Here comes another round of "Bitcoin is for terrorists" statements and opinion pieces.

Are fees going to flip the block subsidy after the halving?

Could you try making your channels 2M sat minimum? I know it's starting to get to the level where a lot of plebs can't put that much up. If you can, maybe it will be stable.

Nope, but it’s probably something that will increase in frequency. Moving business out of the US may be the only option for avoiding it if you want to maintain any privacy.

What is the point of coinjoining if you’re going to just link your input and output transactions for the government?

Very good article. I believe Liquid actually can help scaling to some degree but, as mentioned here, fedimints will be great. nostr:note1nyp0v09vzkmj9d5jdzqrumjdg3284spnkv5pn0nznmc38lkz7gqq289xep

Sounds like tax software to not use, or to edit the report it generates.

Is the Liquid federation resistant in any way to being compelled by the US government to impose KYC requirements?

Transactions fees are high. Did you manage your UTXOs appropriately while fees were low? Learn how to avoid getting burned by future high fees:

https://blog.lopp.net/economically-unspendable-bitcoin-utxos/

Coinjoining during low fee environments kind of takes care of this as a benefit additional to privacy. You tend to end up with larger-size post-mix UTXOs with the change being the (presumably small % of your stash) area to worry about future spendability.

Layer 2s for cash use cases like LN and Fedimints will get there eventually. Frustrating now, yes.

Addicts getting their fentanyl taken away. Gonna get pretty bad before getting better.

This might be a necessary component to such cities with strict space limitations. https://interestingengineering.com/innovation/china-unveils-vertical-farm-ai

Wow. Just wait until games have LLM-powered NPCs.

Smash the theft code.

An opinion piece advocating for strict government regulation of open source software. Interesting times ahead. https://techpolicy.press/how-to-regulate-unsecured-opensource-ai-no-exemptions

One possible downside to using the poor privacy of Bitcoin's blockchain as a reason to avoid knee-jerk regulations is the same argument could be used to support knee-jerk regulations against privacy tech like coinjoins and Lightning features.

