Global Feed

Resilience, if you can achieve what's needed now, you can win 🤑 But what guarantees that?

T1767365119.157:status:stx89968b9ad29e8f8f8c:kbzh2thun6+2133558685/g860412-c376a9d44fd8f05c8c9925df8ff09bdda+2133560199

‘Wicked’ Composer Stephen Schwartz Cancels Kennedy Center Event After Trump Name Change

"There's no way I would set foot in it now," said the Oscar-winner, who was set to host an event there in May

That 50% feels like a ball and chain if you cannot leave no matter where you go. Someone once said (paraphrasing here) make someone feel free and they’re the perfect prisoner.

Is this the same as a proxy war❓️❔️❓️

https://blossom.primal.net/97cfa84ed26cc9faa7ecaf53ed449edfeede19b9b68c4e8ef11f934c69733f23.mp4

You can’t say “humanitarian” and China in the same sentence without mentioning what they’ve been doing in Tibet, and to Uighurs.

Still a positive outcome for Palestine but this is just a strategic play from CCP

Pour ma game de jeu de rôle Werewolf: L'Apocalypse, j'ai rendu publique le site web conçu pour les joueurs pour les aider à se remémorer les PNJ et l'histoire en général.

Il y a une playlist des résumés de session de jeu que j'ai créé avec la IA.

#JDR #NostrFr #Werewolf #WorldOfDarkness #RPG

Block 930578

5 - high priority

4 - medium priority

3 - low priority

2 - no priority

1 - purging

#bitcoinfees #mempool

I had the same thought!

And it seems like you can:

Tesla Q4 Deliveries Fall 16% As Investors Pivot Toward Robotaxi, Optimus https://www.zerohedge.com/markets/tesla-q4-deliveries-fall-16-418227-investors-pivot-toward-robotaxi-optimus-future-focus

https://nitter.poast.org/zerohedge/status/2007100850490011775#m

(bot) Como não obtive o seu retorno, a sua ordem foi enviada para um provider disponível.

Bitcoin price: $89247, Sats per USD: 1120

📊 Whale Summary (2026-01-02 14:45 UTC)

🟢 Top Bullish

#WLFI/USDT → Score 35 🟢 📈

🔴 ⬜⬜⬜⬜⬜ | 🟩🟩🟩🟩🟩 🟢

🌋 Extreme bullish – High pump risk!

#SLP/USDT → Score 28 🟢 📈

🔴 ⬜⬜⬜⬜⬜ | 🟩🟩🟩🟩🟩 🟢

🌋 Extreme bullish – High pump risk!

#MEME/USDT → Score 25 🟢 📈

🔴 ⬜⬜⬜⬜⬜ | 🟩🟩🟩🟩🟩 🟢

🌋 Extreme bullish – High pump risk!

🔴 Top Bearish

#NULS/USDT → Score -18 🔴 📉

🔴 🟥🟥🟥🟥🟥 | ⬜⬜⬜⬜⬜ 🟢

💀 Extreme bearish – High dump risk!

#OMNI/USDT → Score -21 🔴 📉

🔴 🟥🟥🟥🟥🟥 | ⬜⬜⬜⬜⬜ 🟢

💀 Extreme bearish – High dump risk!

#1000PEPE/USDT → Score -50 🔴 📉

🔴 🟥🟥🟥🟥🟥 | ⬜⬜⬜⬜⬜ 🟢

💀 Extreme bearish – High dump risk!

Fri - Jan 02 - 06:45 AM - PST

// bit.site

☹️ Error connecting to node-1.ipfs.bit.site 4001 - [Errno -2] Name or service not known

// pinnable.xyz

✅ Connection successful: 167.71.172.216 4001

✅ Connection successful: 188.166.180.196 4001

✅ Connection successful: 143.198.18.166 4001

// 4everland.io

✅ Connection successful: node-1.ipfs.4everland.net 4001

"Berkshire Hathaway is better prepared than any other company to be around for another 100 years," Warren Buffett said as he officially handed the CEO role to his chosen successor, Greg Abel, at the start of 2026. The comment accompanied the formal transfer of leadership with the new year.

