I'm afraid if I start using this to trade I might break nostr:npub1lnm0ac8ft8r3jhddchekledgwvqrkwy7wqejjwcxq47gy87te8zs6utnnn

I'll be gentle with you guys.

I'm afraid if I start using this to trade I might break nostr:npub1lnm0ac8ft8r3jhddchekledgwvqrkwy7wqejjwcxq47gy87te8zs6utnnn

I'll be gentle with you guys.

I honestly didn't do it for trading. I did it because PlanB's STFX model interested me but is like ok you can't do a regression on his stuff and get a statistically significant model for BTC using daily pricing. He did stuff where it was like grouping things together for certain time periods gave you statistical significance but it was fuzzy math.

I watched some thing where people were sliding gm2 money supply around and matching peaks and troths with Bitcoin. Really rudimentary stuff. But I was like huh, it does look like btc lags gm2 but it was obvi not directly corelate.

I started thinking about how scarce assets go up in value first when there is inflation; inflation is a result of M2 creation. I wonder if I can sharpen up S2F and prove to myself it is the legit driver of BTC value.

Then when I got a bump on my first try I started tinkering around with lag because M2 doesnt create inflation overnight. Then finding the best lag. Then plotting r2 value over different lag times. Once I optimized GM2 lag I was like we'll what about lag on S2F. That tightening shouldn't be felt overnight either.

As you can see once I start digging into something I can't stop. Messed with weighting and smoothing and lag and optimized each. I think I could get it even tighter if I used daily pricing instead of weekly. But .97 is very high and it probably would still round to .97 no matter what.

Had to share because I thought it was cool and I thought it was weird that optimized smoothing and lag all were fibs.

R² > 0.95 is huge.

Congrats!

Still holding in? I actually revisited this because I didn't like that the power trend line for all weekly BTC price breaks below the S2F model long term. Basically I started say well how bad will it break do I have to keep readjusting? That's a big fault. Read more about people saying that because I didn't use strictly price and I used market cap and divided out stock to get price I was getting r2 higher than I should. Bunch of shit.

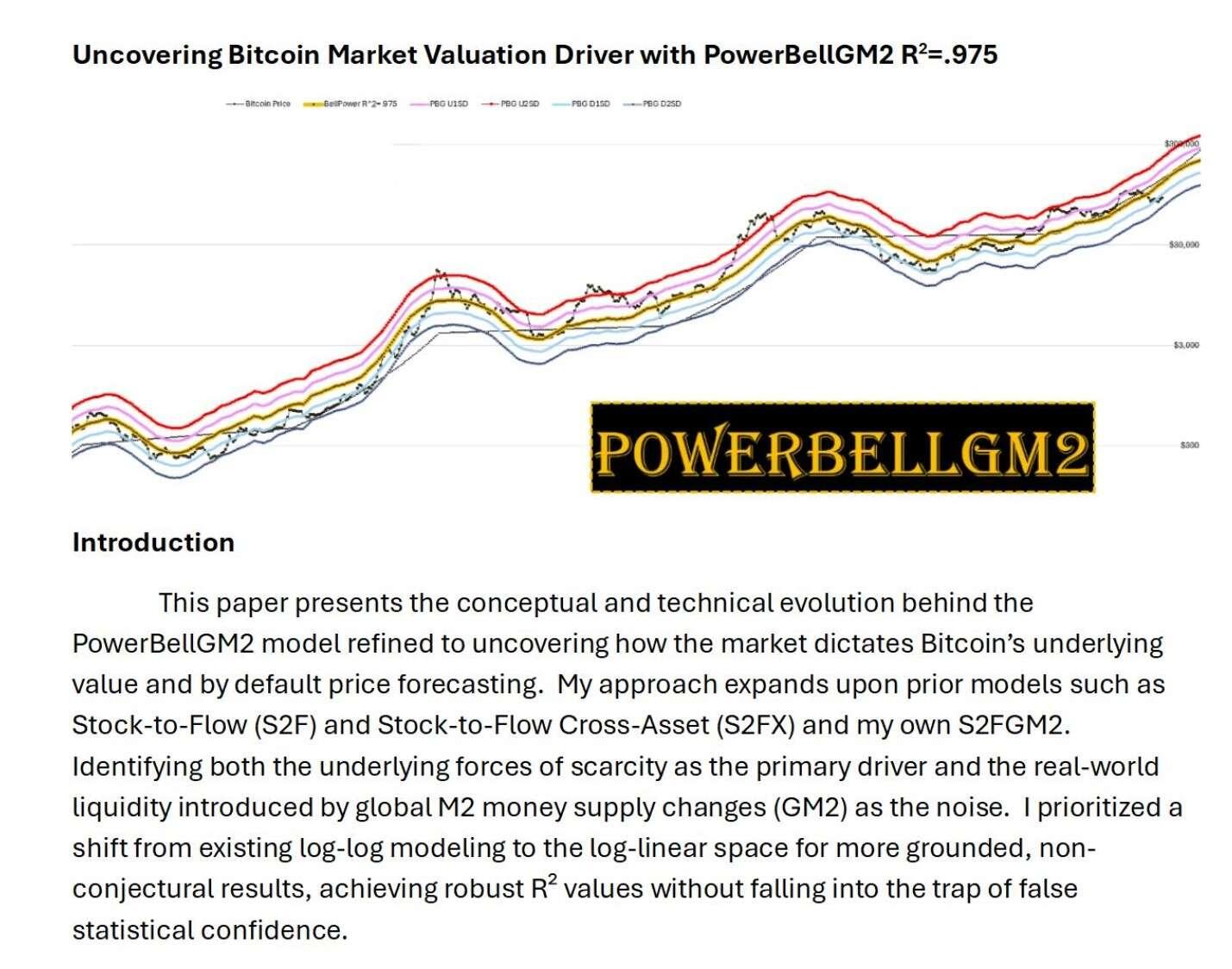

I came up with something even better that fixes those problems arguments and gets a r2= 975.

Using weekly price. Most granular chart ever also its log standard time unlike planb log log. Uses what i learned from s2fgm2. I actually wrote a white paper that 3xplaines everything.

I think it is fucking genius. But I'm partial. Look at this shit! It doesn't break.

https://1drv.ms/w/c/4c4514cda59498b0/Eb_4HMYDJnlIvNYL3fVSmXsB4pr8nldaiYlSHFy1G8yD4w?e=EPBqsR

If you want to check out the whitepaper here is a link. Not sure how else to share so people don't think I'm trying to spread awareness virus or some shit. If you know anything way I'll do that.

If your a statistics nerd like me.

When I find the time I'll test it myself independently. Don't trust, verify!

But your work looks solid.

👏

Don't trust,; verify.

If you run into any issues let me know and I'll walk you through it. There were a lot of things I tweaked to get better r2. Like instead of big delta bumps once a month in GM2 I took the delta and divided it into the weeks of the month. Stuff like that.

So I opened a long yesterday on nostr:npub1lnm0ac8ft8r3jhddchekledgwvqrkwy7wqejjwcxq47gy87te8zs6utnnn based on my (simplified) interpretation of this. Going well.

We'll see how it does over the next 15 days.

I expect to make a few million sats at least. I will zap generously if I do!

...and it worked. Thank you nostr:npub1fgnuaulzmkpnpe8jy843hf7lhwefh5xyejl5s4307ajw25tgrlssxnyj2h 🎯

I even made it on the leaderboard... although at a humble 10th place.

Still, can't complain...