Wuhuuu it’s online. 🏡🧮🧡

Please test it and send us your feedback so we can optimize it if necessary. 🙏 nostr:note10v9mh8z2stsmmc53lshndwjqdj2g8t6d0n7xcu0tucz86qh2gu5q394fyt

🧡 Series: "The Fiat System and Its Empty Growth Promises – How #Bitcoin Provides a Solution" 🧡

Sometimes life doesn’t go as planned – and that’s okay. Originally, I intended to present this article series "The Fiat System and Its Empty Growth Promises – How Bitcoin Provides a Solution" in a different chronological order, but a personal experience prompted me to start with the third part today. Why? Because its content is helping me process a personally disappointing situation.

This reminds me a bit of how the Star Wars movies were released – not in numerical order. Similarly, I’m beginning this series unconventionally with Part 3, highlighting how the fiat system fosters mistrust and societal conflict through division and inequality, while Bitcoin offers a solution through #transparency, #fairness, and #community.

Stay tuned to see how the series unfolds.

➡️Title: Social Consequences and Societal Cohesion – Fiat System vs. Bitcoin

Fiat System: Societal Division, Eroding Trust, and the Productivity Paradox

The fiat system operates on the premise of endless growth and continuous money creation through credit issuance and inflationary mechanisms, fostering societal division and alienation. In this environment, many perceive an effort-reward imbalance where increased labor is not proportionally rewarded. Instead, profits are often concentrated in a few societal layers, while the majority suffers from loss of purchasing power and increased financial pressure. This unequal distribution creates social injustice and feeds a sense of exploitation, identified by psychologists as a key source of social tension (Siegrist, 1996).

The imbalance between effort and reward breeds social envy and distrust toward institutions. People increasingly perceive the fiat system as manipulative, with promised rewards and wealth growth realized only for a small elite. This leads to deep societal division and significantly erodes trust in central institutions – including banks and governments. Research indicates that in societies with low institutional trust, radical movements and populist ideologies gain traction, threatening social cohesion and political stability (Rothstein & Uslaner, 2005).

Additionally, the increasing performance pressure within the fiat system often results in the productivity paradox: although employees are expected to deliver more, studies show that such pressure ultimately reduces real productivity (Bosworth & Triplett, 2007). High work demands and lack of recognition demotivate workers and foster inefficient practices. Young talent and highly skilled professionals are increasingly withdrawing from traditional industries or emigrating to countries and sectors that offer a more balanced effort-reward ratio. This "brain drain" poses a long-term threat to innovation and economic stability, as skilled labor forms the foundation of technological advancement and productive economic structures.

