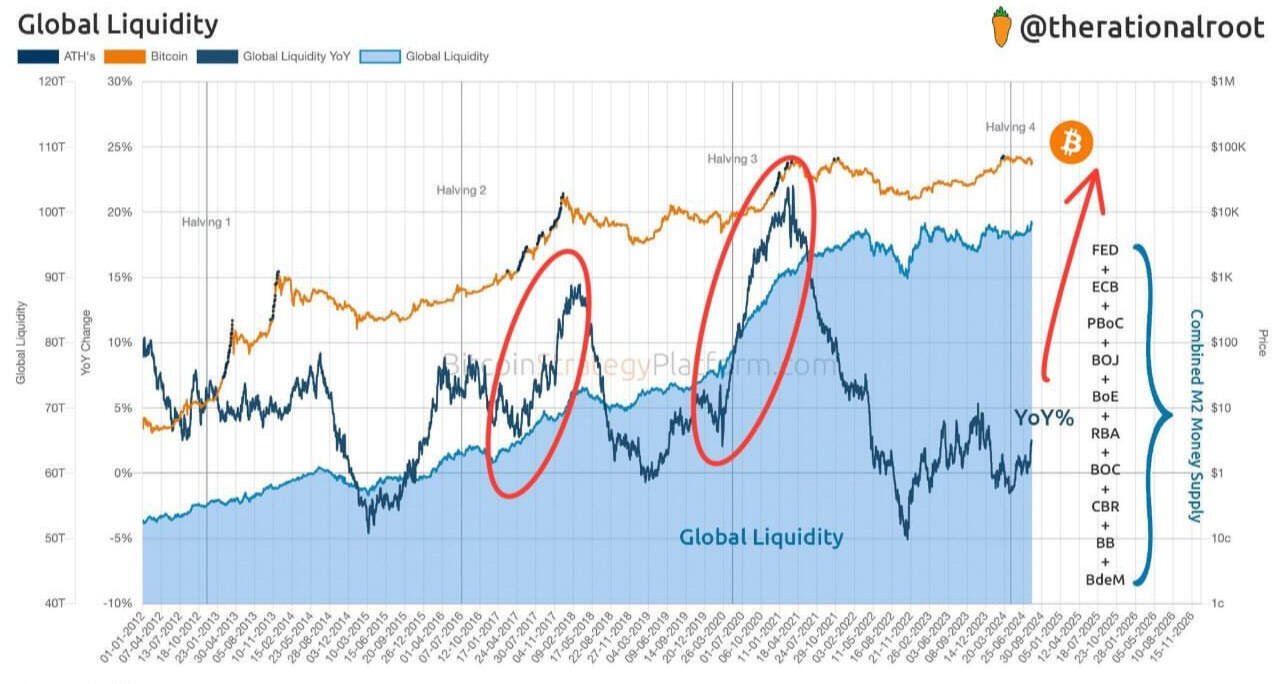

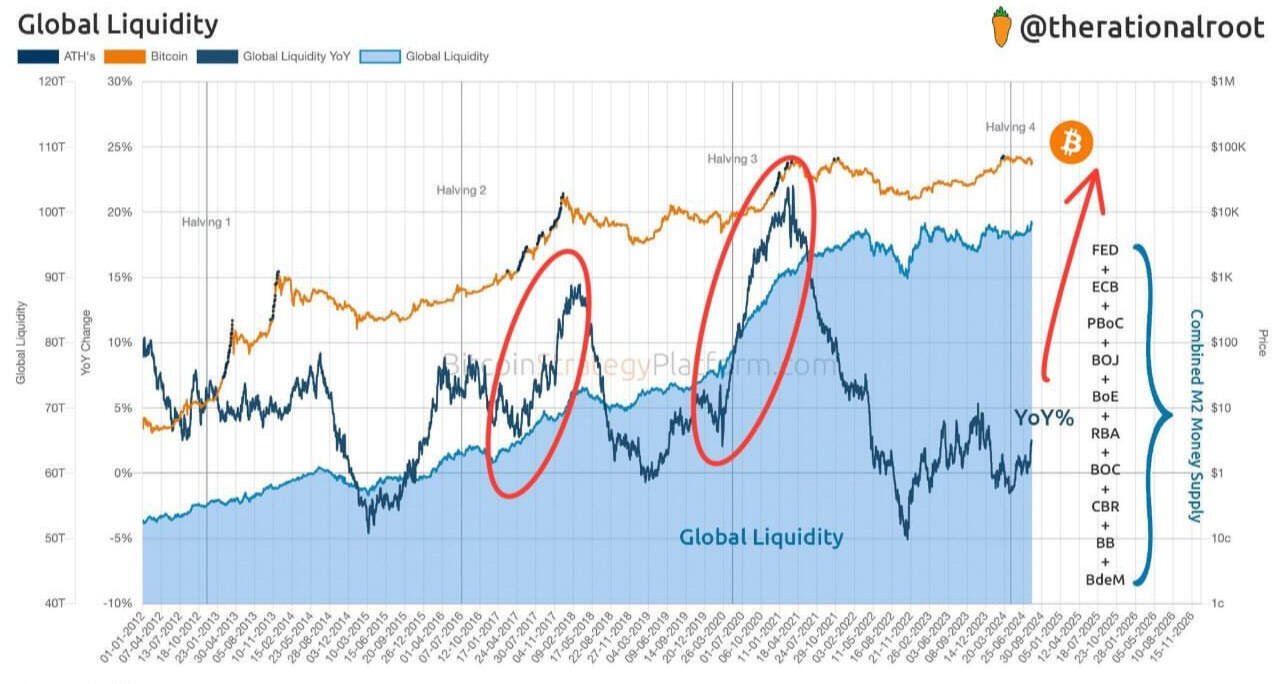

Global liquidity will soon rip again to finance record levels of government debt. Guess what's the best asset to soak up this liquidity? #Bitcoin

There is no second best.

Global liquidity will soon rip again to finance record levels of government debt. Guess what's the best asset to soak up this liquidity? #Bitcoin

There is no second best.

Global liquidity, represented by the money supply of the largest central banks, has been a strong driver of the #Bitcoin price in recent years.

Whenever liquidity grows, Bitcoin experiences significant increases.

After a phase of restrictive monetary policy and declining liquidity, an expansive phase could soon be imminent in which more money is pumped into the system.

With possible interest rate cuts and monetary easing in 2024 / 2025, billions could flow back into the markets - which could boost Bitcoin.

Halvings and increasing liquidity have always triggered strong price increases in $BTC in the past. Only question is will it be the same this time?

In fact, this chart perfectly illustrates why we started the correction at our all-time high a few months ago.

The return of liquidity could be the catalyst for the next big Bitcoin rally!

If Lyn says BTC rips when liquidity rips, I tend to believe it is indeed the case.

Mr Menger you know the answer to that rhetorical question.