House prices are going a lot higher and there will be no crash.

Look at house prices in Argentina in nominal terms - the average home there is 443,789,086 ars.

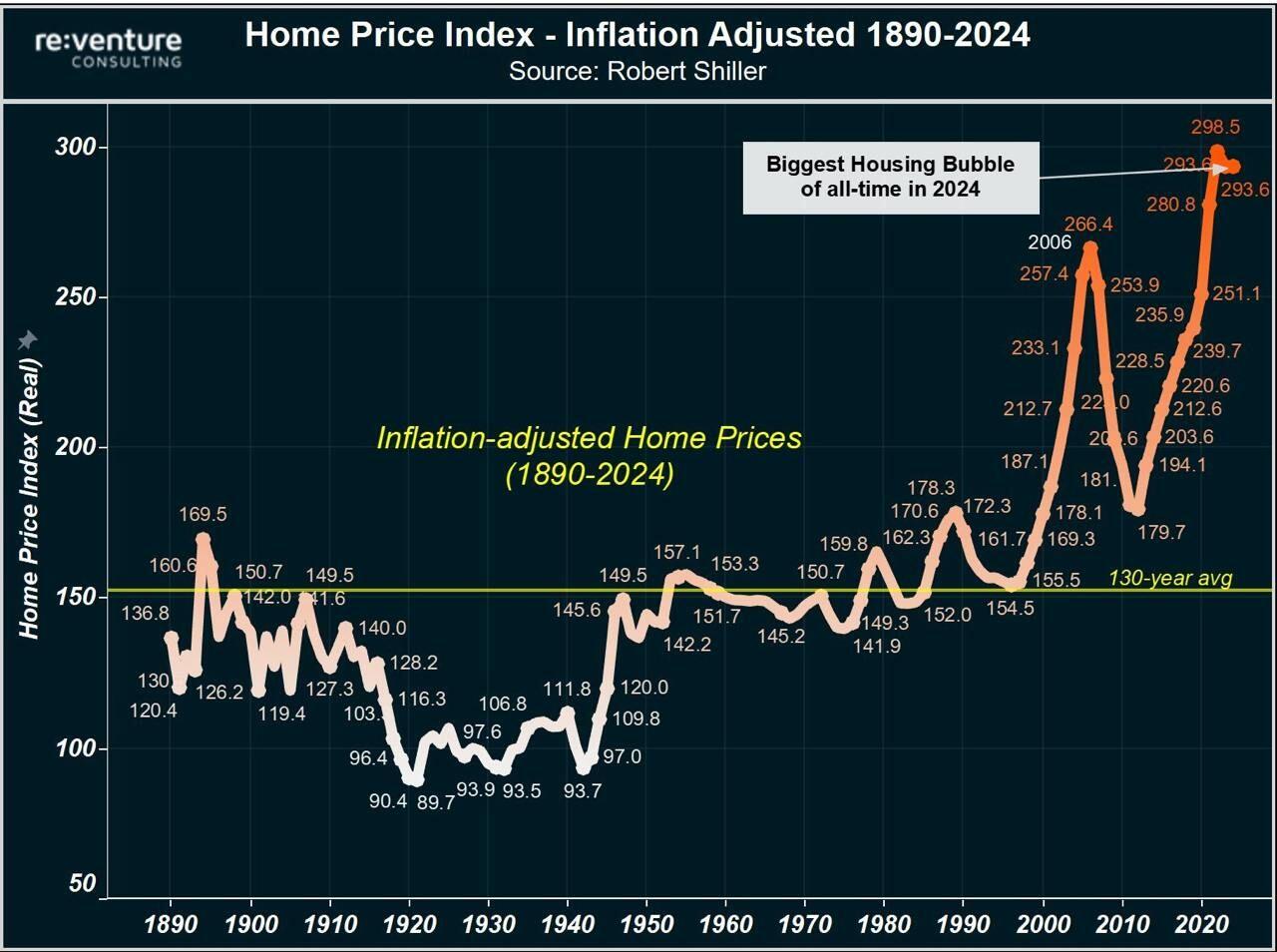

When money fails real estate is monetized to match the losses in purchasing power cause by inflation.

Houses are not cheap in Argentina vs the US. They cost a similar amount in purchasing power terms, it’s just the amount of currency units it takes to buy them is much greater in the country experiencing advanced stage hyperinflation. This will play out all over the world and real estate will continue to be monetized to record nominal prices, at least for the next decade (minimum).