Mother of all bull markets next year?

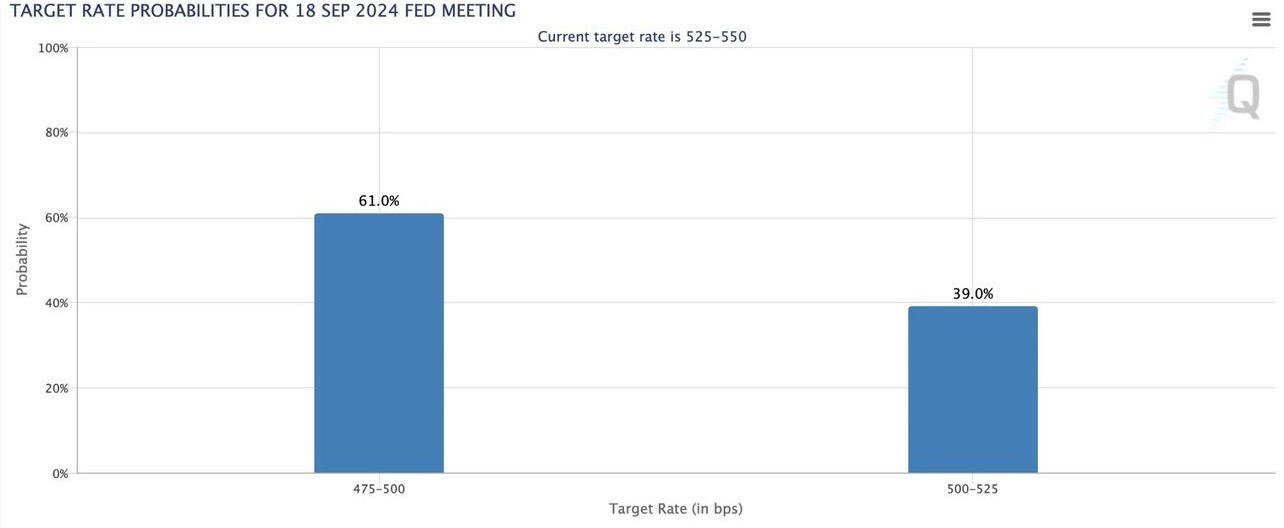

Interest rate easing will be good for asset holders for sure

But it’s not the 2020 QE bonanza…

Yet…

Cutting rates does not equal money printing

So question is, when?

“unhedgable for your meat suit”

This hits home

My wife likes to say “you can’t live in a Bitcoin”

At some stage it makes sense to have physical assets for sure

To live somewhere eg is a big deal & totally different to store-of-value

I guess I’ve spent the day looking at properly going “wtf, these guys have no idea there is only 21 million”

Whilst there always seems to be the next off market land deal

Interesting process

lol

Need to ask my wife that…

Pretty sure the answer is that she’s just a soothing magical la la land of easy viewing switch off time

Or something like that

Been researching a potential real estate investment

Thinking to buy some land then build a family home

Almost every single advertised plot says the same thing

“Once in a lifetime”

“Rare”

“Exclusive”

“First time on the market in 40 years”

