What that guy said^^

Gold is scarce 🤡

Eating factory farmed meat is so fiat.

So this suggests the power law will be broken to the upside in the next decade or so to become exponential, and then the constant exponential will be broken to the upside as global fomo sets in and it starts a super exponential. Love it.

I’ve been calling this curve a tan function because visually it looks similar, but I like this formula a lot more.

I Love math.

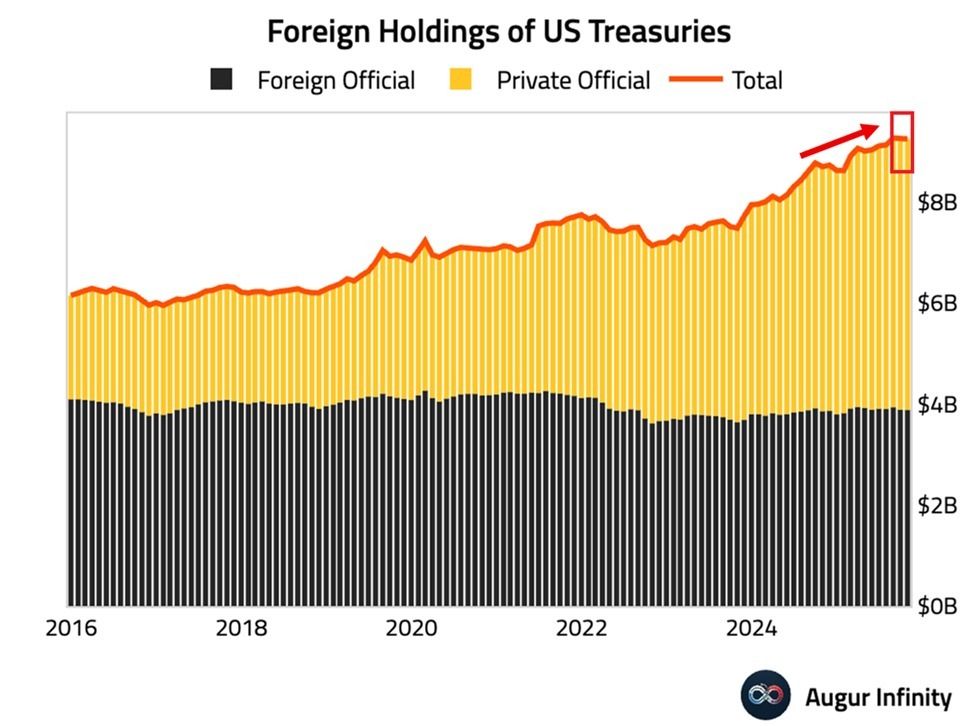

Foreign holdings of U.S. Treasuries declined by $5.8B in October, with China’s holdings falling to $688.7B, the lowest since 2008.

Shared via https://pullthatupjamie.ai

This chart doesn’t make any sense

This is what I’ve been thinking for a while now. Thank you for making a chart 🙏🏽

Watch Stephen Perenot on the power law. Has math is saying he thinks there will be another bubble in 2027.

All the 4 year cycler’s are gonna have to fomo in pretty soon

I’m bullish on all of it. I think it’s an opportunity to harden and prove the antifragility of the protocol

I love your story. And I wholeheartedly agree with the game theory. You should write a book with that plot. It would be very entertaining and probably encourage devs to push updates.

Couldn’t quantum also reenforce the hashing as well? Being an extremely efficient compute resource?

I just listened to Stephen Perrenod and he claims google is on the order of 1000 physical qubits and 1-10 logical cubits. Assuming an aggressive moores law they should double logical qubits about every 1-2 years. This gives us a deadline of 10 years conservatively. We should probably push a solution in the next 5 years.

He also reinforced that trad fi uses RSA and ECC and the quantum threat will actually incentivize movement *towards* Bitcoin, not away from it due to its antifragile nature.

I agree. The day the US gov takes a stake in strategy we will see a god candle

One of the primary solutions Bitcoin is supposed to solve is that it will evolve and be competitive forever, or at least as long as money is needed.

In a world with quantum computation, unlimited energy, and abundance, money doesn’t serve as much of a purpose.

Idk, half of the internet crashes whenever AWS or cloud flare goes down. Bitcoin is much more resilient then the rest of the internet infrastructure encryption aside.

Also a quick ai search says that the broader industry is not quantum resistant. But maybe you know something that it doesn’t. It said they use RSA and ECC.

Wouldn’t bitcoin just need to go from SHA256 to say SHA512, SHA1024.

I am probably being naive especially since I know very little about cryptography.

So then it seems pretty straight forward for Bitcoin devs to follow the trend and upgrade to match the broader industry.

Don’t freeze any keys, just allow people to use quantum resistant addresses

The quantum FUD makes no sense to me. The years-months before a private key is stolen, every single piece of traditionally encrypted information (banks, stocks, personal data, etc) would be vulnerable if not already gone.

The financial system as we know it would collapse.

Then, either bitcoins price goes near 0 to reflect the broader market in which case there isn’t even much incentive to steal anyone’s coins, or the market price skyrockets as it serves as the last form of digital property. In the latter case, we’d have a least a little bit of time to prepare quantum proof keys.

Yeah, I agree CO2 isn’t good or bad. Humans are just effecting the environment with our emissions, and that can have bad effects.

Too bad we’re decimating these populations. Ever driven through the Midwest USA? Those ecosystems don’t exist anymore.

We only have these jobs because fiat created roles that exclusively “carbonize” we don’t call them that cause it’s not sexy, but people exist solely to burn oil for others to consume. This is the rebuttal.

We call it dawg breath where I’m from

#gm yall