The State's Banking Monopoly: Marx's Blueprint for Economic Destruction

The Marxists have never hidden their intentions. Right there in their revolutionary manifesto, Marx and Engels explicitly called for "Centralisation of credit in the hands of the state, by means of a national bank with State capital and an exclusive monopoly." This was no mere footnote, but a central pillar in their plan to destroy the free market and impose economic totalitarianism.

By centralizing banking, the state gains the power to manipulate the very lifeblood of the market economy - money itself. Every expansion of the money supply amounts to a hidden tax, stealing purchasing power from productive citizens and transferring it to the state and its cronies who receive the new money first. This is no accident - it is precisely what the architects of state banking intended.

Consider the pernicious effects: When the central bank expands credit, it sets in motion an artificial boom. Entrepreneurs are misled by false interest rate signals to invest in projects that cannot be sustained by real savings. When reality eventually reasserts itself, we get the inevitable bust - but rather than allowing the necessary liquidation of malinvestments, the central bank doubles down with more credit expansion, perpetuating the destructive cycle.

This is exactly what Marx and his followers wanted - to destabilize the market economy through monetary manipulation. By monopolizing banking, the state gains the power to generate the boom-bust cycles that Marxists then disingenuously blame on capitalism itself. The central bank serves as their primary weapon for undermining sound money and economic calculation.

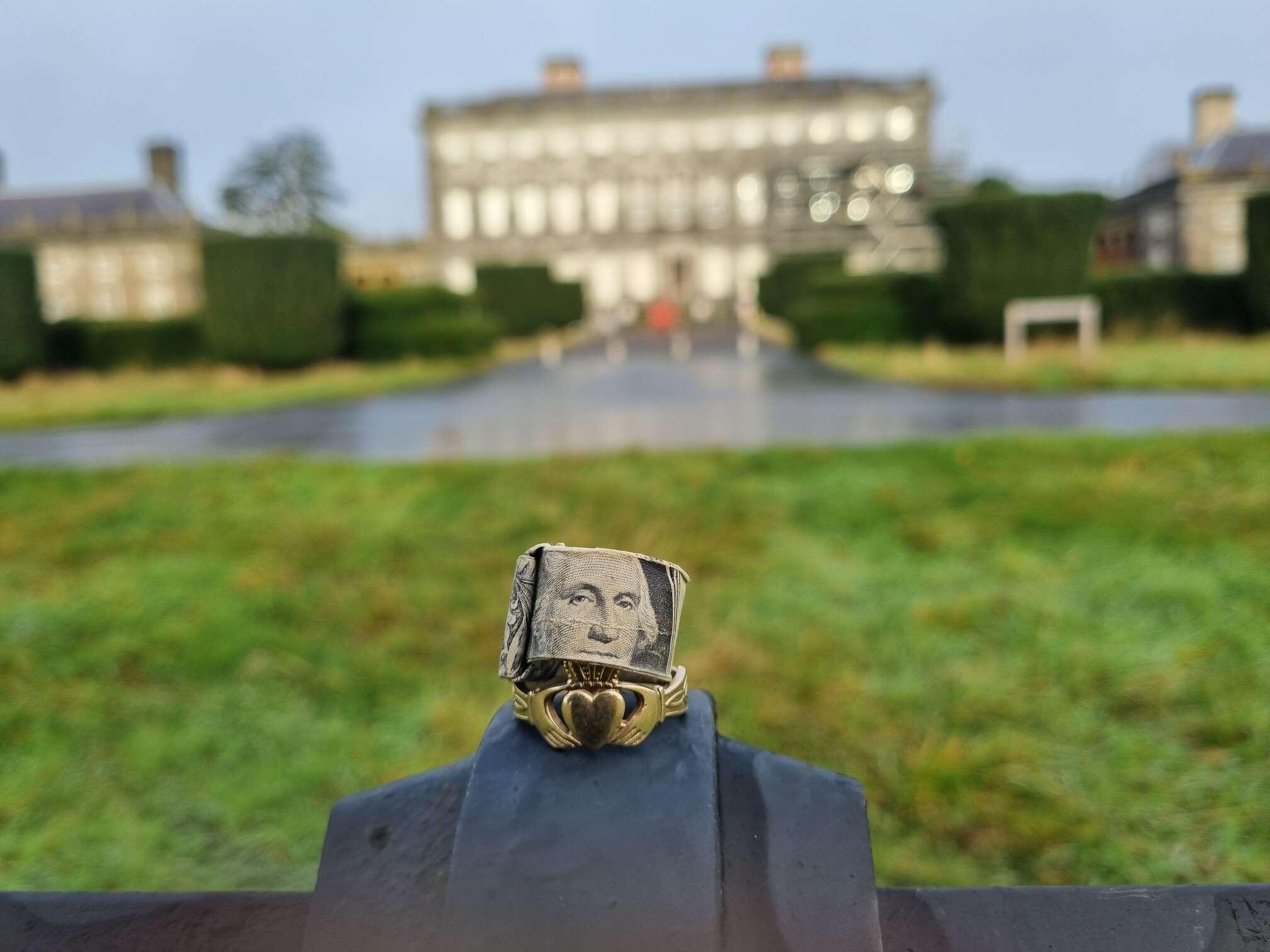

The Federal Reserve and its global counterparts represent the realization of Marx's vision. Through their monopoly on money creation, they enable the endless growth of state power, fund the welfare-warfare state, and steadily destroy the purchasing power of the common man's savings. Every new round of quantitative easing and interest rate manipulation takes us one step closer to the Marxist goal of abolishing private property and free markets.

The solution is clear - we must end the state's banking monopoly and restore sound money based on voluntary market choices. The free market, not bureaucratic central planners, should determine interest rates and the money supply. Until we eliminate this engine of statism, we remain trapped in a monetary system designed by our enemies to bring about our economic destruction.

#communism #socialism #wef #eu #fed #ecb #inflation #freemarket #mises #bitcoin