Bitcoin: Promoting Community, Fairness, and Sustainable Productivity

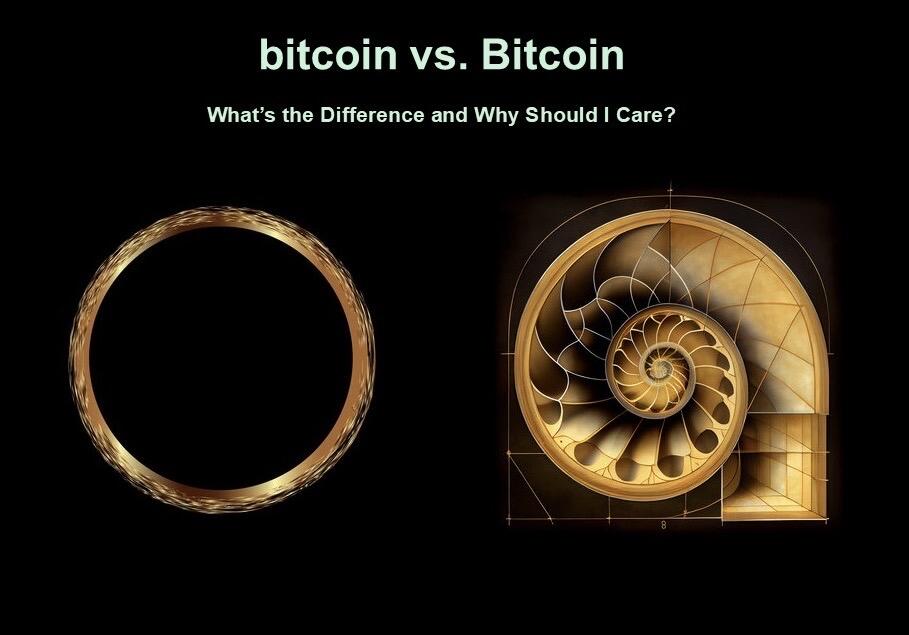

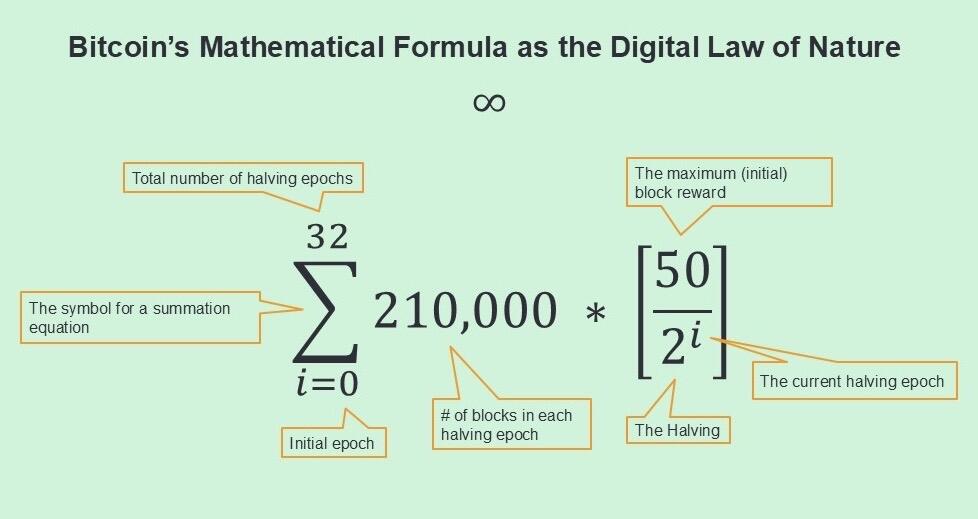

Bitcoin, on the other hand, provides a transparent and decentralized system that could mitigate many of the negative consequences described above. The architecture of Bitcoin is based on a fixed protocol, which limits the total supply to 21 million units. This scarcity creates a sustainable store of value and prevents inflationary devaluation – a central difference from the fiat system, which allows for theoretically unlimited money creation. Since no central institution controls Bitcoin or can change its rules, all participants operate under the same immutable principles. This transparency and equality foster a sense of fairness, which forms the foundation for societal trust and cohesion (Nakamoto, 2008).

Bitcoin’s decentralized system allows anyone to participate in the network without favoritism or discrimination, managing their assets independently of state or institutional control. Studies on social cohesion suggest that such egalitarian structures strengthen community spirit and societal stability, as people are more likely to trust systems perceived as fair and open (Putnam, 2000). Bitcoin’s decentralization and traceability promote a sense of responsibility and community among users, contrasting with the competition-driven mentality of the fiat system. People feel less compelled to compete and instead share a collective responsibility to maintain the system.

Furthermore, Bitcoin encourages a sustainable productivity model focused on real value creation and long-term stability. Unlike the fiat system, which depends on exponential growth, Bitcoin relies on a constant, predictable system that reduces short-term performance expectations and growth pressures. This allows businesses and individuals to focus on innovation and efficiency without the immediate threat of inflation or purchasing power loss. The limited supply of Bitcoin incentivizes efficient and sustainable resource use, contributing to a more productive economic system in the long run (Fry & Cheah, 2016).

Additionally, Bitcoin’s stable and transparent system attracts young talent and highly skilled professionals who are increasingly interested in alternative financial structures based on fairness and sustainability. In an environment free from arbitrary interference or monetary manipulation, professionals experience a work setting that values their efforts and expertise over the long term. Thus, Bitcoin not only fosters sustainable productivity but also offers a solution to the brain drain by providing a stable foundation for innovative minds focused on long-term value creation and collective stability.

Summary

The fiat system, through unlimited money creation and growth pressure, fosters social division and distrust as many people feel unfairly compensated, and institutional trust diminishes. This leads to social envy, brain drain among skilled professionals, and declining productivity, as constant pressure undermines real value creation. Bitcoin, however, offers a transparent, decentralized system with fixed rules that promote fairness and a sense of shared responsibility. Bitcoin’s stability and scarcity enable long-term planning and innovation, potentially strengthening social cohesion and creating a more sustainable economic foundation.

References:

• Bosworth, B., & Triplett, J. E. (2007). The Productivity Paradox: Evidence from the U.S. Economy. Brookings Institution Press.

• Fry, J., & Cheah, E. T. (2016). Negative bubbles and shocks in cryptocurrency markets. International Review of Financial Analysis, 47, 343–352.

• Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System.

