Alright, so let's really dig into Elliott Wave. We're not just talking about the basic 5 waves up, 3 waves down thing anymore. We're going deep.

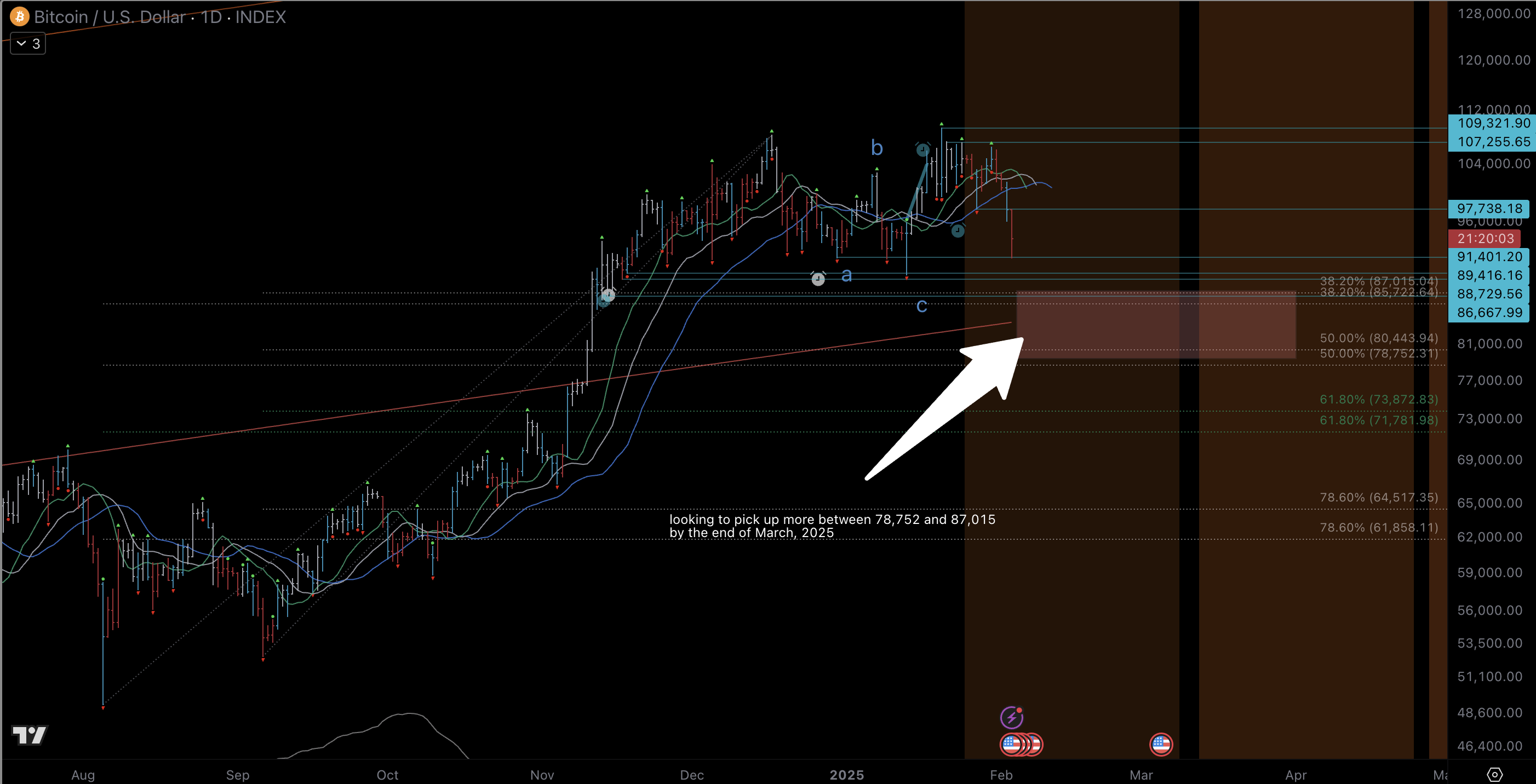

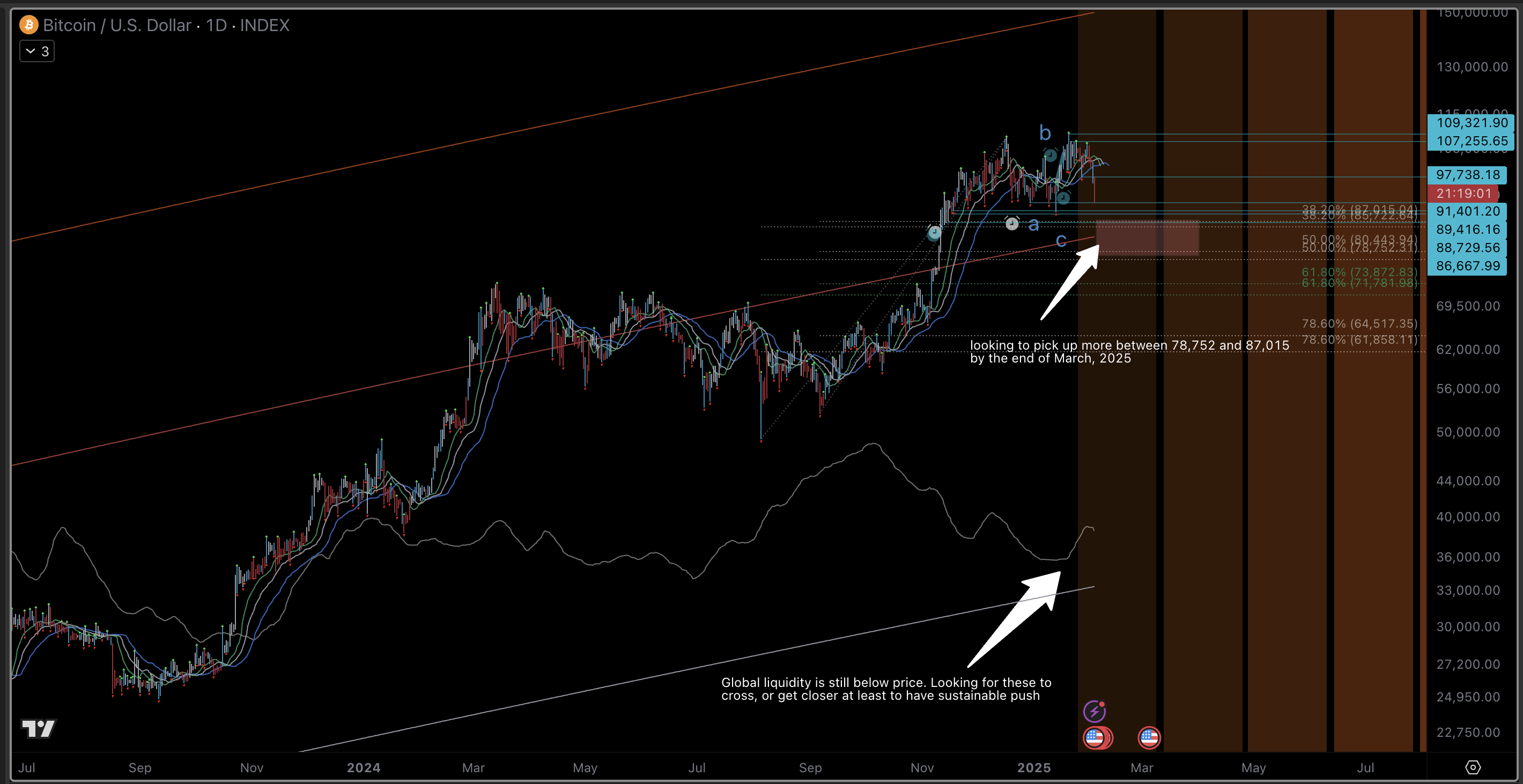

First off, Fibonacci. It's not just about the wave count, it's about the size of the waves too. You'll see those Fibonacci ratios popping up everywhere – 1.618, 0.618, all that. Wave 3 is often 1.618 times wave 1, stuff like that. Knowing those ratios is key for figuring out where prices might go.

Then there's wave personality. Each wave has its own vibe. Wave 1 is kinda hesitant, wave 3 is the big, strong one, wave 5 can be a bit of a letdown sometimes. Knowing these "personalities" helps you spot the patterns.

