Great read, Nathan. Thank you for posting. What would be your $MSTR price target to go back in?

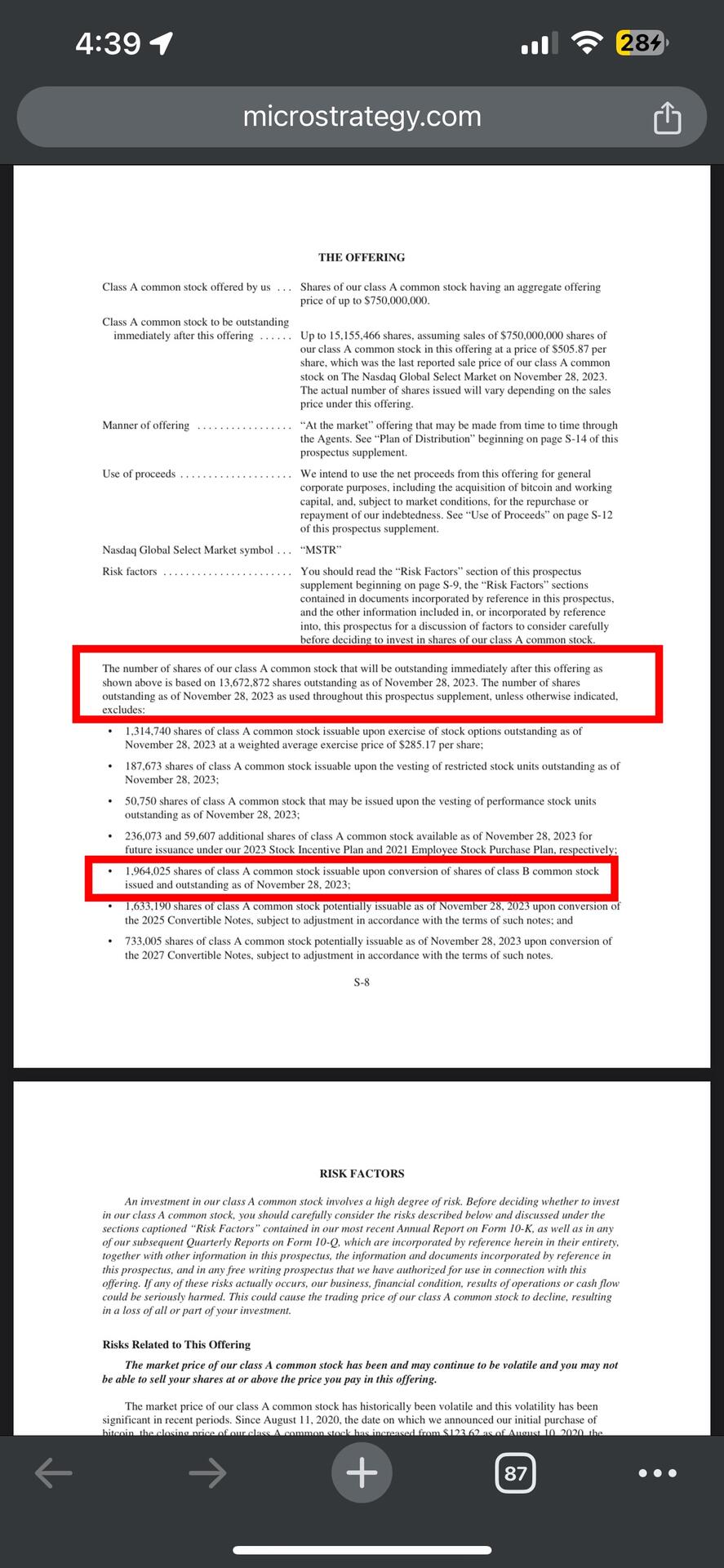

No surprise, $MSTR issued more stock to do it. (See below.)

This was the right move as the stock has been trading at a high premium above its #bitcoin holdings, higher than the operating company is worth. ($MSTR should trade at a premium above its bitcoin holdings as hr operating company also has value, the question is how much.)

I believe nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m is laser eye focused on one metric: *sats per share.* He’ll do anything that doesn’t threaten the stack to increase it.

IMO, he’s a brilliant capital allocator.

