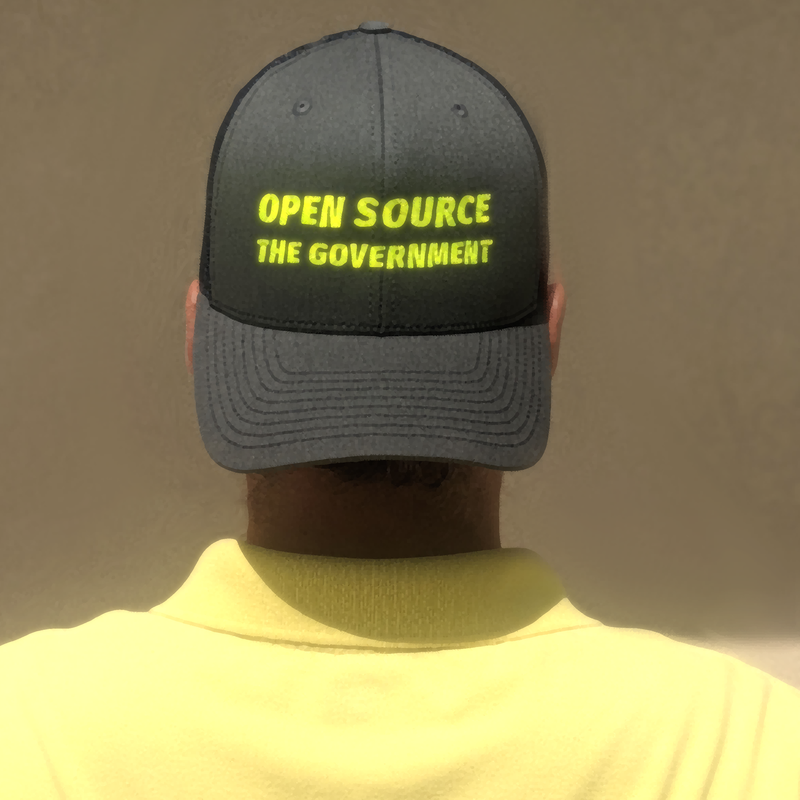

I'm hopeful in the midst of the chaos. There is a quickening happening and yes, privacy must be addressed before everything is surveiled. Let's shift the narrative and also secure the Bitcoin Blockchain so it need not become the largest transaction database for the AI to decipher what it deems normal. Tech exists for this and it is critical and maintains Bitcoin's values.

Yet, this is a discussion maxis tune out on..i get it. And what if it only was positive impact for Bitcoin? The willingness to be open to possibilities that actually empower Bitcoin as a reserve asset while maintaining privacy are another narrative to shift. Believing everything goes to zero against Bitcoin so that you can't hearabout tech that incorporates Bitcoin and catapults it is another version of cognitive bias.