My December newsletter is available now.

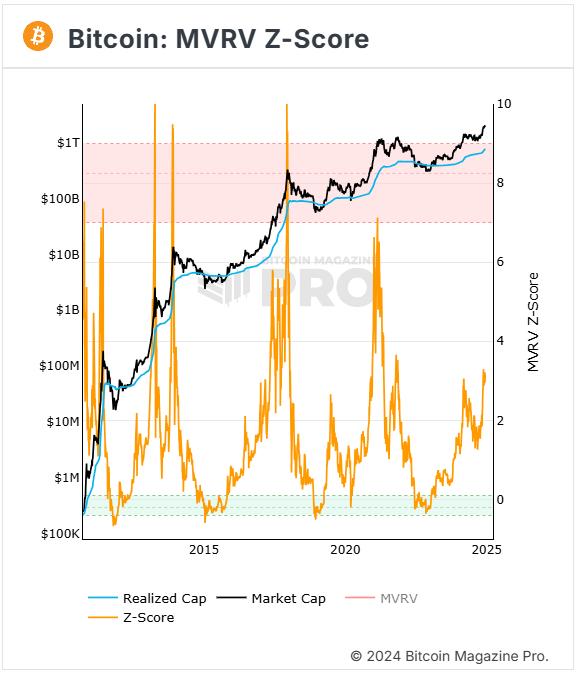

The topic for this one is mainly Bitcoin:

https://www.lynalden.com/december-2024-newsletter/

My December newsletter is available now.

The topic for this one is mainly Bitcoin:

https://www.lynalden.com/december-2024-newsletter/

I’m curious how you think about holding and researching assets other than bitcoin. I used to hold quite a few equities as well as ETFs for exposure to commodities and foreign markets. But I got tired of spending hours digging in only to compare it to bitcoin and be woefully underwhelmed. So now I have bitcoin, USD, and a couple of equities that have outperformed bitcoin over the past few years (but aren’t likely to continue to).

Is it for hedging purposes against bitcoin bear markets and tail risks?

I already know from your notes that nothing stops this train.

Thanks Lyn, I always look forward to your newsletters. I'm still working my way through Broken Money, hopefully I'll have some time during the winter break to finish it, great read so far.

Read it. Appreciate it

Such a good framework! I’m sharing this with all my normie friends who are curious. Thank you Lyn 🧡

Feels like a perfect storm of a tail wind right now doesn’t it?

I FCA into #Monero every month. I use some of it as cash to buy things I want, but I hold more than I spend. So I'm always increasing a little bit.

Honest question, I'm doing a mini deep dive on Monero vs Bitcoin so I'm genuinely curious.

What about Monero makes you think it is a good store of value over the long term? Also what market places are you using to "buy things you want" in Monero?

Thanks!

answering your second question first XMRBazaar.com, MoneroMarket.io, and Monerica.com.

As for your first question, it's the privacy because you don't have to switch back and forth between a currency that is private and a currency that is not private.

Some people incorrectly say that the supply of Monero is unlimited, which it is not, because it would only be unlimited over unlimited time, and we as humans do not have unlimited time on this earth. It does have some inflation because of the 0.6 Monero Tail emission reward, but that's specifically to replace lost coins over time and incentivize miners to continue mining the chain and not relying on only transaction fees, which are unsteady. Monero's current inflation rate is 0.85%, which is less than the inflation rate of gold, according to the World Gold Council, which has roughly 1.5% inflation per year. And we know exactly how much Monero is going to be released at all times, where with gold, that is not the case.

Gotcha, thanks for the response 👍

I am still formulating my opinion on the scarcity of Monero. I agree with your assessment of the tail emissions.

My issue with the supply, and potential future of Monero as money on the global stage is that it is no where near decentralized enough to withstand the types of attacks that Bitcoin has survived. Bitcoin has been under attack essentially constantly for almost 10 years and no one can change it. I am skeptical that Monero could survive in its current form with that kind of pressure.

It's hard forks have had consensus, but again it hasn't had to survive a malicious or contentious hard or soft fork attempt.

I wasn't around for them, but apparently there was at least one rather contentious hard fork. Back when random X was introduced that stopped ASIC miners from being able to mine it, and the original, I guess, was called "Monero V" or something. Obviously, most of the community did not want that because they want digital cash and believe that anybody should be able to get their hands on it. And ASIC devices would prevent that. Also, the Monero community believes that ASIC devices are extremely centralizing because only a couple of manufacturers make them. They only have one purpose and they can be easily tracked from imports and stuff. Like, if I buy an ASIC, there's only one thing I'm going to be doing with it, and that's mining crypto. But if I buy a high end gaming computer, I might be mining Monero with it, but I might also be playing Skyrim, or something like it. And they don't know which it is.

Also, to the best of my knowledge, there are at least 15,000 Monero nodes in the network. While I'm not certain how many Bitcoin nodes there are, I do know that that is quite a bit more than some other coins, such as Dogecoin ~700 nodes.

Nice analysis. Noob friendly, but deep.

Article: December 2024 Newsletter: The Rise of Digital Assets | nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a

https://www.lynalden.com/december-2024-newsletter/

Original Source

nostr:note1d7nnuc0r8xmn7hq5pmcfx0vl7nesh8rzjuuasvfu75fcmut0zw3qwma3wv

🔁 Share

———

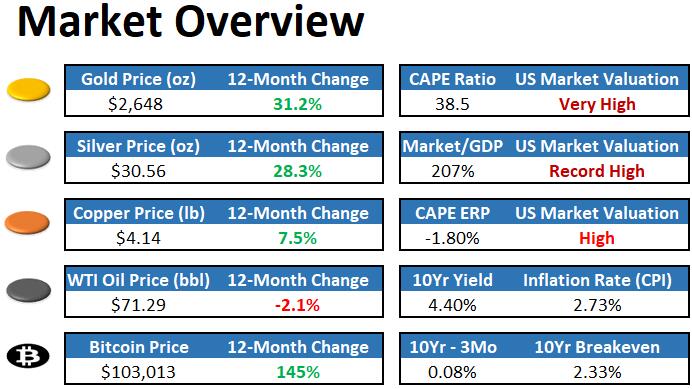

#Bitcoin #BTC #December #Gold #Silver #Copper #Oil #Ratio #Yield #Market #Valuation #inflation #digital #assets #Bull #Bear #ATH #ATL #Newsletter #research #report #Sovereign #Artigo #Dezembro #Ouro #Prata #Petroleo #Cobre #rendimento #roi #inflação #Ativos #digitais #Alta #Baixa #Mercado #Soberano

———

⚡️"Sovereign" - Protection from Censorship, Inflation and Confiscation.

🛡 ₿ = ∞/21M

Thanks for the newsletter as always. You're clearly getting zaps on this poast but I'm getting this error from Amethyst...not sure what that's all about. Zaps to others are going through...

'Unable to send zap: Could not fetch invoice from https://primal.net/lnurlp/lyn/callback'

Thanks Lyn amazing work!

Another great letter, very well put together as expected 🙏 🙏

Compelling reading thanks nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a

Thoroughly enjoy savouring your work 🤓 🤗

Where do you get the global M2 data?

I've been wanting to track global M2 for a while now but I don't know where to get it other than adding up all the major economies individually.

Is that essentially what you have to do? Or is there a source that aggregates it for you?

Thanks, great read as always! 🤙

Great read. Thanks!