Buffett made the remark while stepping aside and passing day-to-day chief executive duties to Abel. No additional figures or forecasts were provided in the brief statement.

The handover marks a milestone in Berkshire Hathaway's succession process, placing Abel in charge of the conglomerate going forward. #WarrenBuffett #GregAbel #BRK.B #FiatNews

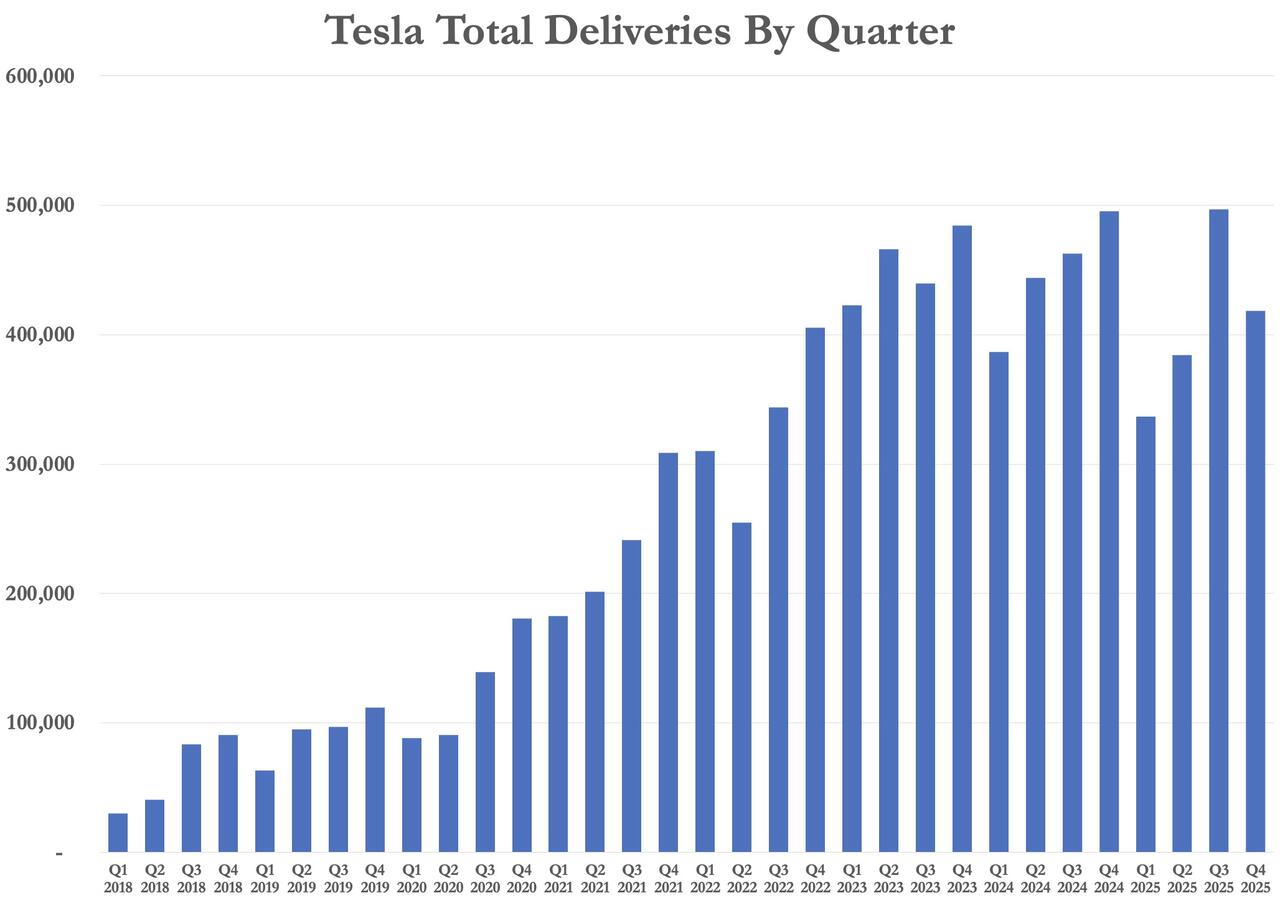

Tesla Q4 Deliveries Fall 16% As Investors Pivot Toward Robotaxi, Optimus