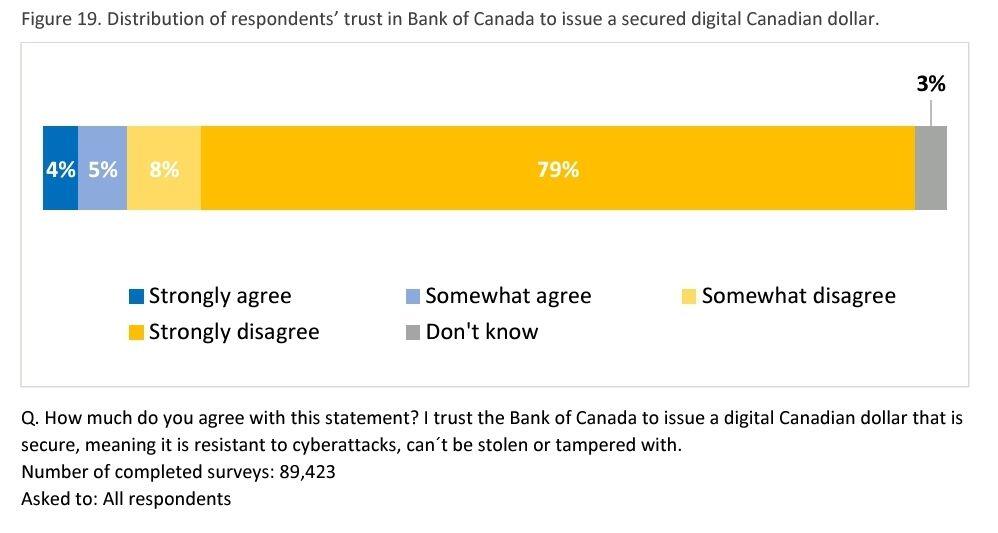

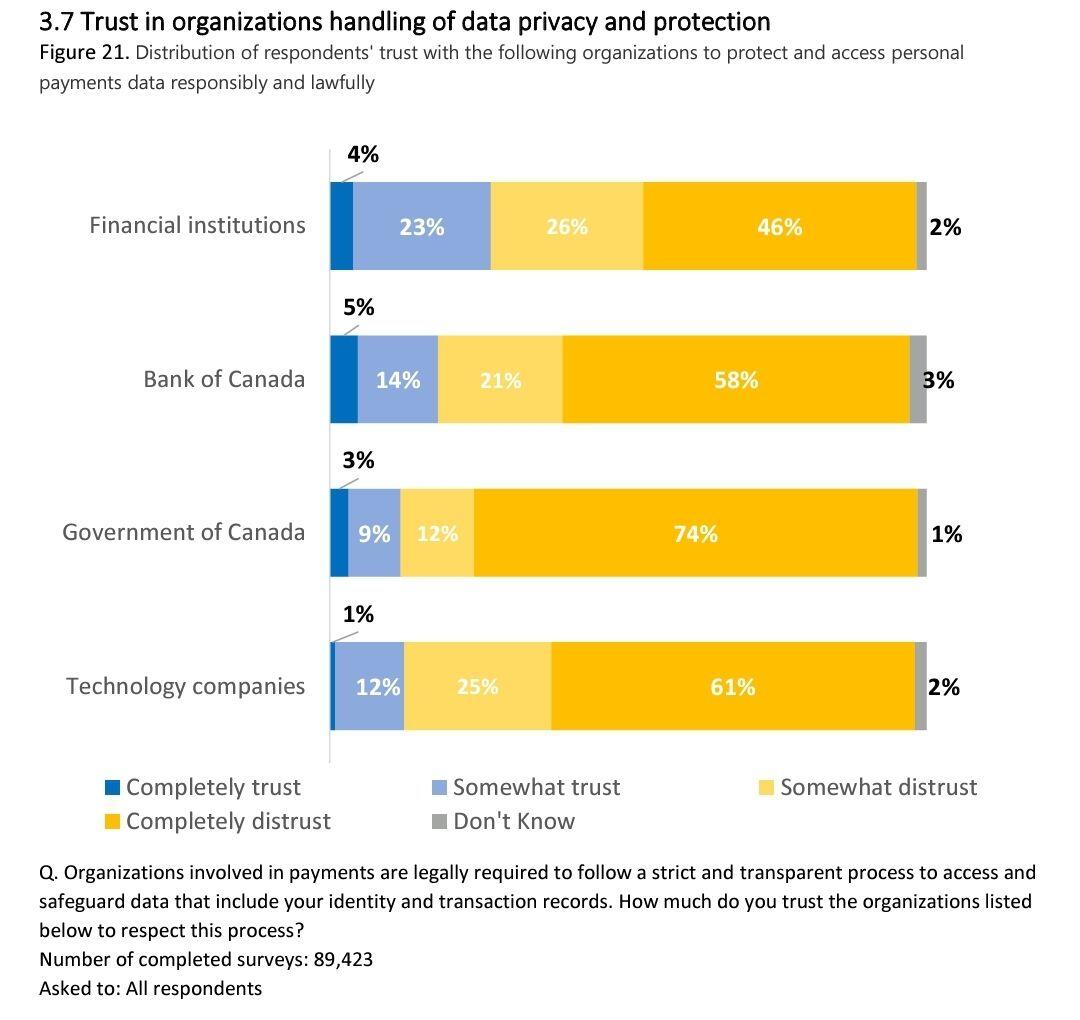

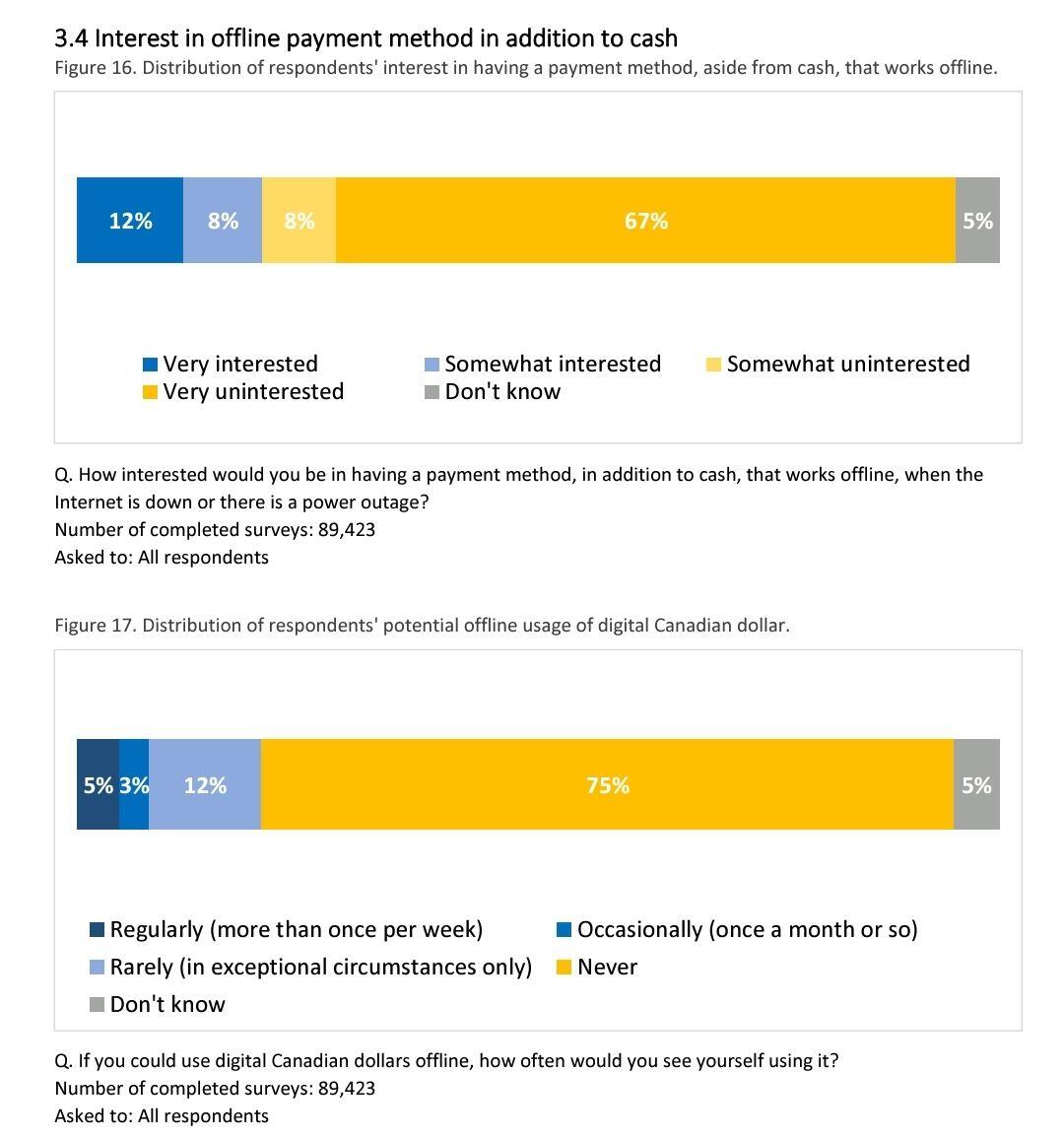