• Putnam, R. D. (2000). Bowling Alone: The Collapse and Revival of American Community. Simon and Schuster.

• Rothstein, B., & Uslaner, E. M. (2005). All for All: Equality, Corruption, and Social Trust. World Politics, 58(1), 41-72.

• Siegrist, J. (1996). Adverse health effects of high-effort/low-reward conditions. Journal of Occupational Health Psychology, 1(1), 27-41.

bitcoin vs. Bitcoin – What’s the Difference and Why Should I Care?

In recent days, the rising price of Bitcoin has attracted many people once again – driven by typical FOMO and the hope for quick profits. As in every cycle, many of them will drop out again once the price falls, thinking Bitcoin is just a tool for making money fast. The good thing is, some people will stay who genuinely want to learn more about Bitcoin. Some of them will come to realize that Bitcoin (with a capital “B”) represents more – a vision of decentralization, self-sovereignty, and freedom.

bitcoin (Store of Value & Medium of Exchange)

When we talk about bitcoin with a lowercase “b,” it refers to the digital currency itself – the coins we use as a store of value and for payments. bitcoin is often compared to “digital gold” because its supply is limited to 21 million units, which protects it from inflation. Thus, bitcoin offers an alternative to traditional currencies, which can be devalued by central banks. Behind this stands the idea of independence and financial freedom: bitcoin gives people the ability to secure and protect their wealth without relying on banks or governments.

Bitcoin (Network & Protocol)

With a capital “B,” Bitcoin refers to the network and protocol that make bitcoin as a currency possible. The Bitcoin network is a decentralized network operated on thousands of computers worldwide, ensuring that all transactions are verified and permanently recorded in a blockchain. The Bitcoin protocol is a set of established rules that ensures all participants play by the same, unchangeable rules. There is no central authority or institution that can interfere. Instead, Bitcoin relies on mathematics and security principles. Bitcoin as a network stands for fairness, transparency, and independence. Every participant in the network plays by the same rules and contributes to the security of the system. Bitcoin enables a fairer system that is not influenced by the decisions of a few.

Why Does This Distinction Matter?

In summary: bitcoin is the "digital gold" serving as a store of value, while Bitcoin is the revolutionary network that offers transparency, security, and decentralization. Many people who come only because of the price, stay for the values and vision that Bitcoin embodies. They realize that Bitcoin is about more than just an asset – it’s about supporting a system that enables true independence and fairness.

Why Is This Understanding Important?

One could consider Bitcoin as a kind of “digital force of nature.” Just as physical laws exist independently of our approval – gravity, the passage of time, the movement of planets – Bitcoin functions through immutable mathematical rules. The network moves steadily and reliably according to fixed rules, regardless of external events, based on consensus created solely by the participants themselves – a natural principle in the digital realm. This “independence” is one of its most fascinating qualities and makes it one of the few systems that can genuinely operate globally and neutrally.

This understanding offers a glimpse into the true meaning of Bitcoin and why it plays an important role in an increasingly digital world. Bitcoin is more than a currency – it is a system that redefines security, control, and independence.

With this article, I hope to encourage you to reflect on your own values, question them critically, and potentially realign them. It is helpful to view Bitcoin in comparison to fiat currencies initially to better grasp the concept. But ultimately, this comparison only goes so far: 1 BTC = 1 BTC – a fixed and immutable unit, independent of external influences. Those who understand this see that Bitcoin models a system based on stability, clarity, and independence that cannot be manipulated by central authorities

#Bitcoin#Freedom #Decentralization #BitcoinCommunity #StoreOfValue #MediumOfExchange #Network #Protocol

