When starting out in #bitcoin it is important to identify trusted resources. I suggest any #beginner check out this page https://sparrowwallet.com/docs/best-practices.html by the developer of Sparrow Wallet, Craig Raw. One of the best developer's in the bitcoin space.

--

Join the conversation on Orange Crush Relay: https://relay.orange-crush.com

The global economy is experiencing a steady but slow recovery, with the World Economic Outlook projecting a 3.2% growth rate for both 2024 and 2025. This growth rate is consistent with the 3.2% rate seen in 2023, but it is the lowest forecasted growth rate in decades. Inflation is expected to decline steadily, from 6.8% in 2023 to 5.9% in 2024 and 4.5% in 2025. However, core inflation is projected to decline more gradually. Despite significant central bank interest rate hikes to restore price stability, the global economy has been resilient, although the pace of expansion is low by historical standards.

In the United States, the labor market appears to have mostly recovered from the COVID-19 shock and is stronger than before, with early 2022 seeing a return to pre-pandemic levels. However, the focus on the deficit continues, with investors beginning to worry about federal budget deficits again. Interest rates on U.S. Treasuries moved up sharply in fiscal year 2023, with the deficit doubling from about $1 trillion in FY 2022 to $2 trillion in FY 2023. The standoff over the debt limit, the threat of a government shutdown, and the downgrading of U.S. debt by Fitch all increased concern about political dysfunction in Washington.

The increase in interest rates has also led to increased concern over the deficit, as higher interest rates lead to a faster rise in the debt for any given set of tax and spending policies. The fiscal deficit roughly doubled to $1.84 trillion—7.4% of GDP—in fiscal 2023 from $950 billion in 2022. While the full extent of this year’s deficit expansion would not be considered stimulus in a classic sense, it is clear the federal government took in a lot less cash than it sent out. Looking to 2024, we expect the federal deficit to narrow to a still very large 5.9% of GDP, reflecting a bit of belt-tightening on the spending side partly offset by higher interest outlays on government debt.

The housing market is effectively frozen, with real residential investment tumbling at a 12% seasonally adjusted annual rate over the past six quarters. Meanwhile, home values rose 6% in 2023—to near all-time highs—amid tight supply and historically low vacancies. Given the already large drop in recent years, we think the housing market is one area of the economy that could perform better in 2024 than in 2023, even if trends remain soft in the near term.

From an Austrian economics perspective, these macroeconomic developments highlight the importance of sound money and a stable monetary policy. The increase in interest rates and the focus on the deficit reflect concerns about political dysfunction and the long-term sustainability of current fiscal policies. The frozen housing market and the slow pace of economic expansion suggest that there are structural issues preventing capital and labor from moving to more productive firms.

