nostr:npub1cj8znuztfqkvq89pl8hceph0svvvqk0qay6nydgk9uyq7fhpfsgsqwrz4u nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a Let’s say the economy (GDP) is represented this year by the harvesting of 10 apples, and that is the whole economy. Let’s say that there are $10 total in circulation. In this case, each Apple would be worth about $1.

Let’s say there was some technological advancement and the economy was able to harvest 40 Apples in the next year. Let’s also say there are $20 in circulation in the next year. Now, each Apple is only worth about $0.50 each.

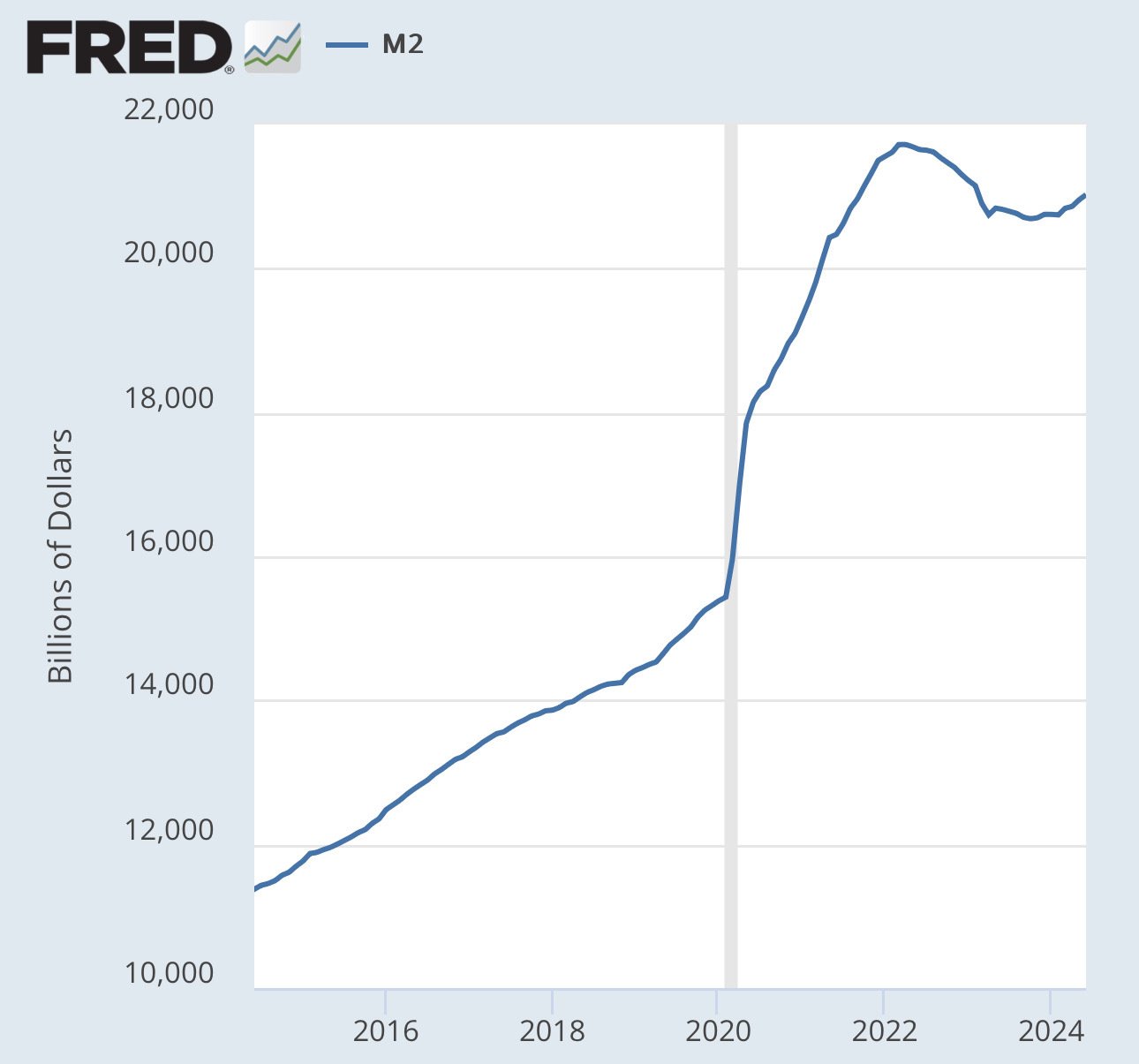

Money in circulation is generally correlated with GDP of course (money created through bank loans and central bank money “printing”, generally goes up with GDP growth) but in theory they are independent of each other.

So we had monetary inflation of 100%, but the general price level DROPPED by 50%. The actual economy is infinitely more complex of course but I think this explains the general idea.