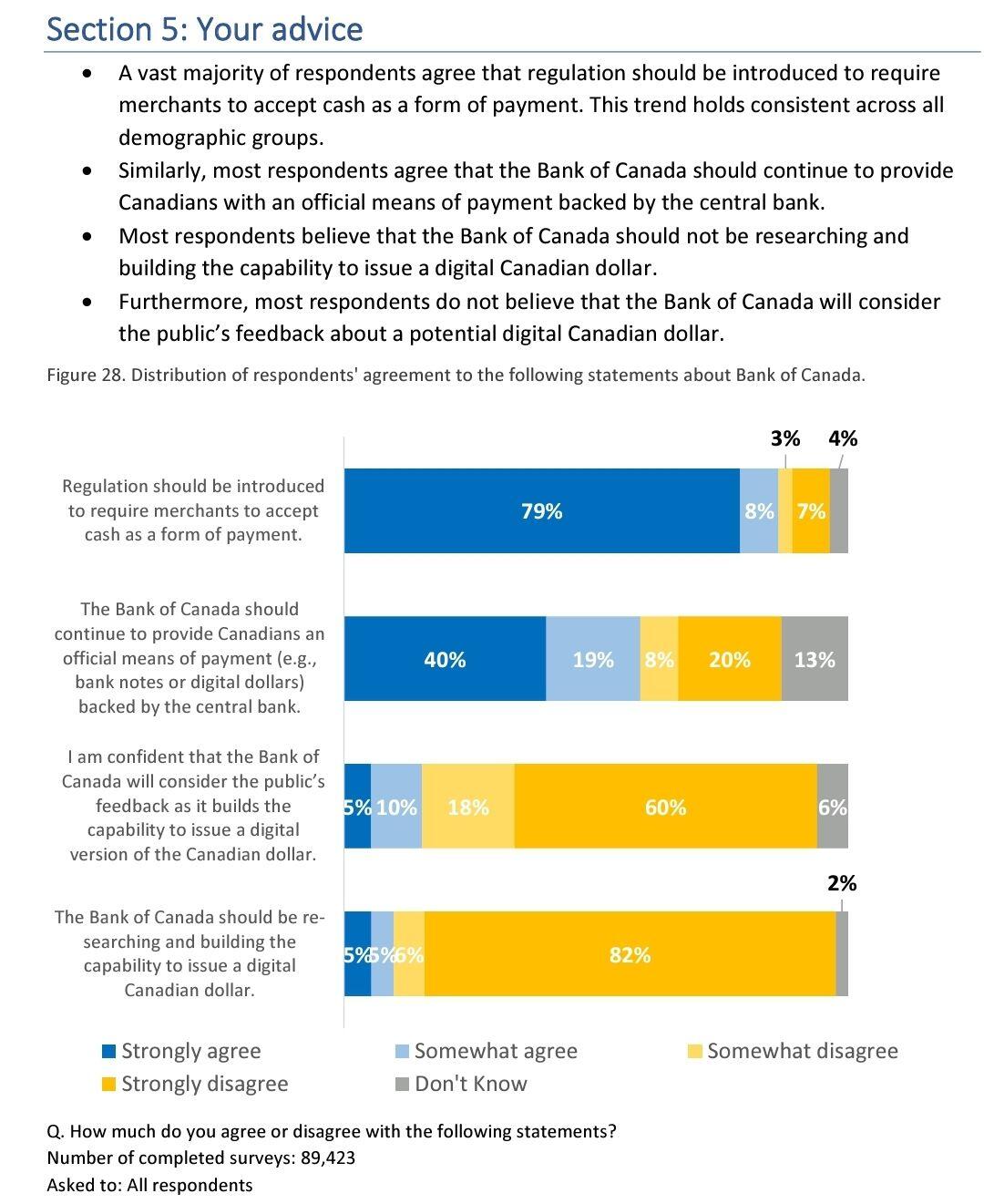

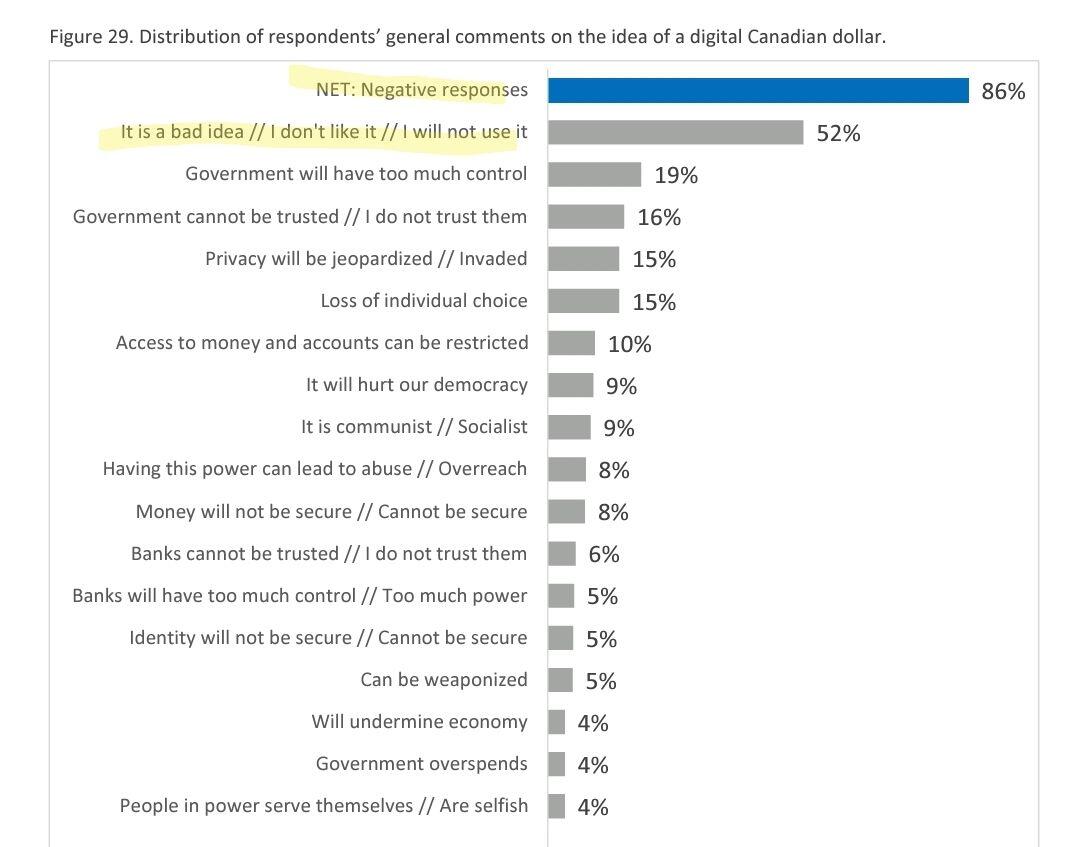

Canadians do *not* want a CBDC. Today the Bank of Canada dropped a report from its #CBDC consultations. Some highlights:

9 out of 10 Canadians don't trust the Bank of Canada to issue a secure #CBDC. In fact, there's not a lot of trust in government, tech companies or government in this regard.