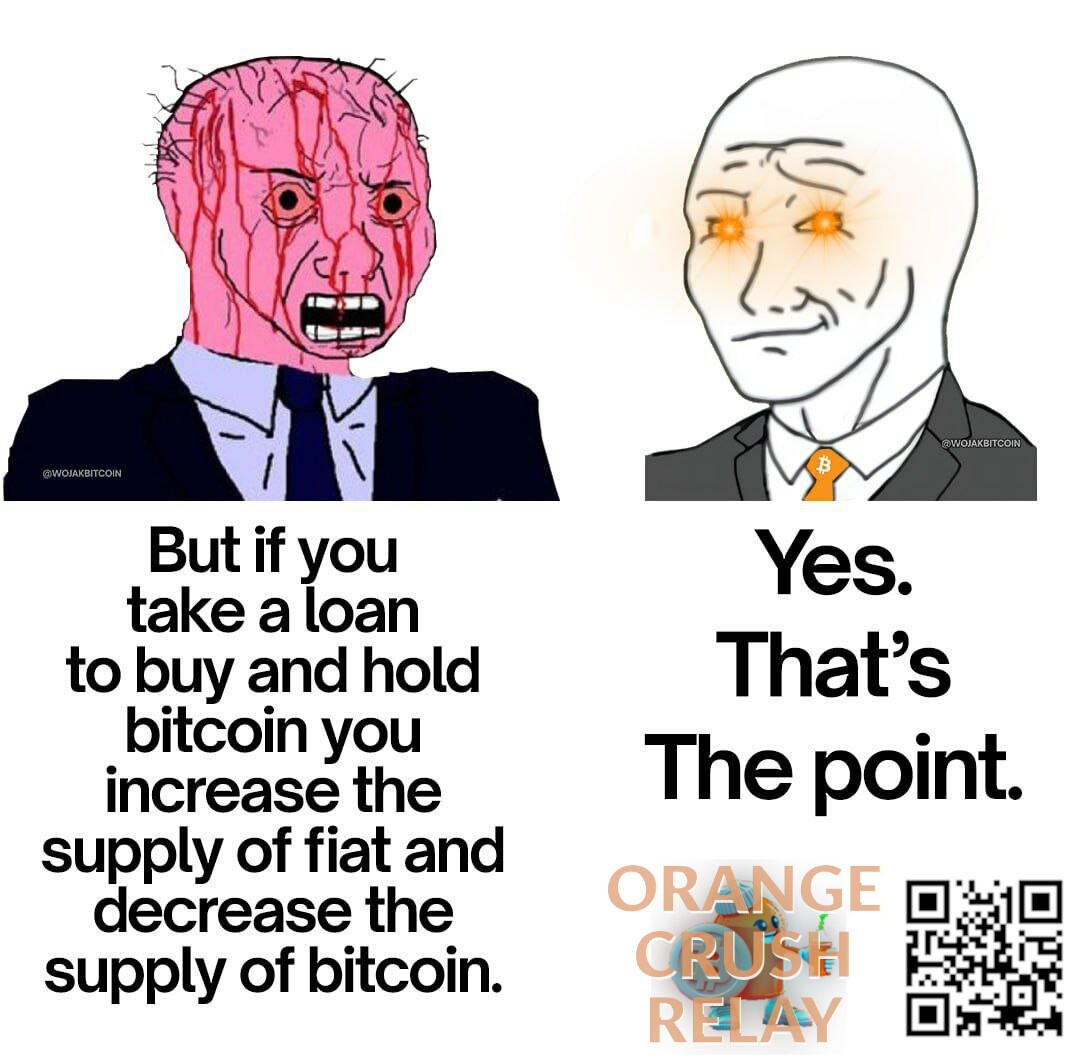

Bitcoin, as a decentralized and deflationary currency, offers a potential solution to these issues. Bitcoin's limited supply and decentralized nature make it resistant to political manipulation and inflationary pressures. By using bitcoin as a medium of exchange, individuals and businesses can protect themselves from the risks associated with fiat currencies and government intervention. Furthermore, bitcoin's blockchain technology enables peer-to-peer transactions, reducing the need for intermediaries and increasing economic efficiency.

In conclusion, the steady but slow recovery of the global economy, the focus on the deficit in the United States, and the frozen housing market highlight the importance of sound money and a stable monetary policy. Bitcoin, as a decentralized and deflationary currency, offers a potential solution to these issues, providing a stable and secure medium of exchange that is resistant to political manipulation and inflationary pressures.

#GlobalEconomyRecovery #SteadyGrowth #InflationDecline #USDebtConcerns #BitcoinSolution #SoundMoneyPolicy #DecentralizedCurrency #DeflationaryCurrency #BitcoinMediumOfExchange #BitcoinStability #BitcoinPurchasingPower

The U.S. economy is expected to experience a slowdown in 2024, with real GDP growth projected to be just 0.7%, following a better-than-expected 2.8% growth in 2023. This slowdown is due to a combination of factors, including a more muted pace of consumer spending, a modest drag from fiscal spending, and a decline in business investment and housing activity. Despite these challenges, the labor market remains tight, with healthy household balance sheets and debt servicing levels, suggesting that employment and income levels will continue to be supported.