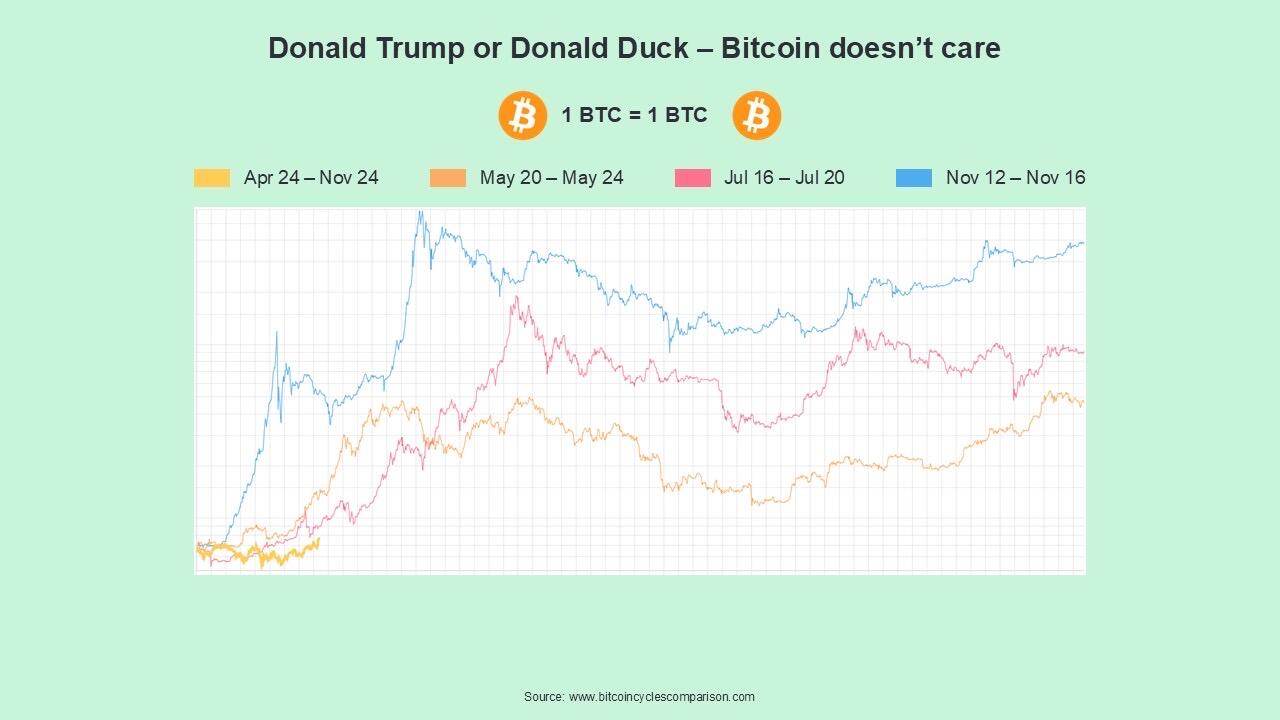

Donald Trump or Donald Duck – Bitcoin Doesn’t Care!

Two questions have been on my mind due to the U.S. elections and their resonance in the Bitcoin world:

1. Why do so many people fall so easily for propaganda?

2. Why do "Bitcoiners" use Trump’s statements on Bitcoin as a justification for their support of him instead of simply admitting that they share his political views?

This isn’t about politics for me – everyone should vote for whomever they want. That’s democracy. And as Bitcoin teaches us, a majority of 51% should prevail.

What bothers me is when people are still so heavily influenced by propaganda or when something as valuable and independent as Bitcoin is used to avoid honestly expressing one’s opinion. To me, this has two causes: a lack of knowledge or a lack of courage – both are issues that divide our society.

The Power of Propaganda – and Its Dangers

History and the present repeatedly show us how destructive propaganda can be. Hitler used targeted propaganda to spread his ideology and lead an entire nation into war. Propaganda also contributed to conflicts like the Vietnam War and continues to foster hostilities worldwide by spreading fear and misinformation. And yet, many people still let themselves be guided by manipulative information – whether it’s for or against a particular issue. Only the truth allows for a truly neutral decision. It’s not about whether we like the truth or not – it is the only way to make informed and independent decisions.

Bitcoin Operates Independently of Political Influence

Many claim that Trump has a positive influence on Bitcoin. But Bitcoin behaves in this cycle just as it did in previous halvings. Bitcoin doesn’t follow any political agenda. Those who believe that Bitcoin has something to do with Trump or any other political figure are missing the point. This idea is comparable to the early days of the internet when many thought it was only about emails. In reality, Bitcoin is about much more than just a means of payment or a store of value. Yes, Trump could further increase the money supply, which would affect Bitcoin’s fiat value – that’s called inflation. But the basic rule of Bitcoin remains simple: 1 BTC = 1 BTC. Anyone who doesn’t understand this hasn’t made an effort to understand Bitcoin.

The Only Chance: Clarity and Courage to Hold One’s Own Opinion

For humanity, I see only one chance: to stop being influenced by propaganda and to find the courage to express our own opinions honestly. Only those who bravely voice their own views are also willing to listen to the perspectives of others. This fundamental attitude allows for truly good and meaningful communication. If we don’t learn this, we will either be restrained by conflicts or by a nature that cannot be controlled.

Please don’t feel encouraged to share your political opinions with me now. In my view, no one can make truly good politics in today’s system – for that, the state system would first have to be separated from the monetary system.