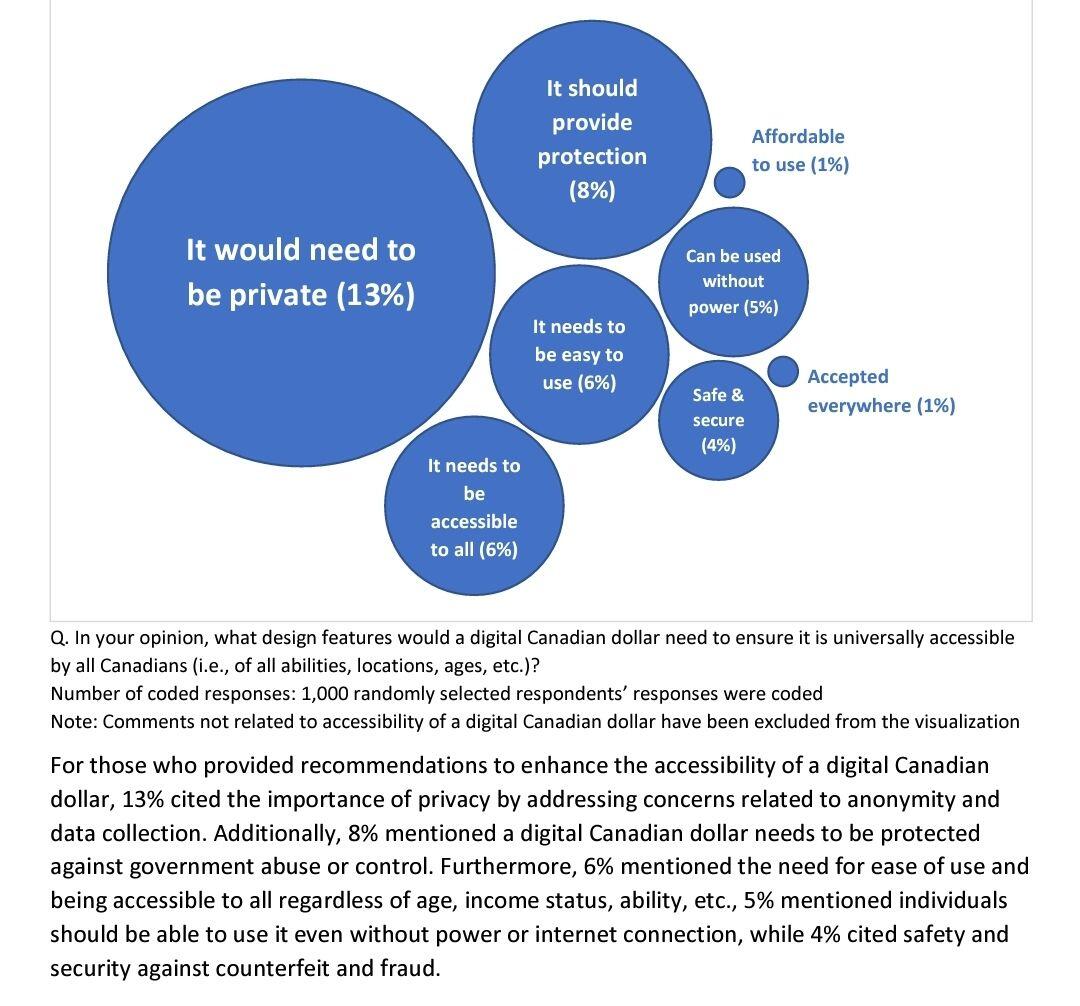

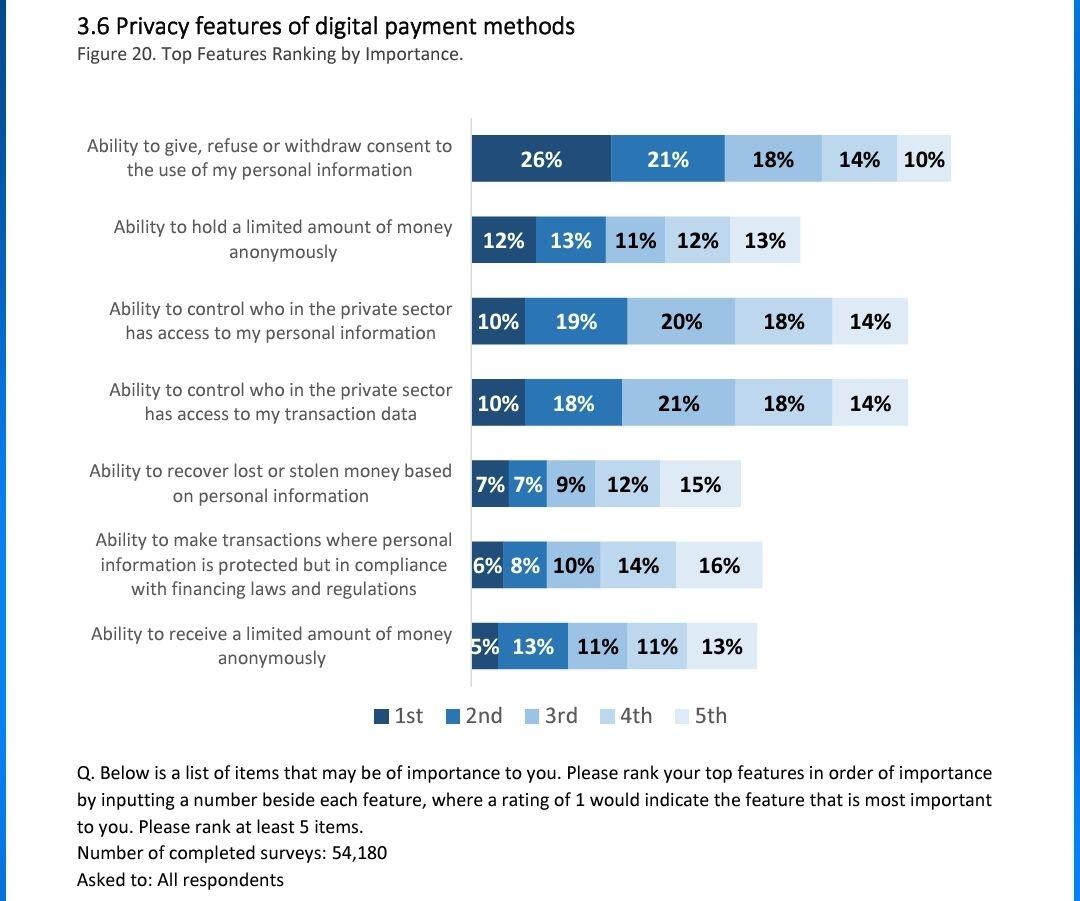

Privacy is the most sought after design feature in a CBDC. Canadians value the ability to give, refuse or withdraw consent to the use of their personal info & ability to hold an anonymous amount of money over being able to recover funds.

The survey show that Canadians just aren't interested in using a CBDC & most would never use it.

