The goal has always been to chill and enjoy life. To do exactly what you want to with your time.

Let’s make it a great one #gm

Good morning yall

A mother leopard teaching her baby how to hunt at sundown in Kruger National park.

I think it’s simply a humility issue. Everyone’s egos (particularly Americans, that’s where I’m from) are attached to this system they were born into, learned, and profited from. Even knowing it’s problematic.

After watching Bitcoin talks from developers in developing countries, the community often embraces the ideas immediately.

The double decker Saint Louis Style pizza….

In one week they shut up all of the people whining and complaining about the dividends… and they did in during the first green week in 2 months (it didn’t affect the share price whatsoever)

Zebras and their foals stand in this position to confuse predators.

Respectfully, this rant is bs and out of touch. She’s so red/blue, black/white, so Fiat.

The morning Winnie. Good morning everyone. Happy consumption day.

Good morning everyone, I’m grateful I woke up today and can watch the sun rise and the leaves fall.

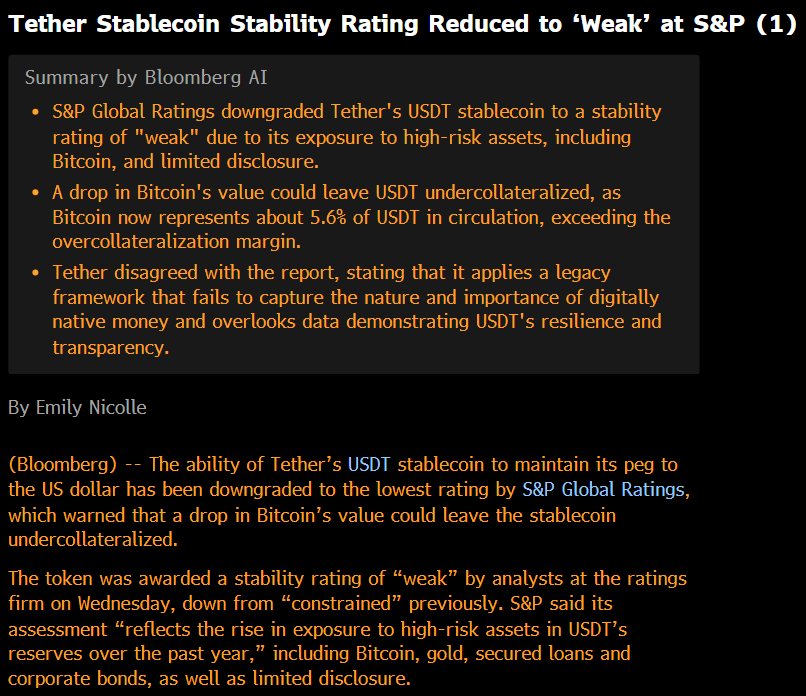

S&P has downgraded Tether’s stability rating to “weak,” stating that #Bitcoin now makes up 5.6% of USDT reserves, above the 3.9% buffer needed to absorb a price drop.

Shared via https://pullthatupjamie.ai

lol if the price drops it’lil be 3.9% to meet the buffer

GM 🍂🍁

Colloquially, “Bits” and “sats” will be like “dollars” and “bucks”.

What is more scarce in the universe, gold or wood?

Digital credit came out a month ago bridging a 300T market to Bitcoin. What you’re feeling is the emotional response of an mMAV going from 3 to 1 after exploding from 1 to 3.

Ask yourself what you’ve done 10

Years from now. For Bitcoin to become a global standard, institutional adoption is a necessary step that started only 2 years ago

This analysis doesn’t mention the use of digital credit instruments with Bitcoin collateral once….

At a price of ~$4,000 per ounce, more gold can be mined than ever before….