Tesla Q4 Deliveries Fall 16% As Investors Pivot Toward Robotaxi, Optimus

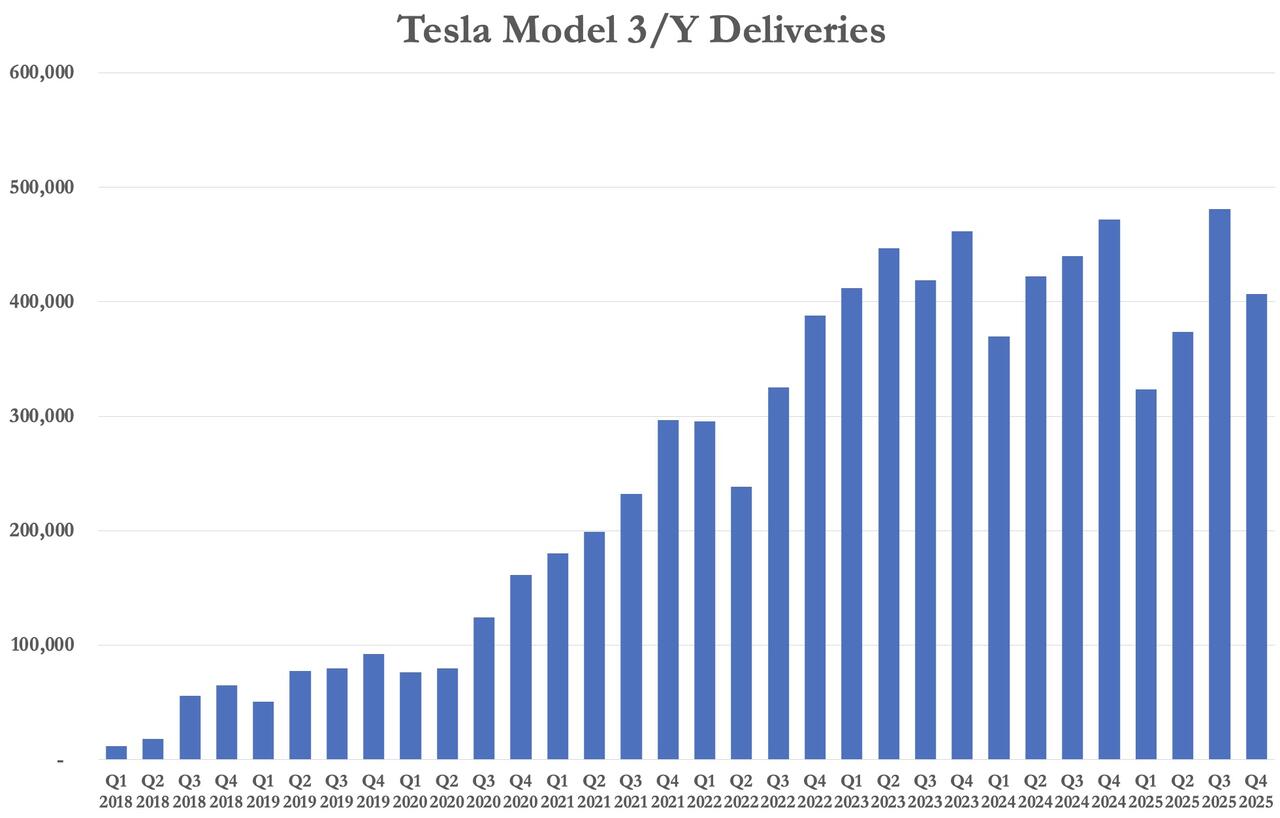

Tesla delivered 418,227 vehicles in Q4 2025, below Wall Street’s expectation of roughly 426,000 deliveries, according to https://www.cnbc.com/2026/01/02/tesla-tsla-q4-2025-vehicle-deliveries.html

. Production totaled 434,358 vehicles. For the full year, Tesla delivered 1.64 million vehicles in 2025, down 9% from 2024 and marking the second consecutive annual decline in deliveries.