However, I do want to compliment Trump’s advisors: at least they taught him well to distinguish between Bitcoin and crypto. That’s probably the only positive contribution his statements have made toward the development and understanding of Bitcoin.

#Bitcoin #Trump #Propaganda #Courage

🇩🇪 Germany, wake up! It’s time to change the broken pension system.

The German government had a great opportunity – an opportunity that has been missed so far: a direct investment in Bitcoin. Initially, it was understandable to be skeptical of Bitcoin. But today, it’s clear that Bitcoin has evolved from an experiment into a serious store of value. 💰⚡

Instead, the so-called retirement savings account has now been proposed by Federal Finance Minister Christian Lindner. This model allows for investments in stocks, funds, and ETFs, with the state contributing 20 cents for every euro invested. Yet, once again, this system unnecessarily involves third parties who profit from the pension, rather than letting the money truly benefit the retirees. 💸

So why take these detours and add extra profiteers? 🤔 It’s time for a clearer, more straightforward solution. Why not invest 10% of state pension contributions directly in Bitcoin each year?

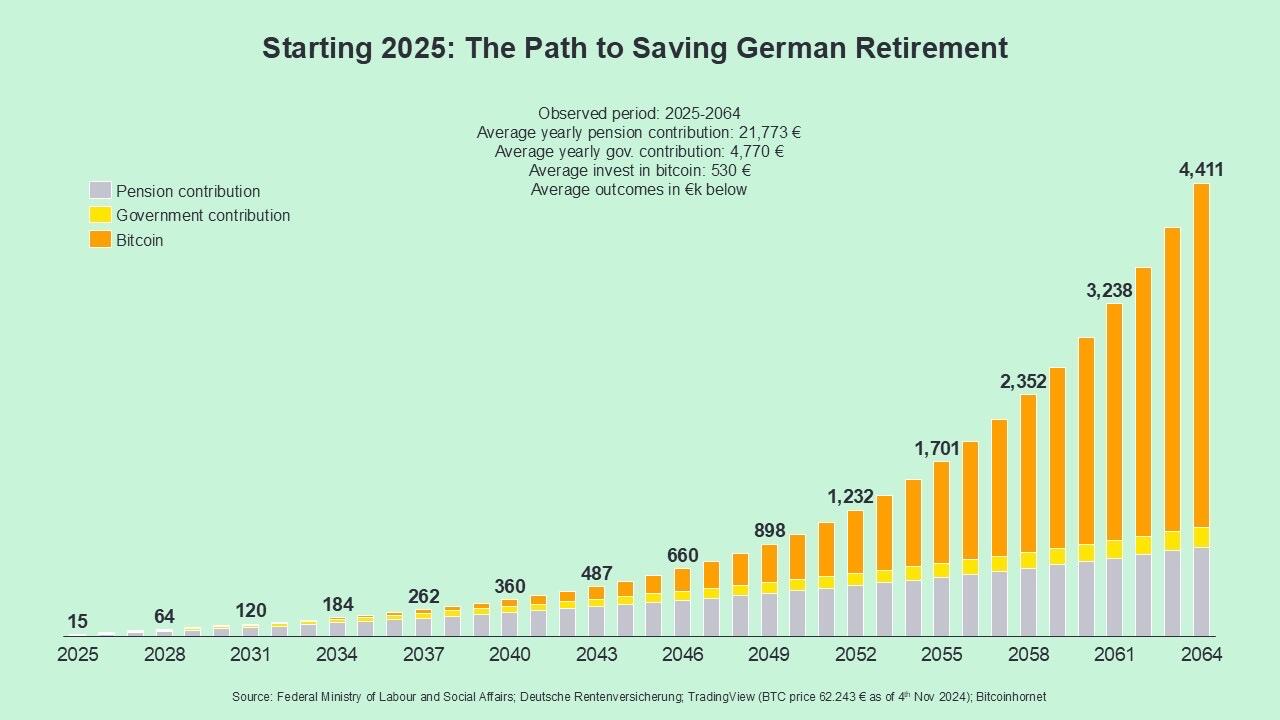

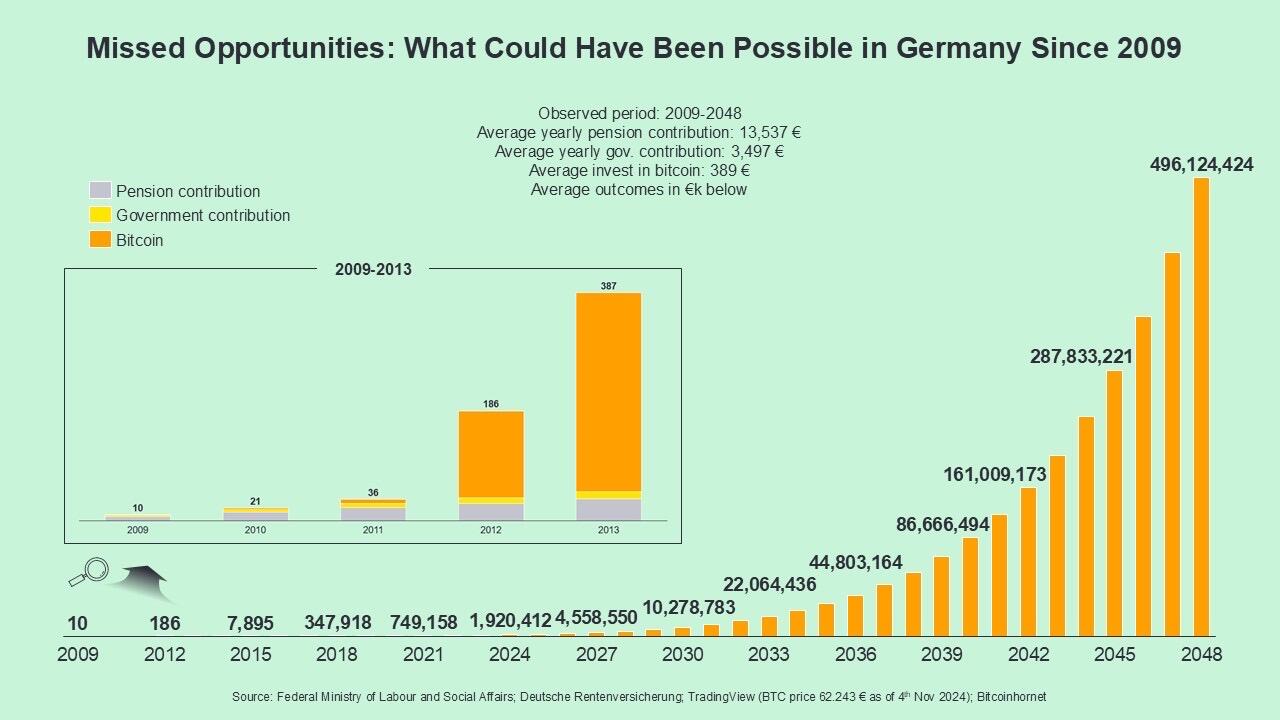

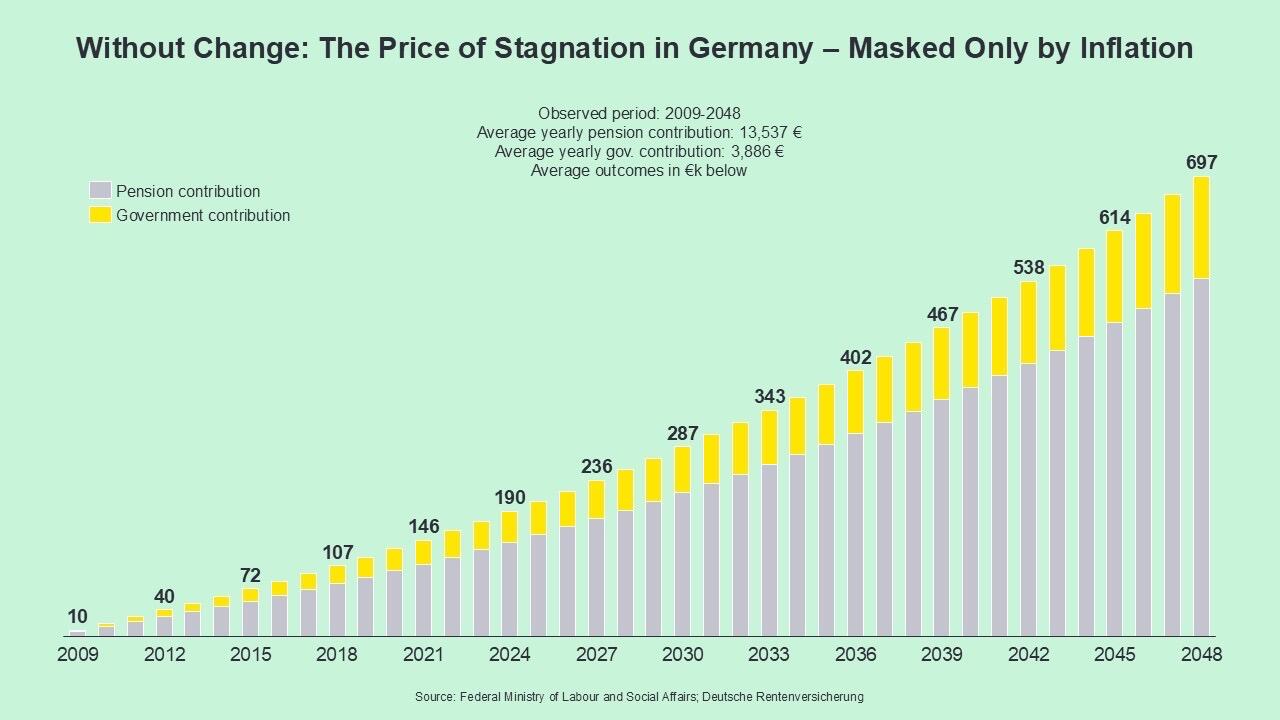

📊 The first chart shows the potential trajectory if this strategy were implemented in 2025. The second shows what would have happened if this approach had been applied since 2009, and the third shows the outlook if nothing changes.

It’s time for the government to think more clearly and long-term – in the interest of retirees and future generations, rather than unnecessarily expanding the state apparatus. 🏛️🚫

FYI – We’ve based the Bitcoin price forecast on one of the most conservative growth models.