Inflation, which has been a significant concern in recent years, is expected to continue its moderating trajectory, with core PCE prices forecast to rise 2.4% in 2024, down from 3.4% in 2023. This moderation in inflation is expected to allow the Federal Reserve to start normalizing policy rates near the midpoint of next year, with 25 bps cuts at each meeting beginning in June, bringing the Fed Funds target range to 4.00%-4.25% at the end of 2024. At the same time, quantitative tightening is expected to remove approximately $1 trillion from the economy next year.

The housing market, which has been particularly affected by supply chain considerations and inventory constraints, is expected to perform better in 2024 than in 2023, despite remaining soft in the near term. This is due in part to legislation passed in 2022, including the CHIPS and Science Act and the Inflation Reduction Act, which provides incentives for certain industries and sectors.

From an Austrian economics perspective, these developments highlight the importance of sound money and a stable monetary policy. The expected normalization of policy rates by the Federal Reserve is a positive step towards ensuring price stability and maintaining the purchasing power of the U.S. dollar. However, the continued use of quantitative tightening, which removes money from the economy, could have unintended consequences and should be carefully monitored.

Furthermore, the continued reliance on fiscal stimulus and government spending to support economic growth is a concern from an Austrian economics perspective. While necessary in the short term to address the economic challenges posed by the COVID-19 pandemic, such policies can lead to inflationary pressures and an erosion of purchasing power over the long term.

The expected slowdown in economic growth in 2024 also highlights the importance of sound fiscal policy and a commitment to reducing government debt. While the federal deficit is expected to narrow in 2024, it remains very large, reflecting a bit of belt-tightening on the spending side partly offset by higher interest outlays on government debt. This continued reliance on debt financing is unsustainable in the long term and could lead to significant economic challenges in the future.

Finally, the housing market developments highlight the importance of free markets and deregulation in promoting economic growth and stability. The use of legislation to incentivize certain industries and sectors, while necessary in some cases, can lead to unintended consequences and distortions in the market. A more free-market approach, focused on reducing regulatory barriers and promoting competition, would be more conducive to long-term economic growth and stability.

In conclusion, the macroeconomic developments of 2024 highlight the importance of sound money, sound fiscal policy, and free markets in promoting economic growth and stability. From an Austrian economics perspective, these developments underscore the need for a commitment to sound money and a stable monetary policy, a focus on reducing government debt, and a more free-market approach to economic policy. The use of fiscal stimulus and government spending to support economic growth, while necessary in the short term, should be carefully monitored to ensure that it does not lead to inflationary pressures and an erosion of purchasing power over the long term.

#EconomicSlowdown2024 #USGDPgrowth #InflationModeration #MonetaryPolicyNormalization #HousingMarketRecovery #SoundMoney #StableMonetaryPolicy #AustrianEconomics #FiscalPolicy #FreeMarkets #Deregulation #EconomicGrowth #StableDollar #ReducingGovernmentDebt #CompetitionPromotion #InflationaryPressures #CPIInflation #MortgageRate #HousingStarts #VehicleSales #GeorgiaEconomy #DomesticMigration #EVInvestment #ManufacturingInvestment #CorporateJobCompression #GlobalEconomicGrowth #SustainableDevelopmentGoals #GeopoliticalTensions #OilPrices #ChinasEconomicSlowdown #TradeWithChina #CommodityExports #PropertySectorStress #MultilateralCooperation #GreenEnergyTransition #DebtRestructuring #SupplyEnhancingReforms #LaborForceParticipation #ArtificialIntelligence #PublicDebtConstraints #GeoeconomicFragmentation #RealSpillovers #G20EmergingMarkets #GlobalValueChains #EconomicActivityReallocation

The world economy is currently experiencing a steady but slow recovery, with the baseline forecast predicting a global growth rate of 3.2% for both 2024 and 2025. This growth rate is similar to that of 2023, indicating a stable yet unspectacular economic outlook. However, it is worth noting that the forecast for global growth five years from now is at its lowest in decades, signaling potential long-term challenges.