Which can be deduced to mean: scarcity

Little do people realise that digital scarcity has been discovered

It’s hard to translate the fact there will only ever be 21 million…

GM

Morning beach walks with the dog

Really is one of life’s true pleasures

🙏🏻

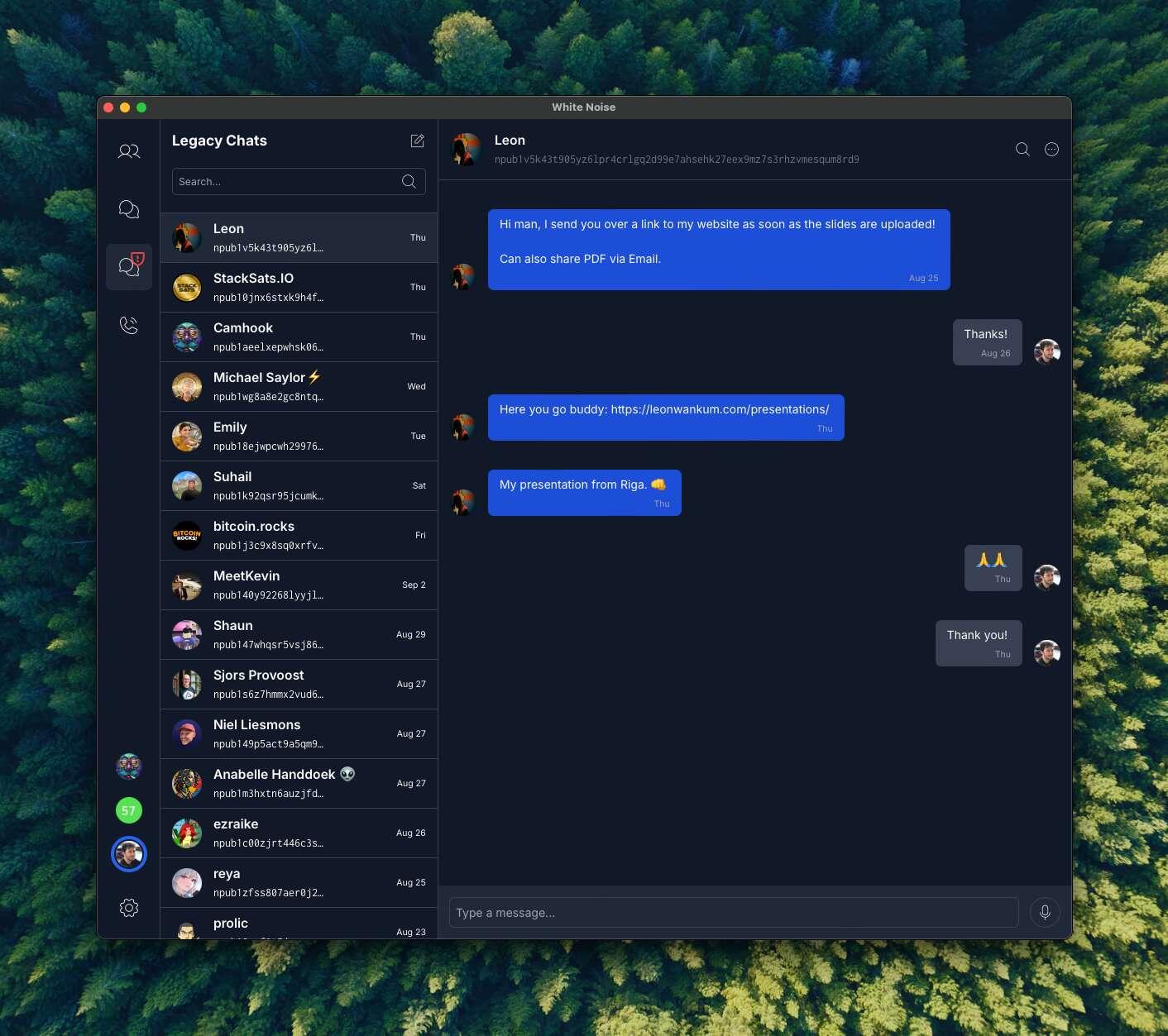

The fact we have Nostr as an option to utilise is a wonderful thing

How would you feel if we didn’t? Frustrated to say the least…

Some clients have them built in. Eg primal

Wos is a good option. Also I like Alby

I honestly think nostr:nprofile1qqspwwwexlwgcrrnwz4zwkze8rq3ncjug8mvgsd96dxx6wzs8ccndmcpzemhxue69uhk2er9dchxummnw3ezumrpdejz7qtxwaehxw309anxjmr5v4ezumn0wd68ytnhd9hx2tmwwp6kyvt6w46kz6nyxa6nxumc8pu82wfj09shvwt2wau8qu3cxvukxuesdd3nxufkws6nvanyx46njufsxvehsmtgwd4nvcejw43n7cnjdaskgcmpwd6r6arjw4jszxrhwden5te0dehhxarj9enx6apwwa5h5tnzd9az77vr4lw Telegram alternative is going to quickly become the worlds most used nostr client. There's a billion tg users happy to jump ship, particularly if someone can make a bridge for transitioning groups, and a bot father alternative.

Which app is that sorry? Very keen to trial it asap

Learn about Bitcoin

Sack your financial adviser

Connect a bitcoin lightning wallet to your nostr profile

Once setup, I can “zap” you

A “zap” can be as many sats as you want

Indeed. All of which represent a tuition fee of sorts

Opportunity costs at its essence

Understanding purchasing power is a key step that’s often missed frankly

Had the same feeling going through a business bank account application in Australia recently

Painful at best. Downright nefarious at worst

A cartel that has been too much for for too long, at the expense of everyone else

That’s actually a very good lens to use on all discussion

It’s so profound in how many areas of life it touches

If you haven’t looked into it then you’re working from a hymn sheet with the wrong songs

When you truly understand Bitcoin as a store-of-value, it means you’ve begun the process of “unlearning” that is critical

Plenty of problems then arise when it comes to portfolio allocation. Why do I own what I own?

More often than not, diversification, is actually diworsificaiton, & something a financial adviser cannot say

Is there an equities fund that’s focused on global bitcoin adoption for public companies?

Ie as they make meaningful strategy, treasury, & financing decisions, one can get exposure

Trying to figure it out alone is a full time job. Which stock index? Which geography? Which industry?

Seems a smart bet to outpace Bitcoin itself in the right circumstances. But you need the skills to execute on it

Getting financial advice from “successful” boomers

Is going to cost a lot of people the chance to buy #Bitcoin now

Unfair

But true

Thanks