Now that the Fed will lend cash for treasuries at par, there will be a lot more buying of treasuries.

This is why yields are going down.

Now that the Fed will lend cash for treasuries at par, there will be a lot more buying of treasuries.

This is why yields are going down.

Yield curve fixed 🤣

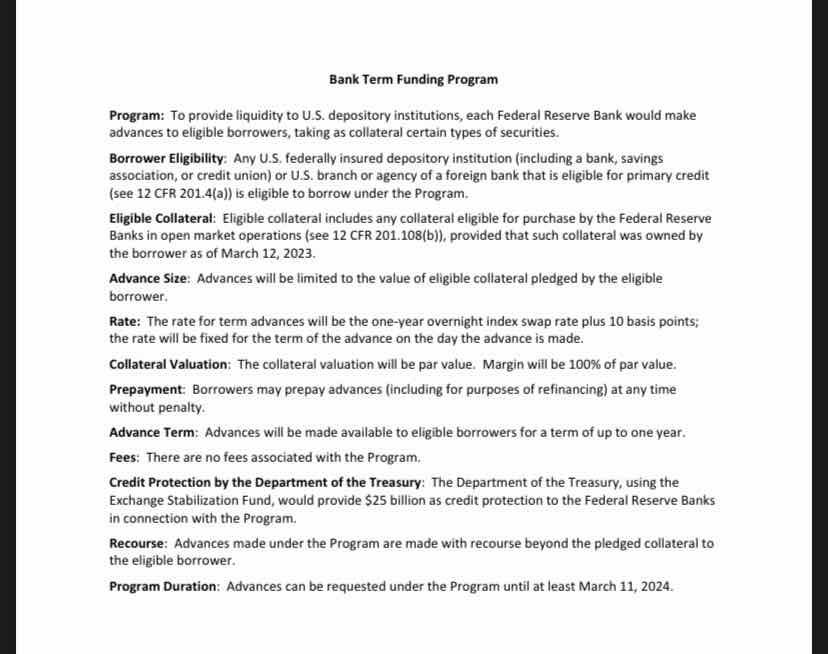

Can you look at this and give any feedback or corrections, i am trying to keep it simple but show that the Fed does not print money (its the banks that go Brrrrr!)

The loans for staking UST is only a $25bn program.

Funny how one simple policy statement can have such a dramatic and apparently benign short-term economic impact but have such a devastating impact long-term.

Not necessarily. If this random picture from the internet is correct, then it only applies to debt that the banks owned before march 12th

I'm aware that it's only for securities owned before 3/12/23 and limited to $25B. But that's not the point. It's now a precedent. And the market acts in anticipation of future moves like this.

If a bank gets in trouble because of treasuries that are underwater, the Fed is signaling it will do this again. Now every bank is going to load up so they can get the same treatment.

There's some uncertainty, of course, which is why yields are not 0%, but there's enough sentiment that this will be a new Fed policy tool that yields are going down fast.

25b was likely the starting number to downplay it. I’ll bet we see one or more zeros added when the reports are eventually made.

+1

+1

True they probably would do it again. And all you need to do if you are a bank is not be the most insolvent one. The fed has turned banking into a game of musical chairs

But lets be clear…they’ll continue to make depositors whole if the run on banks continues, right?

There’s no way this was a ‘one and done’ action if they established the new bank stabilization board…BTFP or whatever its called that I can’t be bothered to look up rn.

Thanks for making it so simple to understand