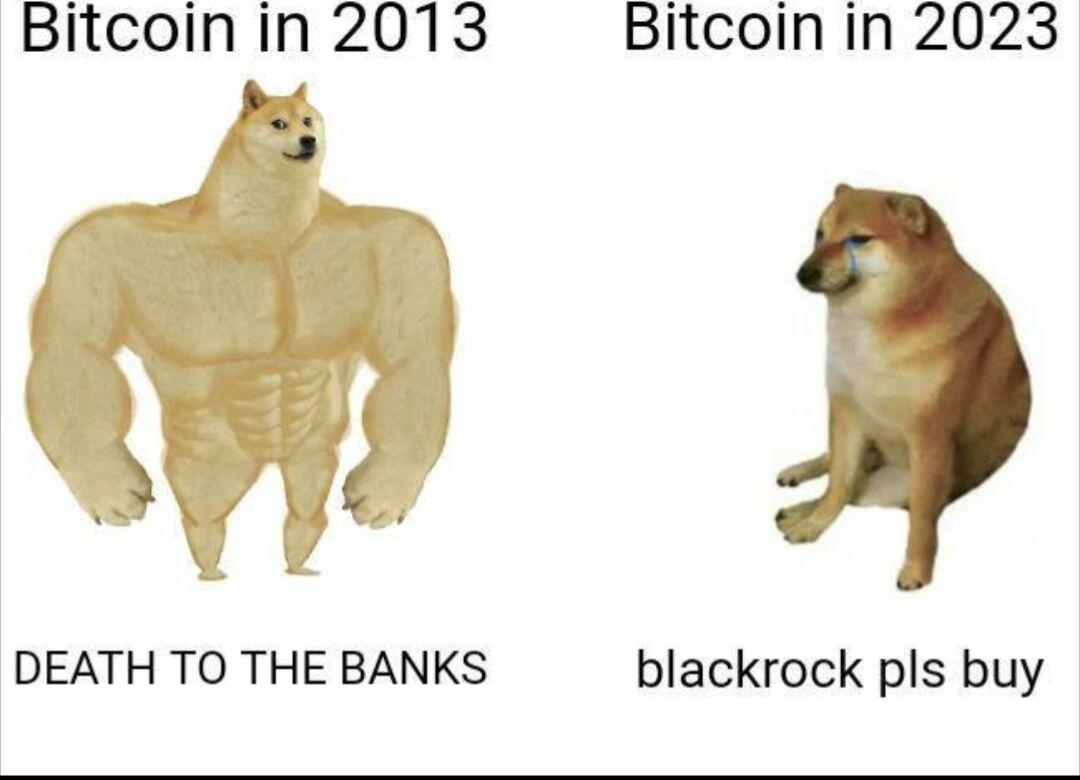

Bitcoin has undoubtedly empowered individuals with financial freedom and privacy in the digital age. While your text discusses a different topic, it's worth noting that the principles of decentralization, censorship resistance, and personal control that underpin Bitcoin can be applied to various aspects of our lives, including our choices and freedoms. It's essential to recognize that, just like in the realm of cryptocurrency, the notion of freedom is deeply rooted in respecting individual rights and personal autonomy.

nostr:npub12rzunrxvx89f78h4df284lzvkjqetljkq0200p62ygwmjevx0j8qhehrv9

10 million #sats is becoming the new 1 #BTC

Let's see what another #Bitcoin cycle brings.

#Hodl #Zapathon #Sats #Bitcoin #plebchain

What are your favorite movies over the past five years?

Send Sats⚡⚡⚡⚡

#Hodl #Zapathon #Sats #Bitcoin #plebchain

#Bitcoin

Ok, I've been doing some math, and my mind is officially blown. I don't think any of us are bullish enough on #BTC . Let's dive in. 👇

Monday's $3,000 BTC candle was a sign of what's to come. Several sources of demand converged onto BTC in a short window of time and caused the price to break out to its highest level in 15 months.

The known sources of estimated demand are:

- Daily buying pressure of $25m per day who soak up the daily issuance of new coins hitting the market.

- Market makers who were short futures and needed to own spot BTC to remain delta neutral. They represented $250m in shorts liquidated (aka rekt).

- $43m in demand from the likes of BlackRock, Fidelity and the gang seeding their spot ETFs.

All together that comes to $325m of demand which pushed price up $3,000 per BTC. The market cap of Bitcoin increased by $63 billion dollars from a few hundred million invested. The multiplier on that is 193x! That means that BTC's market cap increases by $193 for ever $1 invested in the coin. I have heard people talking about this multiplier effect, but it doesn't hit home until you run the numbers yourself.

Now, for the fun part. 👇

Blackrock estimates that $200 billion dollars will flow into Bitcoin from Blackrock's iShares ETF (ticker iBTC) and others in the first 3 years. That amount of demand, if spread evenly over 3 years would come to $183m per day excluding all other sources of demand. Multiply $183m by 193 and the Bitcoin market cap grows by $35 billion dollars per day. In terms of price, that would be about $1700 of price appreciation per BTC, per day. After 3 years, the BTC price would be over $2,000,000 from spot ETF demand alone.

The really mind-boggling part is that I excluded everything else that would also be bullish for BTC. Daily buying pressure could be far greater than what will come from the ETFs. I haven't accounted for the halving, nor the demand from sources other than the ETFs, nor the next nation state(s) to adopt BTC, nor the FOMO from retail investors, nor the next class of Bitcoiners from all walks of life.

Bitcoiners are known to be bullish. But most of us are nowhere near bullish enough.

#Bitcoin #Hodl #Reddit #Plebchain

Send me some sats bruh

#Bitcoin