stay humble

to be fair if it is going to $1M buying at $82K isn't a mistake

I'm no techie, but satoshi said a payment processor could be hooked up to many many nodes and payments could be known "likely good" as quick as 10 sec (without lightning). why doesn't anyone do this?

Former CEO of Sotheby's, Tim Smith discusses a startling finding after going down his #Bitcoin rabbit hole journey with @TimKotzman

“All of the work of the S&P 500, all of the value created there is actually the money printer.” https://video.nostr.build/b7dca10e6be0b578bd8fca1727a3d97e6b15a5d348729eb5f376922295266a58.mp4

majority, not all

This has always been the way. Before people just bought stocks, bonds, real estate, etc... the "game" has always been hold as little fiat as possible.

clearly trying to send a message to anyone develop anonymozing tech same was done to ross

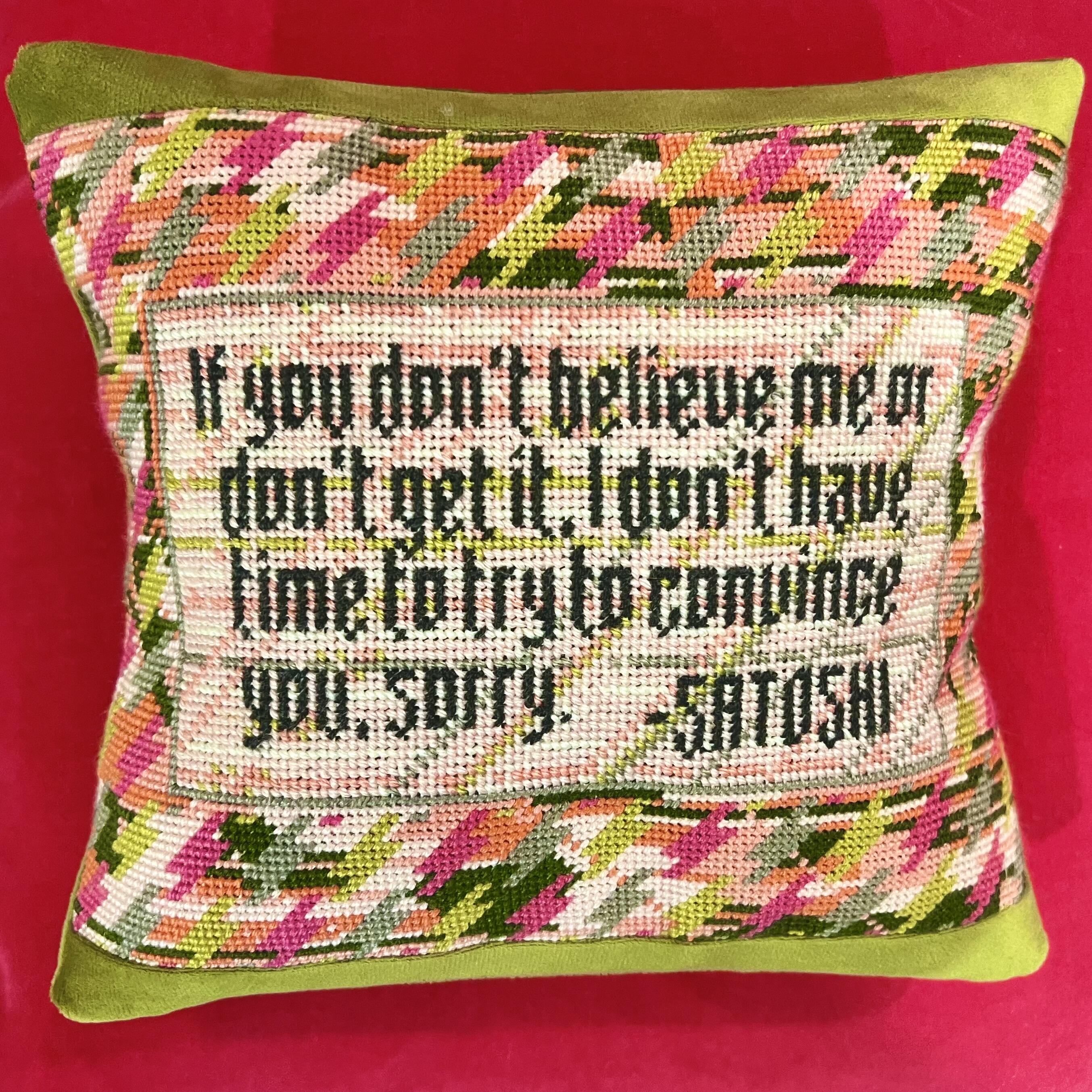

agreed and just posted this elsewhere. next level hasn't been reached until people stop saying how much fiat their Bitcoin can buy.

We don't reach the next level until people stop saying how much fiat their Bitcoin can buy

inheritance strategies? list it in your trust document and then pass them the hardware wallet(s) and seed(s). they'll get it at a stepped up basis.

arguably it would be more favorable to your case just looking at the past 5 years as the money supply has greatly increased.

since 1960 M2 is 6.88%. nominal stocks are around 10-11%. so a real return has been made to the stock investor

I think everyone should get in the habit of zapping content creators here. Even at minor zap of $0.01 per view, with a "youtube" like audience, someone getting 15,000 views a video gets $150 or ~197,000 sats.

This is virtually free to the consumer and a meaningful amount of income to a creator, in the aggregate. Even at $.01 zaps per day is only $3.65 a year!

Remember: "a zap-a-day keeps the censors away!"

Best place to watch your content is on #nostr!

** if you include re-investing dividends, you'd be at 15%-16% return on the S&P over the last 5 years.

Over the last 5 years the M2 money supply has grown at a rate of 6.6% on average, the S&P 500 has grown at 13.4% on average.

Clearly inflation is a large portion of the return, but it isn't all of it. The stock market produces real return.

I'd agree on principle. but practically anything so valuable will always be bought by entities. even if the US govt didn't do so others will/have

Yeah that was also for me a absolute startling insight. S&P keeps you only even, regarding your purchasing power. Only if you invested in the Mag7 tech stocks or at least in an Nasdaq ETF where you able to outgrow your purchasing power against inflation.

Heard that btw two years ago in the nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m interview at the Tucker Carlson show.

I don't agree that this is entirely true. I don't think the top 500 businesses in the world produce zero real return. certainly it isn't 100% real either but don't agree it is 0%

All politicians do this.

The only viable solution is a less powerful government. Power always has and always will corrupt. No side is immune, therefore power should be as limited as possible.

Reduction in the size/scope of the government is the only way to maintain any semblance of freedom.