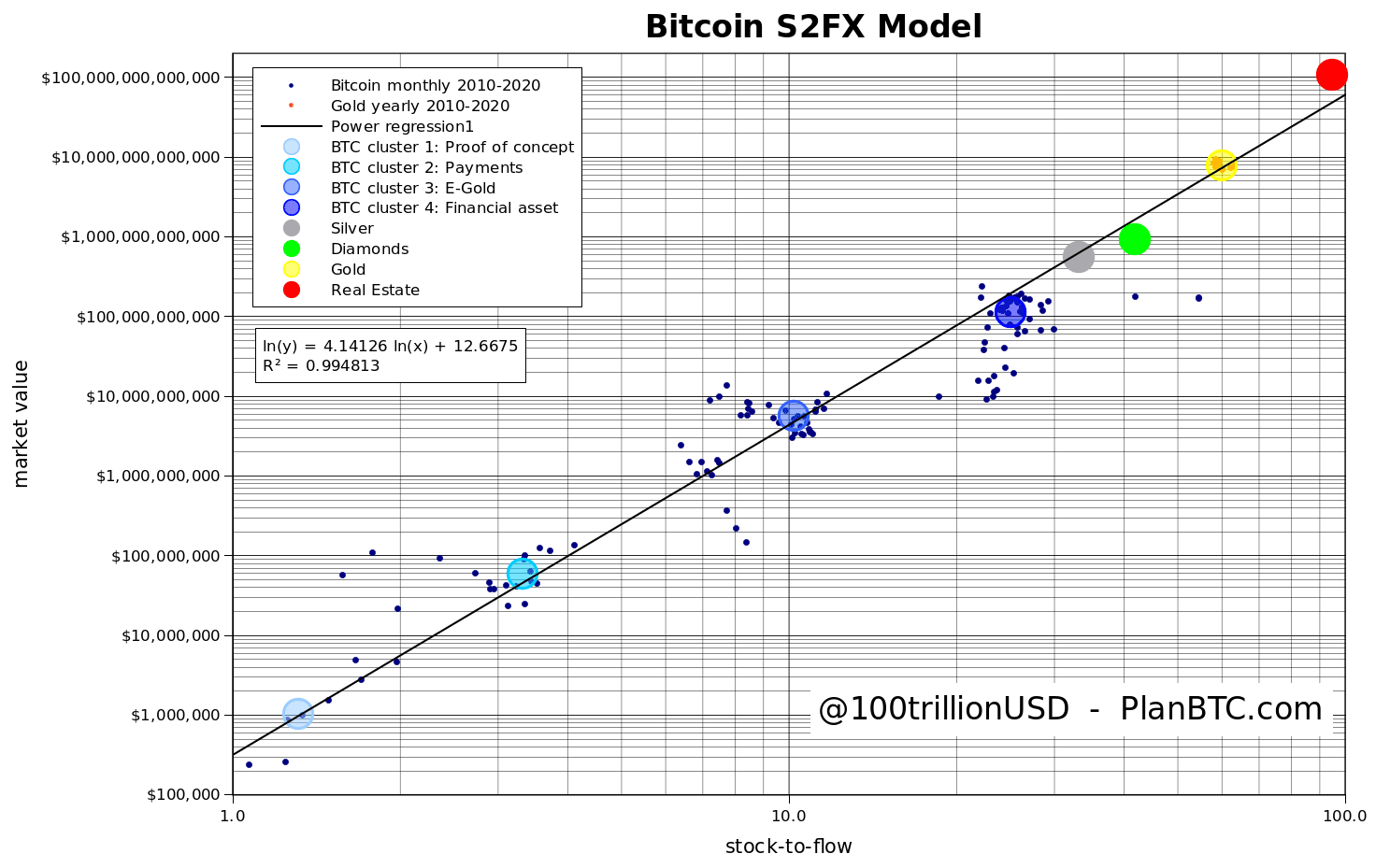

Here is a pricing model for assets based on their respective stock to flow. You’ll notice it tracks pretty spot on with a straight line on a power law basis. Real estate however has a premium of value, perhaps as the most scarce thing it captures more value or because it is essentially subsidized by the banking industry. Even if those aren’t true real estate has major draw backs as a store of value.

- not fungible

- is trapped in its original location

- subject to ongoing expenses and taxes to maintain

Despite this it still has a premium as the most scarce. Due to bitcoins preprogrammed halvings though it will surpass both gold and real estate. Potentially reducing the function of both in a portfolio meaning…

- countries that hoard gold loose to bitcoin hodling countries like #elsalvador

- central banks will have to print even more to prevent a collapsing housing market.

Bitcoin is essentially attacking the fiat system by exploiting the problems it stands to solve.

#stocktoflow #powerlaw #subsidizethis #nostr #gold #realestate #bitcoin