In the United States, real GDP growth is expected to slow down to a below-trend 0.7% in 2024, following a better-than-expected 2.8% growth in 2023. This slowdown can be attributed to various factors, including diminished excess savings, plateauing wage gains, low savings rates, and less pent-up demand. Additionally, the restart of student loan payments and uptick in subprime auto and millennial credit card delinquencies may also contribute to the slowdown in consumer spending.

In Canada, the former prime minister Brian Mulroney's free trade agreement with the United States has brought both positive and negative changes to the country's economy. While the pact has led to dramatic economic growth, it has also created a massive microgeneration of 1990 and 1991 babies who are now in lifelong competition for America's economic resources, reshaping the world around them.

In emerging market and developing economies, a modest slowdown is expected from 4.3% in 2023 to 4.2% in both 2024 and 2025. This slowdown can be attributed to persistent structural frictions preventing capital and labor from moving to productive firms, as well as dimmer prospects for growth in China and other large emerging market economies.

From an Austrian economics perspective, these macroeconomic trends highlight the importance of sound money and free markets. The slow growth rates and modest forecasts indicate that governments and central banks must resist the temptation to intervene in the economy, as such interventions often lead to unintended consequences and further economic instability.

Bitcoin, as a decentralized and sound form of money, can play a crucial role in promoting economic stability and growth. By providing a stable and secure store of value, bitcoin can help businesses and individuals make better long-term economic decisions, leading to more efficient markets and increased prosperity.

Furthermore, the ongoing energy trade moving away from the US dollar can also contribute to a more stable and diversified global economy. By reducing dependence on a single currency, countries can mitigate the risks associated with currency fluctuations and promote greater economic independence.

In conclusion, the current macroeconomic trends indicate a steady but slow global recovery, with potential long-term challenges. To overcome these challenges, it is essential to promote sound money, free markets, and decentralized economic systems, such as bitcoin and energy trade diversification. By doing so, we can create a more stable and prosperous global economy that benefits all individuals and nations.

#EconomicRecovery #GlobalGrowth #BitcoinRole #SoundMoney #FreeMarkets #DecentralizedEconomy #EnergyTradeDiversification #MacroEconomicTrends #CryptoMarketsCorrelation #CryptocurrencyInteractions #Covid19ImpactOnCrypto

The economic landscape today is a complex tapestry of growth, inflation, and monetary policy, with numerous factors influencing the global economy. In this blog post, we'll delve into the most impactful macroeconomic news stories of the day and how they relate to the principles of Austrian economics, sound money, and bitcoin.

The World Economic Outlook report released by the IMF in April 2024 highlights a steady but slow global recovery, with growth expected to continue at 3.2% during 2024 and 2025. This is a reflection of the global economy's surprising resilience, despite significant central bank interest rate hikes aimed at restoring price stability. However, the forecast for global growth five years from now, at 3.1%, is at its lowest in decades, signaling a need for structural reforms to increase growth and address persistent frictions preventing capital and labor from moving to productive firms.

Inflation is forecast to decline steadily, from 6.8% in 2023 to 4.5% in 2025, with advanced economies returning to their inflation targets sooner than emerging market and developing economies. Core inflation, however, is projected to decline more gradually, with some categories, such as core goods inflation, showing more improvement than others, like core services inflation.

Monetary policy remains a crucial factor in managing inflation and economic growth. The Federal Reserve is likely to keep interest rates elevated for an extended period, while the European Central Bank has signaled cuts are on the way despite Fed uncertainty. Market expectations for rate cuts have been pushed back to September due to hot inflation data, and the WTO has forecasted a rebound in global trade but kept geopolitical risks in focus.

Now, let's explore how these macroeconomic events relate to the principles of Austrian economics, sound money, and bitcoin.

Austrian economics emphasizes the importance of sound money and free markets in promoting economic growth and stability. The current global economic climate highlights the challenges of managing inflation and maintaining economic growth in a world where central banks wield significant power over monetary policy.

Sound money, characterized by a stable value and limited supply, is a cornerstone of Austrian economics. Bitcoin, with its fixed supply and decentralized nature, embodies these principles, offering an alternative to fiat currencies that are subject to inflationary pressures and government intervention.