Furthermore, Canadians want The government to enact regulations that require merchants to accept cash so it remains an option.

I suspect that Canada's response to the truckers protest was an eye opener: the government shut down access to banking of Canadians that donated to the truckers (which at the time was *legal*) - this happened in a G7 country, & not an authoritarian state.

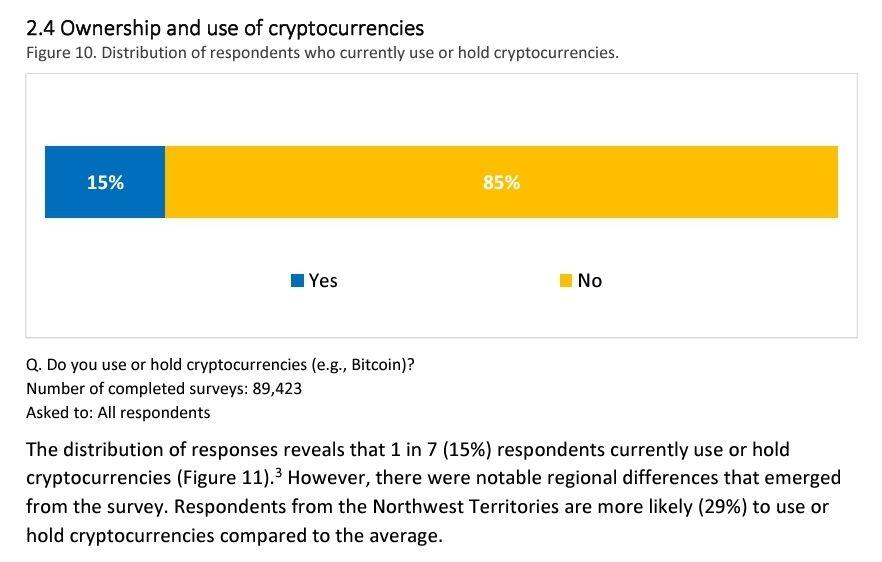

1 in 7 Canadians uses or owns Bitcoin or crypto. The Bank of Canada has conducted studies on Bitcoin every 2 years, but the data set for this report is much larger (90k Canadians) than previous reports (~2k). Thus, this report provides a good picture of what Canadians want - or don't want.

Also, I don't believe this report was skewed by bitcoiners because previous studies by the Bank of Canada and Ontario Securities Commision had similar numbers & this is a larger sample.

Hope this consultation was informative to Bank of Canada & policy makers.

The full study can be accessed here: https://www.bankofcanada.ca/2023/11/what-we-heard-bank-of-canada-publishes-report-on-digital-dollar-consultations-outlines-further-engagement-plans/

The overall reaction 😅

Watch the Canadian government still claim that Canadians actually want this and the polls must have been spammed by trolls and right-wing extremists.

Looks like it starts that way with some kind of plan to move to pooled mining later.

I wonder if nostr search should still be centralized for its efficiency advantages, but completely open source so that anyone could spin up an alternative at any time.

#m=image%2Fjpeg&dim=1080x1733&blurhash=%5E584Y*Xn-U%3Fw-pD*kCaebHaefkj%5BaeR*jbWUjbofozaeWVaya%7CWBtQn%2BX7jGW%3AWBofayj%5Bj%5Bofj%5BV%5BR*jbR%25WBofozjZbHe%3AWVayozjGS1n%25f%2Bae&x=f181f206db0cd46ed4ea838bd7cf18cf78cec023e16c19868a903b56d2ece95b

#m=image%2Fjpeg&dim=1080x1733&blurhash=%5E584Y*Xn-U%3Fw-pD*kCaebHaefkj%5BaeR*jbWUjbofozaeWVaya%7CWBtQn%2BX7jGW%3AWBofayj%5Bj%5Bofj%5BV%5BR*jbR%25WBofozjZbHe%3AWVayozjGS1n%25f%2Bae&x=f181f206db0cd46ed4ea838bd7cf18cf78cec023e16c19868a903b56d2ece95b

nostr:note16dg72cw2c6wg40r55l4q94m77njtcjzct88rkujh7nl2luhay69qrpvxcy

nostr:note16dg72cw2c6wg40r55l4q94m77njtcjzct88rkujh7nl2luhay69qrpvxcy