Shares are now down about 10% from recent highs, despite the stock holding relatively firm given the disappointing numbers so far today.

?itok=Kz-7Qi5M

?itok=Kz-7Qi5M

On December 29, the company publicly released its own analyst delivery consensus for the quarter via a press release on its investor relations website — a significant departure from its normal practice. Tesla typically compiles these estimates but only shares them privately with a select group of analysts and major investors.

The decision to publish the consensus suggested the automaker was trying to manage expectations ahead of what it appeared to anticipate would be a disappointing report.

?itok=6feTS2Qm

?itok=6feTS2Qm

That internal survey of 20 analysts projected 422,850 deliveries for the quarter, far below the broader public consensus at the time, which ranged from roughly 440,000 to 450,000 vehicles. Even Tesla’s lowered benchmark proved too high.

Fourth-quarter deliveries declined 16% from a year earlier, when Tesla delivered 495,570 vehicles. Production fell 5.5% from the 459,445 vehicles the company built in the same period last year.

EV blog electrek https://electrek.co/2026/01/02/tesla-tsla-releases-q4-delivery-results/

in response to the numbers:

"This is pretty much exactly what we expected: a 15% drop year-over-year and a quarter-over-quarter as Tesla loses incentives in the US and its decline in Europe and China continues. Tesla did report of 14.2 GWh of energy storage deployment, a new record. It’s a silverlining, but it won’t be enough to compensate for the significant drop in electric vehicle deliveries.

Tesla will end 2025 with a second consecutive year of decline in revenue and earnings despite being a “leader” in the globally booming EV market. There’s room for concern: unless you 100% believe in Musk’s pivot to AI. Then, you have nothing to worry about."

The company’s deliveries peaked at 1.81 million vehicles in 2023 before its growth began to stall amid intensifying global competition and an aging vehicle lineup.

Tesla’s fourth-quarter breakdown showed 406,585 Model 3 and Model Y vehicles delivered, along with 11,642 deliveries from its other models, for a total of 418,227.

The pressure on Tesla’s core auto business has become especially visible in Europe. While the company does not provide geographic delivery data, figures from the European Automobile Manufacturers’ Association show Tesla’s registrations in the region fell 39% in the first 11 months of 2025, even as overall battery-electric vehicle adoption increased. During the same period, Chinese rival BYD’s European registrations surged 240%.

?itok=rsnK0R8h

?itok=rsnK0R8h

Tesla now faces fierce competition from a growing list of global automakers, including BYD, Xiaomi and Geely in China, Hyundai and Kia in South Korea, and Volkswagen in Europe. At the same time, political controversies surrounding CEO Elon Musk have contributed to consumer backlash in both Europe and the United States, further weighing on the brand.

The company’s energy business offered a bright spot. Tesla said it deployed 14.2 gigawatt-hours of battery energy storage products in the fourth quarter, up from a record 12.5 GWh in the prior period. The division supplies large-scale systems to utilities and data centers as well as backup batteries for homes.

Some analysts believe Tesla’s newly introduced lower-priced Model Y standard, launched in October, could help stabilize sales in coming quarters, particularly in emerging markets such as Brazil, Thailand and Vietnam. Still, Tesla enters 2026 facing its most uncertain growth outlook in more than a decade, as investors increasingly weigh Elon Musk’s ambitious long-term vision for robotaxis and humanoid robots against the near-term realities of slowing vehicle demand.

Tesla is scheduled to report its full fourth-quarter financial results on Jan. 28.

https://cms.zerohedge.com/users/tyler-durden

Fri, 01/02/2026 - 09:45

✄------------ 23:45 ------------✄

T1767365099.530:status:stx899e8a938b:kgt4727g4h+2133539264/g960412-d479c98f72600947067d8638db6386775+2133540593

Who gives a hoot what fat women think? I'll still go after baddies