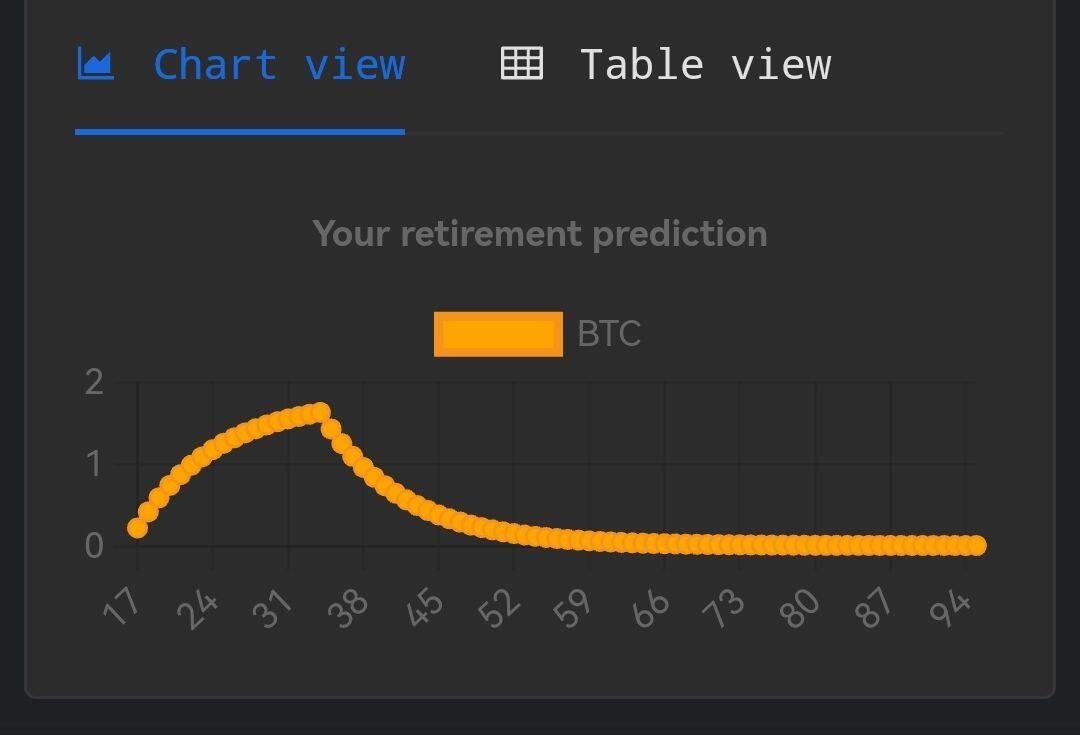

#Bitcoin Retirement Calculator.

Amazing tool to play with:

https://calc.bitcoineracademy.com

I inserted 15% for "annual growth" & 10% for "annual inflation" (FIAT supply).

Totally conservative! ... No adoption, no network effect etc.

Only considering the hardest money character (closed system)

& 5% annual productivity growth according to Jeff Booth.