Yes.

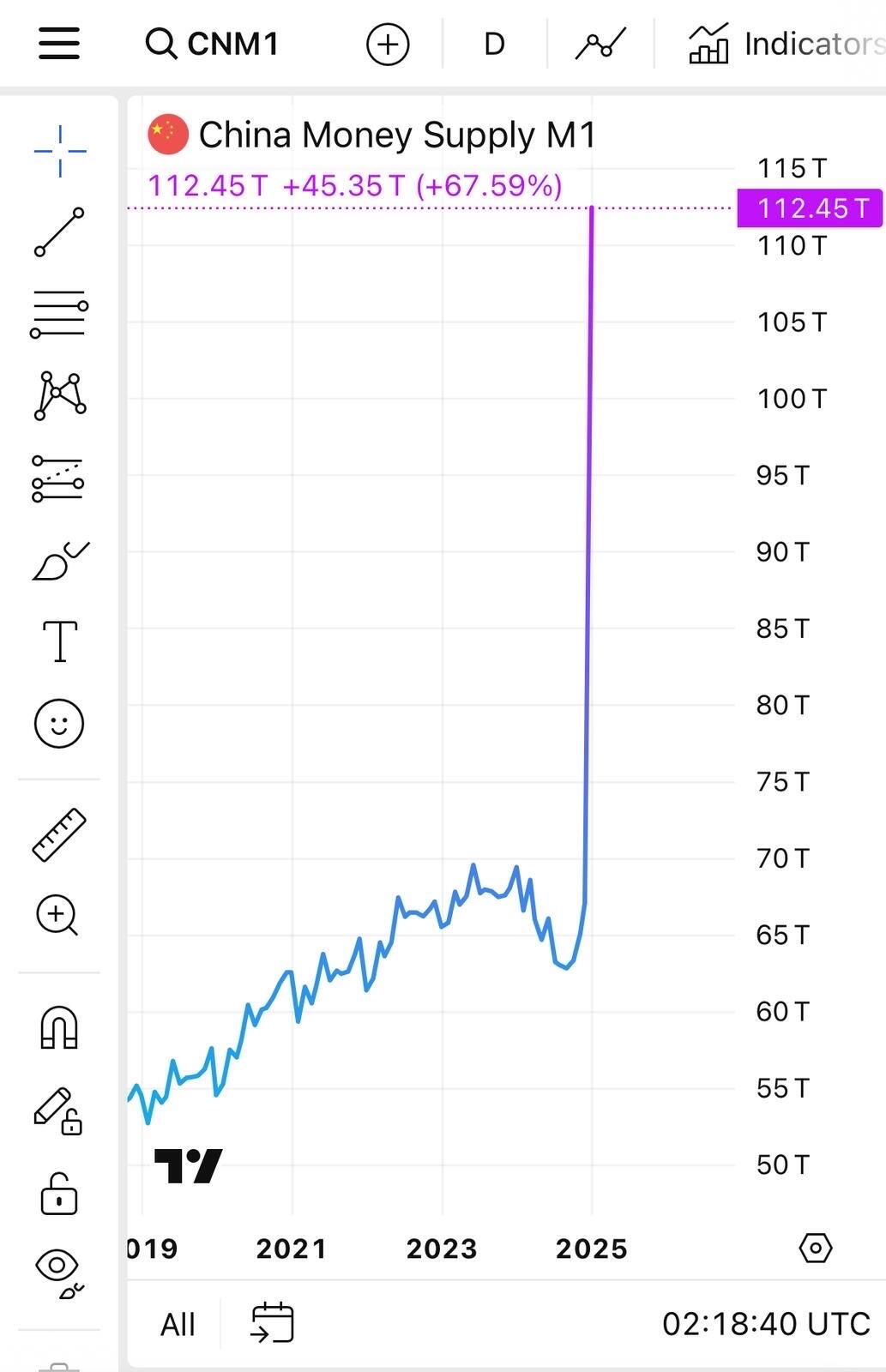

China was waiting for the US dollar to break lower before rapidly increasing their money/credit supply.

Given their relatively low yields on government bonds and a relatively strengthening currency vs the US dollar, copious debasement is about to ensue from China. 🇨🇳

Among other things, this bodes well for #bitcoin in fiat price terms.