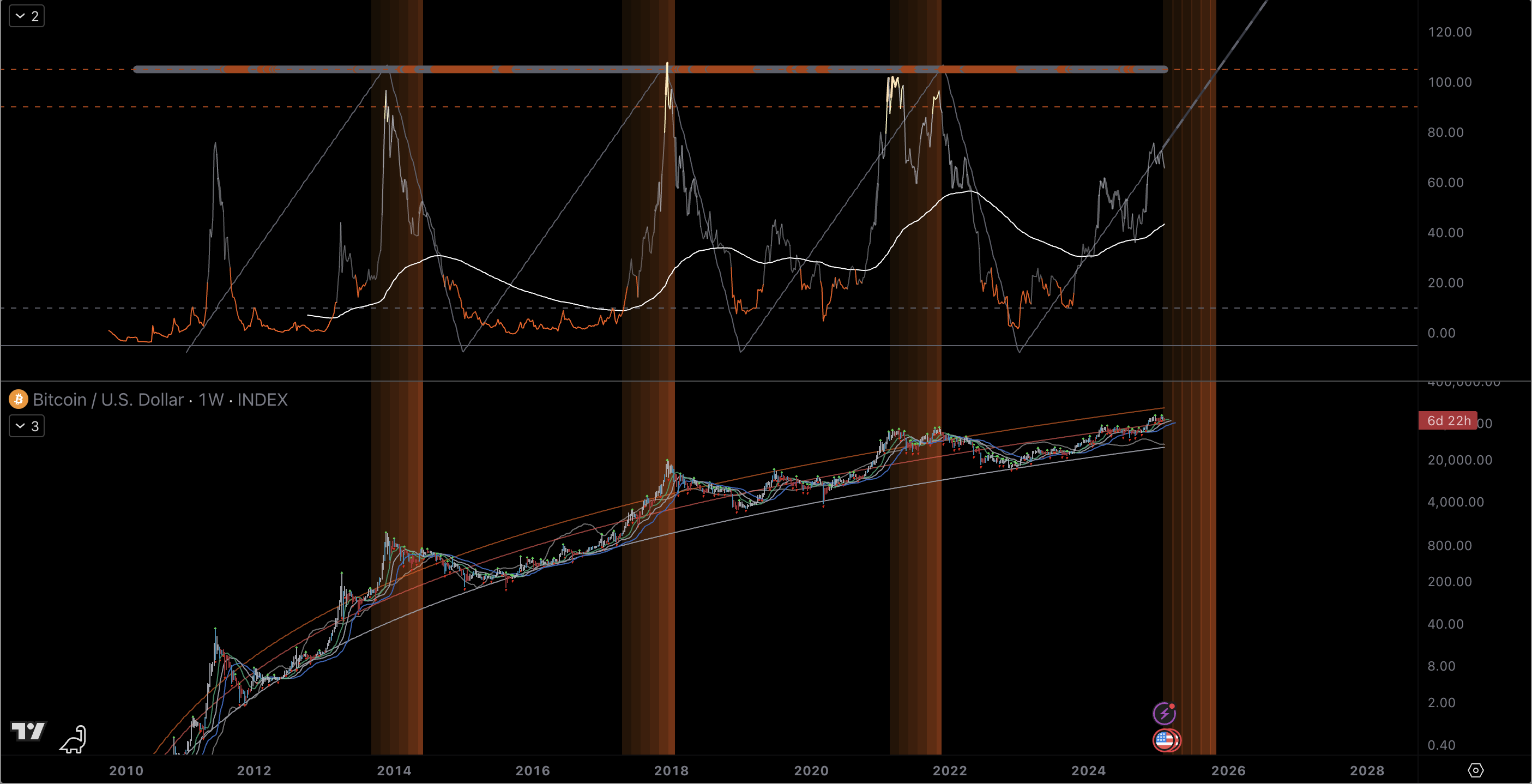

Now, things get complex. Those 5-3 waves? They can be made up of smaller 5-3 waves. It's like fractals, patterns within patterns. And sometimes, one of those impulse waves, usually wave 3, just goes nuts and extends way beyond the others. We gotta know how to spot those extensions.

And don't forget about alternation. If wave 2 is a sharp zigzag, wave 4 will probably be something different, like a triangle or a flat. It's all about keeping an eye on the patterns and how they change.

Speaking of patterns, there are more than just the basic ones. You've got zigzags, flats, triangles, double and triple combos – it gets complicated. But you have to understand these to really get Elliott Wave.

We can't just look at Elliott Wave in isolation either. It works best when you combine it with other tools like RSI, MACD, and volume. Divergences are especially useful when paired with Elliott Wave.

Now, here's the thing: Elliott Wave is hard. It's subjective. One person might see a pattern, and another sees something completely different. Plus, the market doesn't always cooperate. So, we need to talk about risk management, using probabilities, and looking at multiple timeframes to get a clearer picture.

And for the real deep dive, there's Adaptive Elliott Wave. That's where you start thinking about how the market changes and how the patterns adapt. It gets into chaos theory and complexity science.

So, yeah, there's a lot to unpack. We need to look at those specific Fibonacci ratios, the rules for identifying waves, all those different corrective patterns, how to use it with other indicators, and how to manage risk. And we should definitely look at some real-world examples to see how it all plays out. It's a journey, but if you really want to master this, that's the path.