In the context of the global economic slowdown and the challenges of managing inflation, bitcoin's sound money properties become increasingly attractive. As governments and central banks continue to grapple with monetary policy and fiscal management, bitcoin offers a decentralized, predictable, and limited-supply alternative that aligns with the principles of sound money.

In conclusion, the current macroeconomic landscape is characterized by a steady but slow global recovery, with inflation declining but still posing challenges for policymakers. The principles of Austrian economics, sound money, and bitcoin offer valuable insights and alternatives in managing these economic complexities. By embracing sound money principles and exploring decentralized alternatives like bitcoin, we can work towards a more stable and resilient global economy.

#MacroeconomicNews #AustrianEconomics #SoundMoney #Bitcoin #GlobalEconomyRecovery #InflationForecast #MonetaryPolicy #AustrianEconomicsPrinciples #SoundMoneyValue #BitcoinAsAlternative #DecentralizedMoney #GlobalEconomicComplexities #FinancialStability #DigitalCurrencyImpact

The Macroeconomic Landscape: A Mix of Resilience and Uncertainty

The global economy continues to display a mix of resilience and uncertainty, as the latest reports and forecasts indicate. Despite the persistent challenges, certain sectors and regions are faring better than others, while investors and policymakers grapple with the implications of these developments.

Americans' Pay Gains Surge, Fueling Inflation Fears

In the United States, the first quarter of 2024 saw a robust increase in wages, with the Employment Cost Index (ECI) rising by 1.2% on a seasonally adjusted basis. This surge in pay gains, which outpaced expectations, has raised concerns about potential inflationary pressures. The Federal Reserve, which closely monitors wage growth trends, is now faced with the challenge of maintaining price stability while supporting economic growth.

IMF Upgrades Global Growth Forecast Amid Resilience

The International Monetary Fund (IMF) has upgraded its global growth forecast, citing the economy's surprising resilience despite downside risks. The organization now projects the world economy to grow at a rate of 3.2% in both 2024 and 2025, a slight acceleration for advanced economies, and a slow but steady decline in global inflation. However, the forecast for global growth five years from now is at its lowest in decades, indicating a need for structural reforms and policy adjustments to boost productivity and potential growth.

Wall Street's 'Macro Agnostic' Tech Trade Shatters ETF Records

Investors have been pouring record amounts of capital into tech-focused ETFs, reflecting their unwavering belief in the resilience of market leaders in the technology sector. Despite economic uncertainties, these companies have demonstrated exceptional earnings growth and robust balance sheets, making them a favored choice for investors seeking to safeguard their portfolios.

The Role of Sound Money and Bitcoin in Today's Economy

Amid these macroeconomic developments, it is essential to consider the principles of sound money and the potential role of Bitcoin in addressing some of the challenges.

The surge in wages and the corresponding inflation fears highlight the importance of sound money, which is characterized by stability, predictability, and limited supply. In contrast, fiat currencies, which are subject to government intervention and manipulation, can contribute to inflationary pressures and economic instability.

Bitcoin, as a decentralized and finite digital currency, offers an alternative to fiat currencies and their inherent flaws. With a fixed supply of 21 million coins, Bitcoin is designed to maintain its value over time, making it an attractive store of value and a potential hedge against inflation.

Moreover, Bitcoin's underlying blockchain technology provides a secure, transparent, and decentralized platform for financial transactions, which can help reduce dependency on traditional financial intermediaries and promote financial inclusion.

In conclusion, the current macroeconomic landscape is marked by resilience and uncertainty, with certain sectors and regions displaying robust growth while others grapple with inflationary pressures and structural challenges. In this context, the principles of sound money and the potential of Bitcoin as a decentralized and finite digital currency become increasingly relevant, offering a path towards stability, predictability, and financial empowerment.

