I’d be worried if I worked in a corporate treasury and was actively against putting #Bitcoin on the balance sheet. I’m sure some could argue this is negligence by corporate treasuries teams or investment committees.

h/t @TimmerFidelity

Never mind - hike it to 10000% Jerome

https://www.wsj.com/articles/sorority-consultants-rush-colleges-parents-prepare-80b2cfc8

It is interesting that Prometheum has the only approved Special Purpose Broker Dealer License.

This is clearly a grab for legal framework and ultimately control / money - it feels super similar to the Bit License fiasco. Gary is likely a future advisor.

I'm not convinced that with a more rigorous special purpose broker dealer license will prevent future rug pulls. The SEC has proven time and time again to not protect consumers.

WeWork, GameStop - or basically any SPAC or Venture Backed IPO in the last 24 months were a disaster.

The SEC wanted in on the action through future consulting opportunities and advisor roles. The shitcoins are simply the casualty for control of the exchanges.

That said, #Bitcoin doesn't care and that's the signal.

Let’s get this bread

A post inspired by a convo with my father...the OG Ski Bum.

"Brad, what if the government just sold their land holdings to satisfy their debts?"

The US Government owns 620M acres of land. The average acre sells for $17.5K in If the USG sold all its RE holdings it would equate to $10.85T - 34% of the national debt and only 5.7% of total unfunded liabilities.

$17.5K per acre? That sounds cheap - what is the value of an acre in Yosemite?

An acre near Snowmass, Colorado is going for $163K so we'll use that for our multiplier.

US National Parks:

52M acres ($8.5T)

US National Monuments:

14M acres ($2.3T).

Total:

10.8T for priceless US Real Estate

For the US to satisfy the national debt the remaining acreage would need to be sold for $38K per acre - 2X+ the US average.

To satisfy unfunded liabilities the remaining acreage needs to be sold at $319K - 2X what Snowmass land costs.

This assumes no price slippage.

Unfortunately, even the darling asset of prime real estate is no measure for the reckless spending over the last 60 years. Stay Humble and Stack your Sats people, there may be some acreage below Half Dome for sale in the future.

NPS: https://tinyurl.com/2s4ytaxb

Snowmass Property: https://tinyurl.com/ys63bw

Bitcoin Weekly Round Up - May 6th, 2023

https://bradmyers.substack.com/p/ski-bum-capital-weekly-update-may?sd=pf

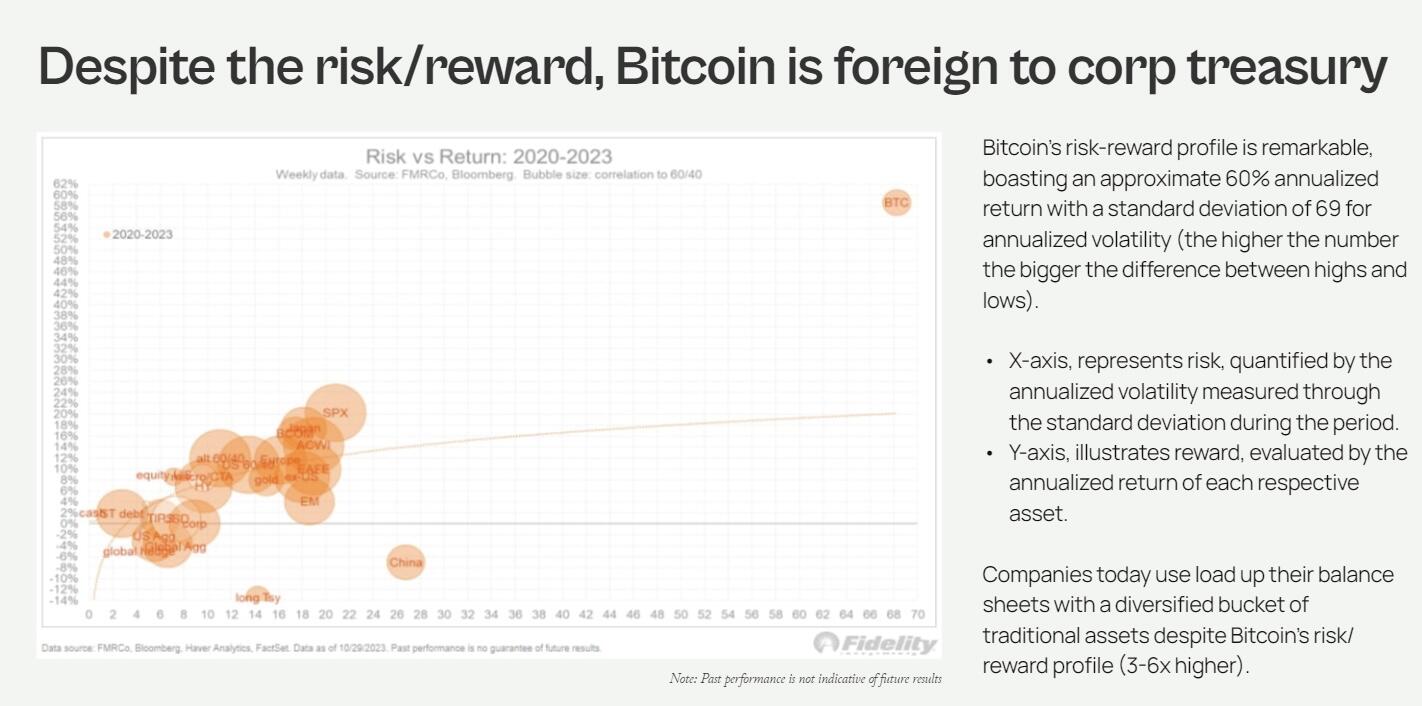

Full disclosure I made this for an investment firm who wants to start educating and offering BTC to clients - hence the high level nature. Open to feedback.

Bitcoin Weekly Round Up - May 6th, 2023

https://bradmyers.substack.com/p/ski-bum-capital-weekly-update-may?sd=pf

I think about Bitcoin in the context of traditional commodity businesses. It’s not groundbreaking but here are things I consider…

Daily global gold production is 9.5 tons and valued at $596M per day. Meanwhile, daily US oil production is valued at ~$415M per day. More simply, to own a day’s worth of global gold or US oil production it would cost you $596M and $415M, respectively.

In 10 years (2032), 75 Bitcoin will be mined per day, a total price of ~$2.8M today. In 30 years (2052), 2.34 Bitcoin will be mined per day, a total price of ~$89K today. In 40 years (2062), 0.58 Bitcoin will be mined per day, a total price of ~$22K today.

Questions…

1. Would a gold producer lock in a day’s worth of global gold production 0 years from now for $2.8M?

2. Would a US oil company would want to purchase a day’s worth of oil production 30 years from now for $89K?

For perspective, global daily gold production in 2012 was valued at $484M and US oil / gas production was $147M in 1992.

In short, any business leader would be misguided not locking in future productivity of the network

New Bitcoin Wedges - I’ll be throwing freedom money darts in no time

Anything to keep the Ponzi going, I guess…

Trying to start with some of the largest expense line items and work backwards.

I’ve been trying to rack my brain for an article on how BTC could save social security or other social programs. While a 5% allocation from the SS balance to Bitcoin, it has NOTHING on the future and unfounded liabilities. It’s totally toast.