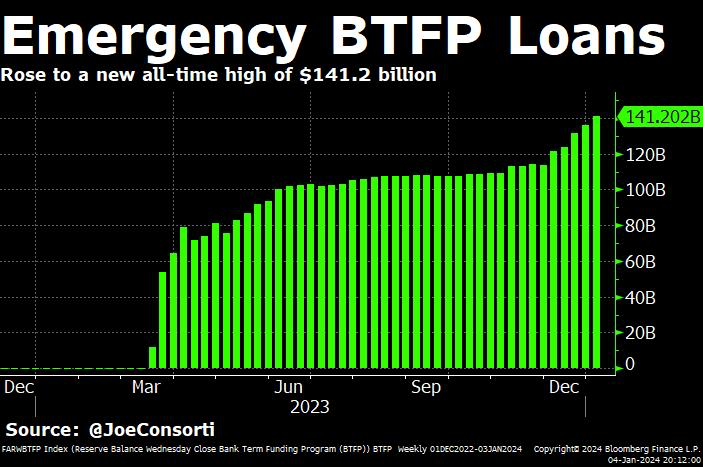

Either they will extend the program or reduce interest rates drastically, the new expansionary cycle has begun, we have been doing this for more than 120 years, this time it will be no different. The FIAT system is like a drug, you need more and more of it to have the same effect, there is no turning back.

Halving is just a strategy to secure the Bitcoin network through a reward incentive while at the same time Bitcoin is capitalized.

If Bitcoin had been created directly with 21 million there would be no incentive for miners with low Bitcoin capitalization and therefore the network would not be secure.

Halving is not the driver of the Bitcoin price.

I have posted several publications other than this one, including this one if you consider that there is noise...

And in no case am I saying that the price will go down because from my point of view the new liquidity cycle has started...

I have only tried to express that for bitcoin price global liquidity is more important than halving.

I think you missed the point of my posts, I'm just explaining the relationship between liquidity cycles and bitcoin price. I don't understand what's wrong with it or why you put that image.

Do you denominate bitcoins with carrots?

It is simply a matter of understanding things, information is power.

Disinformation is slavery.

You still don't believe me? here I show you that the global liquidity cycles coincide with the halving cycle, including the next one if nothing unusual happens, in which the maximum liquidity will be in 2025 and with it the maximum of the cycle.

I hope my information helps you.

I will tell you clearly, after the halving if there is no monetary expansion cycle bitcoin will not reach new highs.

Halving is overestimated in terms of price.

In mathematical terms it can have no effect because the bitcoin spot market is ridiculous compared to the derivatives market...why do you think they approved futures etf's and have so far prevented a spot etf?

Unfortunately in this world many are ignorant of the financial side of things and have been told many lies and inaccuracies.

The only true thing is that the price of bitcoin is driven by the liquidity of money, and this is not bad, as it was created for this, to combat monetary debasement.

In my opinion the effect of halving has been overestimated, the total issuance of bitcoins per year is ridiculous compared to what, for example, is traded in the Bitcoin futures market.

It has no quantitative effect, coincidentally the dollar liquidity cycles have coincided with the halving, this is what most overlook.

And if you don't believe me...

nostr:note1detwa3gaax3d43thrj74gg7xznqn6fswclhuj0drndsm02wz7yrq8dflac

And this is where the liquidity is coming in, and remember that bitcoin is a proxy for liquidity. The question is what will happen in March as the BTFP program is supposed to end.

Interestingly the liquidity cycles have always coincided with halving, you should rethink if halving is so important to the bitcoin price or maybe liquidity is.

Good morning!

I have been able to open it, your link is correct 🙏

Investing in #Bitcoin

Oops! That page can’t be found.

#m=image%2Fjpeg&dim=1067x1920&blurhash=%5DMSF-EWBogj%5Bof_2R*kBfjkB00ayj%5Df7of%7EpayWUj%5Bfi4njaafj%5Bj%5B_3WUWBkCa%7B9Ff6afj%5Bj%5B%3FubGWBfkayD*oMafayf7&x=81fac1c37be72b5ade3cc70eb9099b513fda98fb5f1b6d1c8ee19ddd1e1a1097

#m=image%2Fjpeg&dim=1067x1920&blurhash=%5DMSF-EWBogj%5Bof_2R*kBfjkB00ayj%5Df7of%7EpayWUj%5Bfi4njaafj%5Bj%5B_3WUWBkCa%7B9Ff6afj%5Bj%5B%3FubGWBfkayD*oMafayf7&x=81fac1c37be72b5ade3cc70eb9099b513fda98fb5f1b6d1c8ee19ddd1e1a1097

#m=image%2Fjpeg&dim=899x512&blurhash=iMF%7D%5B%2C0%7DI%5B%7D%5D02RUWXx%5BtP00%25Ln%7ERO%24frqofNGtR5Uw0s99%5B%3FF%25KkBs%3BVxa0xvkXtRb%5EI%3BWBr%3Fi_t2aJadRjWFogRkaxWT&x=12b3af2aa155a3dc8d20cc272fae1ce7f4f7fc68ff683f04e6155ce102a1d402

#m=image%2Fjpeg&dim=899x512&blurhash=iMF%7D%5B%2C0%7DI%5B%7D%5D02RUWXx%5BtP00%25Ln%7ERO%24frqofNGtR5Uw0s99%5B%3FF%25KkBs%3BVxa0xvkXtRb%5EI%3BWBr%3Fi_t2aJadRjWFogRkaxWT&x=12b3af2aa155a3dc8d20cc272fae1ce7f4f7fc68ff683f04e6155ce102a1d402