This is why I had my mom buy some MSTR shares back when the stock was trading at the price of the bitcoin plus $8 for the operating company. It’s was a steal. Since then both Bitcoin and the MSTR premium have soared.

Now, if only Saylor can enter into a tiny loan he uses to buy bitcoin. Then when Bitcoin goes down & every lazy person who can’t be bothered to understand the loan agreement thinks MSTR is going to default pushes the stock to a large discount, he *buys back* shares and demonstrate to Wall Street what real capital allocation looks like.

When Bitcoin tanked, and as a result MSTR tanked because lazy people thought MSTR was at risk of defaulting on the Silvergate Loan, I moved my GBTC into MSTR & netted a bunch of sats. I’ve since moved back into GBTC, then OBTC, and then back into GBTC again netting me a bunch more sats.

I’m waiting for the MSTR premium to come back down to move out of GBTC into MSTR which is, all things being equal, the better play. (No fee, an operating company that will keep generating free cash flow to stack more sats, and one of the best capital allocators in the business.)

My guess is the divergence between the GBTC discount and the MSTR premium closes when a Bitcoin spot etf gets approved/launched. So that’s what I’m keeping my laser eyed focus on.  nostr:note1pk7c7gqws528u8kgrnfefx0yljnhh7m49v3nnu6xca8l5f03wevslfrpd5

nostr:note1pk7c7gqws528u8kgrnfefx0yljnhh7m49v3nnu6xca8l5f03wevslfrpd5

Discussion

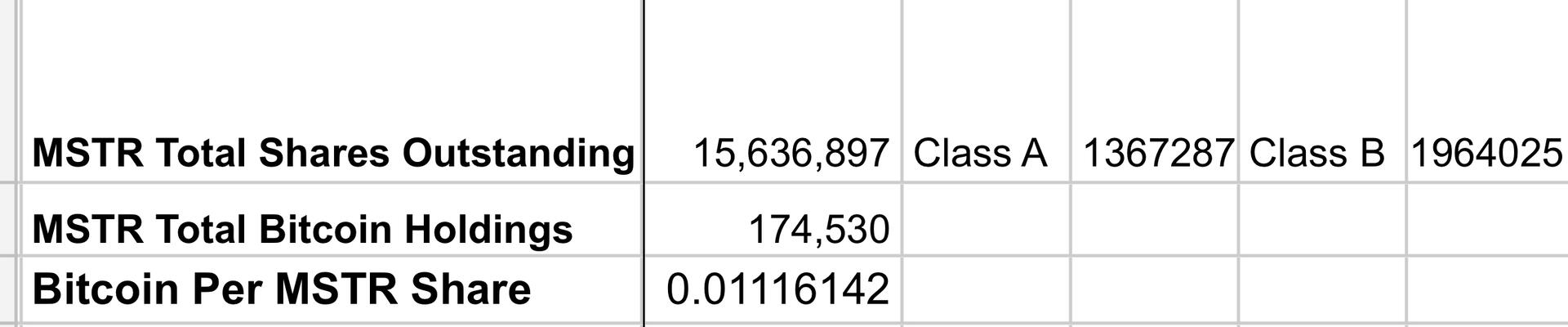

You need to value the operating company separate from the Bitcoin. Once you know what the value of the operating company is, you’re looking for the price of a share of MSTR to be below the per share value of the company + the price of sats per share (the photo below will give you the current sats per share but remember this changes). If an opportunity presents itself again, my guess is that it will be around the approval/launch of the spot bitcoin ETFs and people sell MSTR for the ETF or just buy the ETF instead of MSTR and then it could get oversold.

Another simple way to do it is to build a premium/discount calculator comparing sats per share to the price of bitcoin and if the current MSTR premium ever becomes a discount, you’re good to buy. This means you’re getting the sats at a discount and the operating company for free. This is what I used to trade among MSTR, GBTC, and OBTC.

Understood! I own a ton of $RIOT and $MARA stock and have been floating the idea of getting some exposure to $MSTR. Thank you for this framework! Time to dive into the numbers.

I think my numbers were off slightly. These numbers are taken from page S-8 of the supplemental prospectus and accurate as of November 28th. (I had to verify and kit just trust my work! Haha) https://www.microstrategy.com/content/dam/website-assets/collateral/financial-documents/financial-document-archive/prospectus-supplement_11-30-2023.pdf

Excellent, thank you! 🤙