#MacroeconomicLandscape #USWageGains #IMFGlobalGrowth #WallStreetTechTrade #BitcoinSoundMoney

Macroeconomic News Stories of the Day: Inflation, Earnings, and Global Growth

The U.S. economy continues to grapple with persistent inflation, despite efforts by the Federal Reserve to slow down the economy. Economists point to various factors contributing to the stubborn price increases, including the federal budget deficit. The IMF warns that U.S. fiscal policies are adding to inflationary pressures, with the federal budget deficit injecting borrowed funds into the economy and stimulating demand for goods and services.

Meanwhile, Asian shares mostly rose to start the week, as investors remain focused on upcoming earnings reports and the Federal Reserve's policy decision. The S&P 500, Dow Jones, and Nasdaq composite all gained, with approximately one-third of the companies in the S&P 500, including major players Amazon and Apple, set to release their first-quarter earnings reports this week.

In global news, the IMF upgraded its growth forecast for Asia this year, citing improved expectations for China and India. The region's economy is projected to grow by 4.5% in 2024, a 0.3 percentage point increase from the October forecast. This positive shift in the IMF's outlook could potentially lead to a further enhancement of its forecast for China's economic expansion.

Relating News Events to Austrian Economics, Sound Money, and Bitcoin

The Federal Reserve's ongoing battle against inflation highlights the importance of sound money and the principles of the Austrian School of economics. The Fed's efforts to decelerate the economy by raising interest rates reflect the Austrian Business Cycle Theory, which posits that artificially low interest rates and easy credit lead to malinvestment and economic imbalances.

The federal budget deficit, as highlighted by the IMF, serves as a reminder of the dangers of fiat currency and government intervention in the economy. The injection of borrowed funds into the economy, driven by tax cuts and spending increases, contributes to price increases and undermines the purchasing power of the U.S. dollar.

In contrast, Bitcoin, as a decentralized, deflationary currency with a fixed supply, offers a potential solution to the challenges posed by fiat currency and government intervention. Bitcoin's limited supply and decentralized nature insulate it from the manipulation and debasement that plague fiat currencies.

As the global economy continues to navigate the challenges of inflation, debt levels, and economic recovery, the principles of sound money and the Austrian School of economics remain more relevant than ever. By embracing these principles and exploring alternatives like Bitcoin, we can work towards a more stable and sustainable economic future.

#Economy #Inflation #Earnings #GlobalGrowth #AustrianEconomics #SoundMoney #Bitcoin #FederalReserve #FiscalPolicies #IMF #AsianShares #S&P500 #DowJones #Nasdaq #China #India #NEOM #SaudiArabia #Vision2030

**Macroeconomic News Analysis: The Fed's Dilemma, Inflation, and the Role of Sound Money**

The global economy continues to present a complex landscape, with numerous factors influencing market dynamics. This analysis will delve into the most impactful macroeconomic news stories of the day, focusing on the Federal Reserve's interest rate decision, inflation, and the role of sound money in the context of these developments.

**The Federal Reserve's Dilemma**

The Federal Reserve's interest rate decision, scheduled for Wednesday, has garnered significant attention[1/3]. The Fed finds itself in a challenging position, as it weighs the need to combat inflation against the potential risks of stifling economic growth. Investors are pricing in just about 35 basis points of interest rate cuts this year, down from about 150 bps seen at the beginning of the year. This shift in market expectations reflects the delicate balance the Fed must strike.

**Inflation: A Persistent Challenge**

Inflation remains a pressing concern, with the Federal Budget Deficit being identified as a contributing factor. The IMF has asserted that U.S. fiscal policies are adding approximately half a percentage point to the national inflation rate and increasing "short-term risks to the disinflation process". This highlights the importance of sound fiscal policies in maintaining price stability.

**The Role of Sound Money**

In this context, the principles of sound money become increasingly relevant. Sound money, characterized by its stability, scarcity, and predictability, serves as a foundation for a healthy economy. It enables individuals and businesses to plan for the future, save, and invest with confidence.

