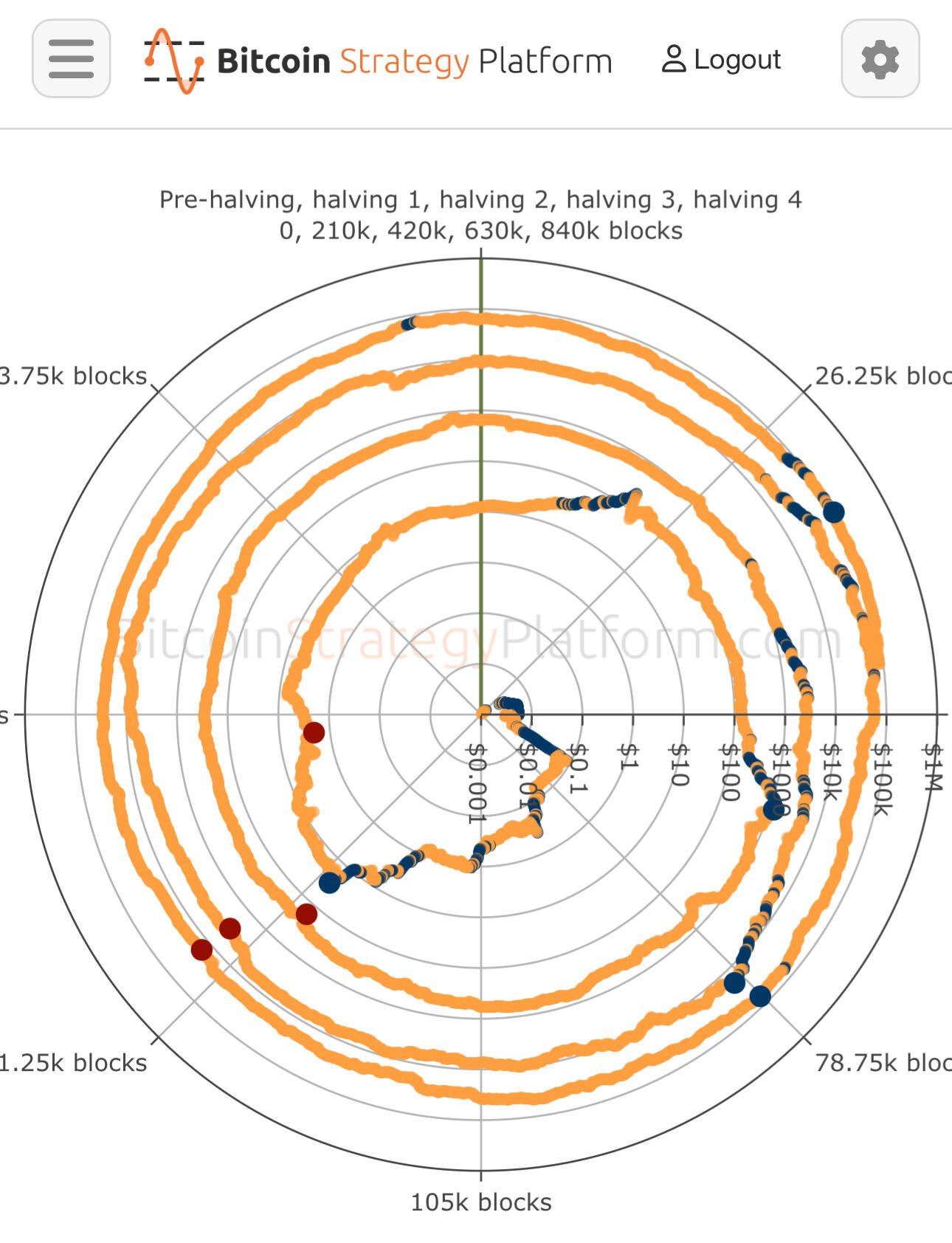

You don’t endure 80% drawdowns for 9% CAGR. Thats just bad risk management. I am expecting something much more aligned with prior cycles’ performance (which is where this tit for tat started). Somewhere around $250k/BTC, minimum.

You don’t endure 80% drawdowns for 9% CAGR. Thats just bad risk management. I am expecting something much more aligned with prior cycles’ performance (which is where this tit for tat started). Somewhere around $250k/BTC, minimum.

I’m not trying to tit for tat

I’m just saying that if the real power of Bitcoin comes when you can start pricing services in the asset and you can use it without permission to buy items.

Until the fed changes the denominator (21M/♾️) and starts QE, we will just see more of the same. Don’t get overlevered or place bets about its price, that’s the real bad risk