I am relatively new to bitcoin and the inner workings of the economy and i’m currently reading the bitcoin standard.

One of the passages that clicked for me was where the book talked about how the hunt brothers lost over a billion dollars trying to drive the price of silver up, the inevitable cycle of when a consumption commodity is used as a store of value, the simplification i made was they bought up a large chunk of the existing silver supply, it drove the price up, in turn this creates more incentive for the producers of the commodity to produce more.

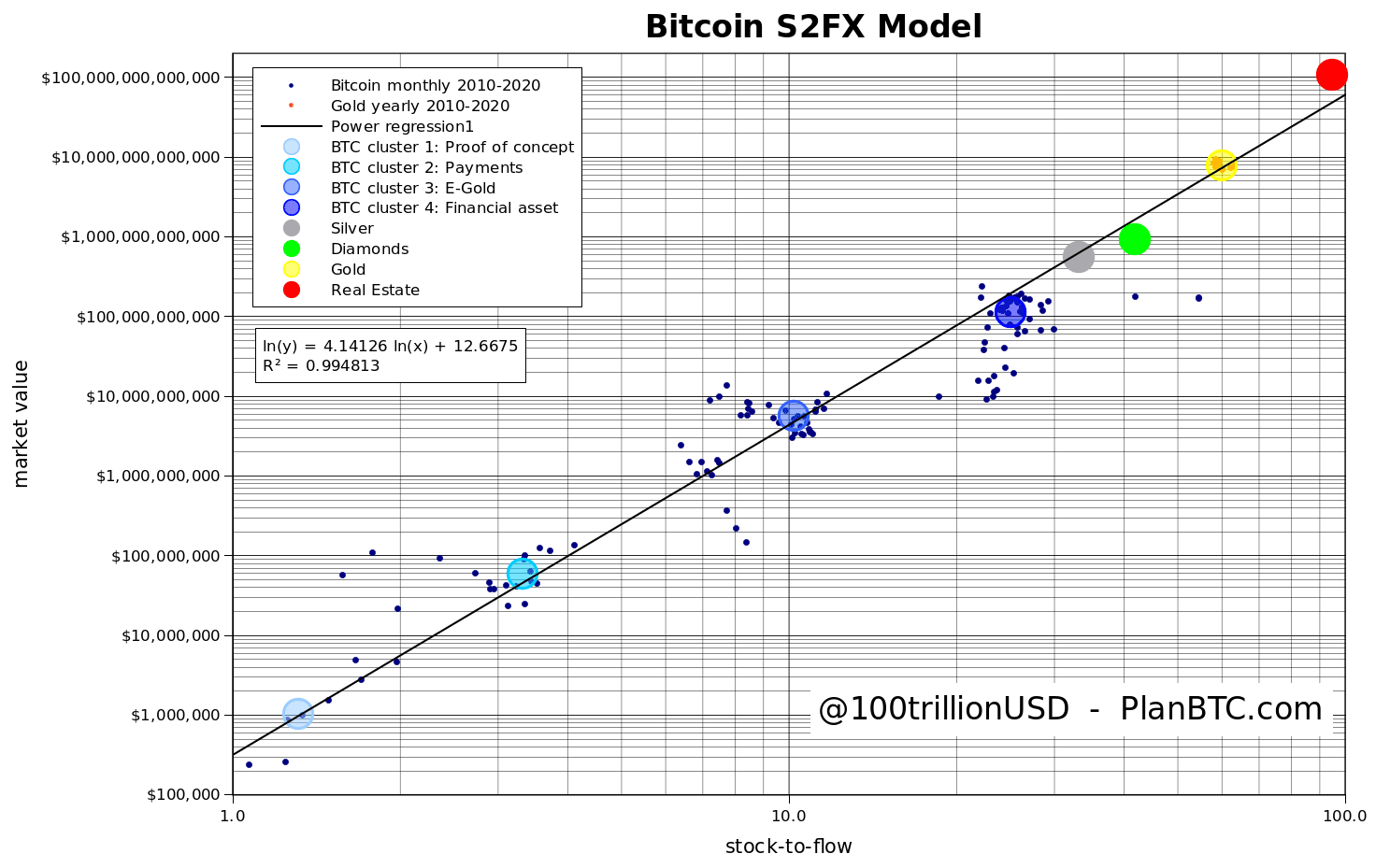

The production doubled and began to dwarf the existing stockpiles of silver, the price crashes due to an inflated supply and when the dust clears the ones closest to the production on the consumption commodity have siphoned the spending power from the misguided folk that couldn’t understand stock to flow and used it as a store of value.

“for any consumable commodity, this doubling of output will dwarf any existing stockpiles”

Just trying to further my understanding, anyone have something they want to add or correct?