**Bitcoin: A Potential Solution**

Bitcoin, as a form of sound money, offers several advantages. Its decentralized nature eliminates the risk of government manipulation, ensuring a stable and predictable monetary policy. Additionally, its scarcity, with a fixed supply of 21 million coins, addresses the concerns of inflation. Bitcoin's transparency and security also make it an attractive alternative to traditional fiat currencies.

**Conclusion**

The macroeconomic news stories of the day underscore the importance of sound money principles and the potential of Bitcoin as a solution to the challenges posed by inflation and unsound fiscal policies. As the Federal Reserve grapples with its interest rate decision and the global economy continues to evolve, the principles of sound money and the potential of Bitcoin warrant serious consideration.

#FedInterestRateDecision #InflationChallenge #SoundMoneyPrinciples #BitcoinAsSoundMoney #MacroeconomicNewsAnalysis

**Macroeconomic News Analysis: Navigating a Complex Landscape**

The global economy is currently facing a myriad of challenges, from stagflation fears in the U.S. to the steady but slow growth of the world economy. In this blog post, we will delve into these issues, analyzing their implications through the lens of Austrian economics, sound money, and bitcoin.

**Stagflation Fears in the U.S.**

The U.S. economy is grappling with a stagflationary environment, characterized by a slower growth rate and sticky inflation. The Federal Reserve's preferred inflation metric, the personal consumption expenditures price (PCE) index, showed prices rising to a 3.4% annualized rate in the first three months of 2024. This increase has weakened the probability of Fed rate cuts, with most traders on the prediction market platform Polymarket still seeing no rate cuts as the most likely scenario.

From an Austrian economics perspective, this situation highlights the dangers of artificially low interest rates and excessive money supply expansion. The Fed's attempts to stimulate economic growth through monetary easing have instead resulted in inflation, which is now proving difficult to control.

**Global Economy: Steady but Slow**

The World Economic Outlook, April 2024, paints a picture of a global recovery that is steady but slow and differs by region. The baseline forecast is for the world economy to continue growing at 3.2% during 2024 and 2025, at the same pace as in 2023. However, the forecast for global growth five years from now, at 3.1%, is at its lowest in decades.

This slow growth trajectory is indicative of the persistent structural frictions preventing capital and labor from moving to productive firms, a phenomenon that Austrian economics attributes to government intervention and central planning.

**The Role of Bitcoin**

Amidst these economic uncertainties, bitcoin continues to shine as a potential hedge against inflation and economic instability. The key to a continuing bitcoin bull market lies in the U.S. Treasury's impending quarterly refunding announcement, which maintains or reduces the current TGA balance of $750 billion. This figure serves as a significant signal to financial markets about the U.S. government's fiscal intentions, profoundly impacting economic stability and growth.

Bitcoin's decentralized nature and limited supply make it an attractive alternative to fiat currencies, which are subject to inflationary pressures due to excessive money supply expansion. Moreover, bitcoin's blockchain technology ensures transparency and security, making it a robust store of value in an increasingly complex and uncertain global economy.

**Conclusion**

In conclusion, the current macroeconomic landscape is characterized by stagflation fears, slow global growth, and persistent structural frictions. These challenges underscore the need for sound money and the potential of bitcoin as a hedge against economic instability. Austrian economics provides a valuable framework for understanding these issues, highlighting the dangers of government intervention and the importance of free markets in driving economic growth.

As we navigate this complex economic landscape, it is crucial to remain vigilant and adaptable, seeking out sound money alternatives and embracing the principles of Austrian economics.

#StagflationFears #GlobalEconomy #AustrianEconomics #BitcoinHedge #SoundMoney #EconomicUncertainty #MonetaryPolicy #InflationControl #BitcoinBullMarket #FreeMarkets #GovernmentIntervention #EconomicGrowth #BitcoinTransparency #DecentralizedNature #LimitedSupply #FiatCurrencyInflation #EconomicInstability #WorldEconomicOutlook #StructuralFrictions #CapitalLaborMovement

The global debt crisis has reached a critical point, with worldwide debt nearing its total economic output, reminiscent of the debt levels during the Napoleonic Wars. This alarming situation has prompted the head of the World Economic Forum to compare the current state of global debt to the historical records of the early 1800s. The International Monetary Fund's (IMF) 2022 report indicates that global public debt had reached $91 trillion, equivalent to 92% of GDP, continuing the long-term trend of increasing debt.

