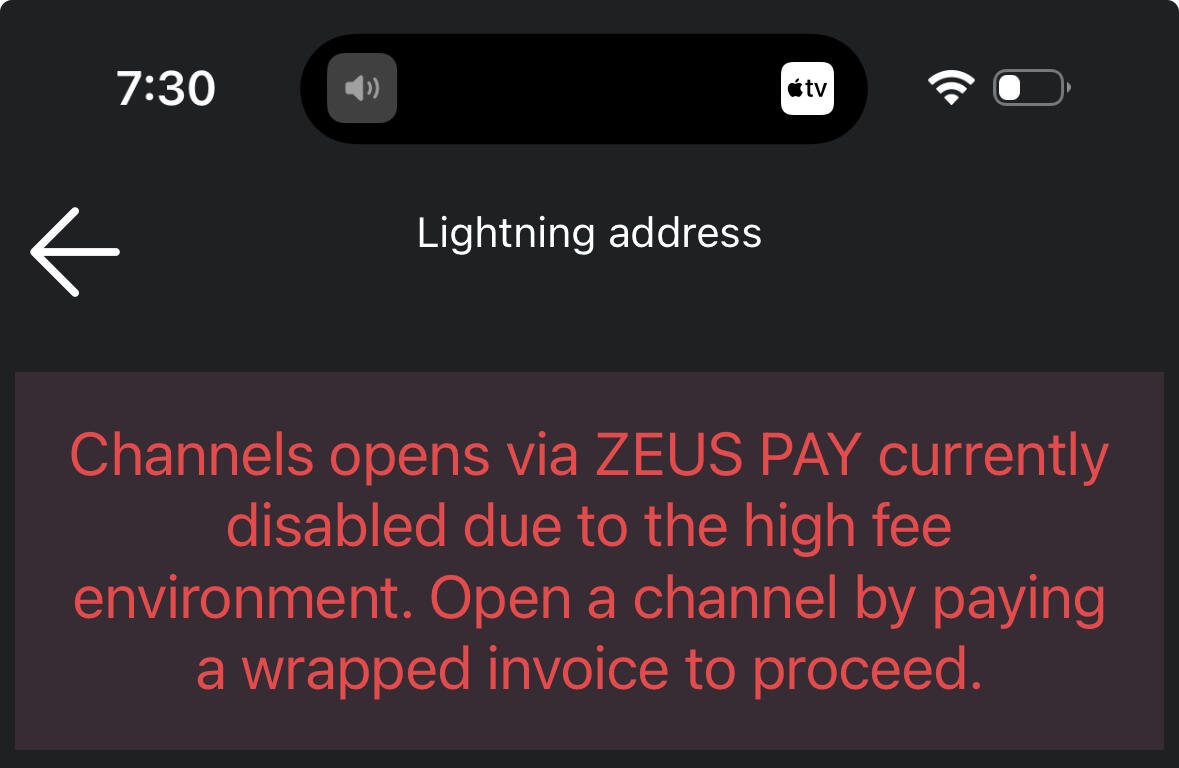

For most people this is the first time ever hearing the word “wrapped invoice.”

Nobody understands what this means.

It’s also probably not intuitive to most people who are coming from custodial wallets that they need to fund a channel with a sizable amount of sats (that they likely don’t have available) in order to start using it.

What’s the best way to overcome these obstacles?