#Pension #FinancialFreedom #Bitcoin #InvestSmart #Germany

Why gamble with luck 🎲 when you can take it into your own hands?!

The odds of hitting the lottery jackpot in Germany are just 1 in 139,838,160 – that’s only 0.00007% 🎰. This vanishingly small chance may seem tempting since everyone dreams of scoring a big win all at once. But the reality is different: on average, every lottery player ends up with a loss over the years, and only a tiny fraction come out ahead 📉.

Looking at the period from 2009 to 2024, a lottery player invested an average of about €233 in lottery tickets annually. By the end of this period, the average loss stands at -€2,124.

Had that amount been saved in Bitcoin over the same period, the value of those savings would be an impressive €1,288,033,204 🚀.

So, why rely on luck when you can take control yourself? 🙌

#Bitcoin #FinancialFreedom #InvestSmart #Lottery #Odds

Understanding bitcoin is not a matter of intelligence – it’s a matter of ego.

Those who don’t recognize that bitcoin is the currency of the future often cling to old systems because they benefit from them. These people have a high time preference, live in the moment, and think they don’t need to change as long as their short-term needs are met. They show little interest in engaging with new concepts like bitcoin because their ego gets in the way. They believe they are secure in the existing system, even though it will inevitably collapse under its own contradictions in the long run.

The core principles of bitcoin as a currency:

Decentralized – no middlemen.

Scarce – a maximum of 21 million coins.

Immutable rules – no manipulation.

Censorship-resistant – transactions cannot be blocked.

Long-term – promotes a low time preference.

The ego problem:

People who cling to the old fiat system often benefit from the Cantillon effect – they are close to the money when it is created and can benefit from inflationary money creation before the negative effects reach the wider population. They live at the expense of those farther from the center of power and see no reason to change.

But bitcoin challenges these power structures. It distributes value fairly, regardless of how close one is to the creation of money. It is this fairness that many refuse to accept – because they would have to give up their power and short-term advantages.

To understand bitcoin is to overcome the ego and embrace the future.

#bitcoin #Currency #CantillonEffect #Fiat #Ego #Freedom #Decentralization #LowTimePreference #SelfDetermination #FinancialFreedom

Freedom and connectedness – two fundamental human needs that drive us. Yet, in our current systems – be it politics, religion, organizations, or the financial sector – these very principles are destroyed by manipulation and abuse of power. The fiat system exists wherever central control prevails, and it is based on human sins:

1. Pride – Politicians, religious leaders, and institutions place their power above the well-being of the people.

2. Greed – Elites accumulate wealth while sacrificing the freedom of the majority.

3. Lust – Short-term profits are prioritized over long-term stability and true values.

4. Wrath – Conflicts arise as power and greed divide societies.

5. Gluttony – Waste and overconsumption occur while resources are unequally distributed.

6. Envy – Constant rule changes benefit the few, fostering competition and resentment.

7. Sloth – Organizations cling to outdated systems instead of allowing for change.

The fiat system collapses under these sins because it can be endlessly manipulated. Whether in politics, religion, or the economy, the rules always change in favor of those who hold control. Trust is the currency in this system, but it is this very trust that is repeatedly abused.