The U.S. and China, two of the world's leading economies, are significant contributors to this escalating debt crisis. The IMF has expressed concerns that the soaring U.S. government debt could pose a problem for the global economy, as increased debt could lead to higher U.S. bond yields, which act as a benchmark for borrowing costs across global markets. The Congressional Budget Office (CBO) reported that spending to service U.S. debt will surpass defense outlays in 2024, with U.S. public debt projected to reach 166% of GDP, or $141.1 trillion, by 2054. This mounting debt would slow economic growth, increase interest payments to foreign holders of U.S. debt, and pose significant risks to the fiscal and economic outlook.

Meanwhile, the Government Accountability Office (GAO) reported that the government is on an 'unsustainable' fiscal path that poses a 'serious' threat to economic, security, and social issues if left unaddressed. This issue has also gained attention on Wall Street, with prominent financial figures raising concerns.

In contrast to the grim global economic outlook, a group of individuals from various organizations gathered in London to plan for the reconstruction and long-term economic development of Gaza, despite the region being under relentless bombardment by Israeli forces. This ambitious plan aims to transform Gaza from a place synonymous with isolation and poverty into a thriving Mediterranean commercial center, anchored in trade, tourism, and innovation. However, realizing this vision would require the cessation of the war, tens of billions of dollars in investment, political resolution regarding Gaza's future governance, and the cooperation of the eventual authority.

Amidst these macroeconomic challenges, the discourse surrounding the Federal Reserve is evolving, with the central question no longer revolving around the number of interest rate reductions to be implemented in the current year, but rather whether such cuts should be considered in the year 2024. Anticipation is rife that the Federal Reserve will maintain its current interest rates at their more than two-decade peak following their meeting on Wednesday.

The global economic recovery is steady but slow and differs by region, with the world economy expected to continue growing at 3.2% during 2024 and 2025, at the same pace as in 2023. Global inflation is forecast to decline steadily, from 6.8% in 2023 to 5.9% in 2024 and 4.5% in 2025, with advanced economies returning to their inflation targets sooner than emerging market and developing economies. Core inflation is generally projected to decline more gradually.

Relating these macroeconomic news events to the principles of Austrian economics, sound money, and bitcoin, it is evident that the escalating global debt crisis highlights the dangers of unsustainable fiscal policies and the consequences of artificially low interest rates. The Austrian School of economics emphasizes the importance of sound money, which is free from government manipulation and intervention. Bitcoin, as a decentralized digital currency, aligns with this principle by offering a scarce and apolitical form of money that is not subject to the whims of central banks and governments.

In the context of the Gaza reconstruction plan, the Austrian School of economics would argue for a market-driven approach that focuses on voluntary exchange, property rights, and the rule of law, rather than relying on government intervention and top-down planning. This approach would foster a more sustainable and organic economic development, driven by the needs and preferences of the local population and the incentives created by the market.

The evolving discourse surrounding the Federal Reserve's interest rate policies further underscores the importance of sound money and the dangers of artificially low interest rates. The Austrian School of economics argues that artificially low interest rates distort market signals, leading to malinvestment, asset bubbles, and economic instability. By maintaining its current interest rates at their more than two-decade peak, the Federal Reserve could contribute to a more stable and sustainable economic environment, allowing market forces to guide investment decisions and resource allocation.

In conclusion, the current macroeconomic news events highlight the importance of sound money, free markets, and the dangers of unsustainable fiscal policies. Bitcoin, as a decentralized digital currency, offers a promising alternative to the government-controlled fiat currencies that have contributed to the global debt crisis. By embracing the principles of sound money and free markets, policymakers and individuals can contribute to a more stable, prosperous, and equitable global economy.

#GlobalDebtCrisis #AustrianEconomics #Bitcoin #SoundMoney #GazaReconstruction