Bitcoin is different.

It is the only fair system in the world because it is based on clear and unchangeable rules. No central authority, no manipulation, no changes. Bitcoin requires no trust because it is not built on promises, but on mathematical principles that apply to everyone – no matter who you are or where you come from.

Bitcoin gives us back the freedom that is lost in our centralized systems. It connects people globally on a fair, transparent foundation – without the sins that continually weaken our societies.

The fiat system will crumble under these sins. Bitcoin will endure.

Freedom. Connection. Fairness. Bitcoin.

#Bitcoin #Freedom #Decentralization #Fiat #Connection #Fairness #Unchangeable #Politics #Religion #Economy #Trust #Mathematics #Time #HumanNature

“The kingdom of God is within you.” — Jesus Christ

“Know thyself.” — Pythagoras

“Do you not know that you are gods?” — Hermes Trismegistus

SELF RESPONSIBILITY 🔐♾️💜

Despite the fact that virtually all worldviews and religions convey the same message—that the truth, the divine, and the solution lie within ourselves—most people continue to look for blame and solutions outside of themselves. Whether it’s personal challenges or global crises, we tend to shift the responsibility onto others. But true change only begins when we turn inward and recognize that the source of peace, happiness, and fulfillment lies within ourselves.

“You must be the change you wish to see in the world.” — Buddha

“He who knows others is wise; he who knows himself is enlightened.” — Laozi (Lao-Tse)

“The unexamined life is not worth living.” — Socrates

“God is in the soul, and the soul is in God.” — Meister Eckhart

“Stop looking outside. Go within; the truth awaits there.” — Rumi

“True knowledge is the understanding of the self beyond all duality.” — Ramana Maharshi

“Where are you going? The true seeker finds God within himself.” — Kabir

“The soul is infinite, it is eternal. There are no limits to the human soul.” — Swami Vivekananda

“Do not seek outside of yourself. The source of all being is within you.” — Plotinus

“The divine consciousness rests within and waits to be discovered.” — Sri Aurobindo

#selfdiscovery #innerwisdom #godwithin #divineconsciousness #knowthyself #innerpeace #meditation #mindfulness #souljourney #innerstrength #philosophy #god #mysticism

How I love to spend my Saturday evenings 🙏🐾🤎

#DateNight with nostr:npub1x82uxuv3h32hagm2l0gyaq9kyjeqnflr5p0sdtyyq6wmchh0q0ys2t8acv #MorningPerson

Enjoying the bright side of my life 😎

"As above, so below; as below, so above."—The Kybalion. The great Second Hermetic Principle embodies the truth that there is a harmony, agreement, and correspondence between the several planes of Manifestation, Life and Being. ♾️

#Hermetic nostr:npub1x82uxuv3h32hagm2l0gyaq9kyjeqnflr5p0sdtyyq6wmchh0q0ys2t8acv

Woke up like this 🤎🙏🤎 nostr:note19k9wjvwdmf7qx4nxf6cx6gsd0x29fnpypf67ay2k9t5zurnf429svj8ajf

Turn the light on ☀️

Feeling totally blessed with this two in my life. 🤎🙏🤎 Snoop & nostr:npub1x82uxuv3h32hagm2l0gyaq9kyjeqnflr5p0sdtyyq6wmchh0q0ys2t8acv

#light #Dog = #God 💫

Amsterdam Art 🖼️ #Street #Art nostr:npub1x82uxuv3h32hagm2l0gyaq9kyjeqnflr5p0sdtyyq6wmchh0q0ys2t8acv

Good morning ☕️ We spent our night listening to the best #Bitcoin podcasts after sleeping all day because I had 16 screws removed from my upper jaw.

When I listen to a podcast at night, it's always one in which nostr:npub1dergggklka99wwrs92yz8wdjs952h2ux2ha2ed598ngwu9w7a6fsh9xzpc speaks. If I fall asleep while doing this, it is guaranteed that I will do so with a positive vibe. nostr:npub1x82uxuv3h32hagm2l0gyaq9kyjeqnflr5p0sdtyyq6wmchh0q0ys2t8acv https://video.nostr.build/b1d2a5531399f5ee3e96bc4db883406c3d8bc91c46322f4c034d4273461b7dce.mp4

The beauty of nature. The only home where my mind finds peace 🕊️💚✌🏻

#nature #copenhagen

Spreading Satoshi‘s mind at Distortion Festival in Copenhagen 🎶🫶🏻🇩🇰 #Bitcoin #Distortion #Satoshi #Copenhagen