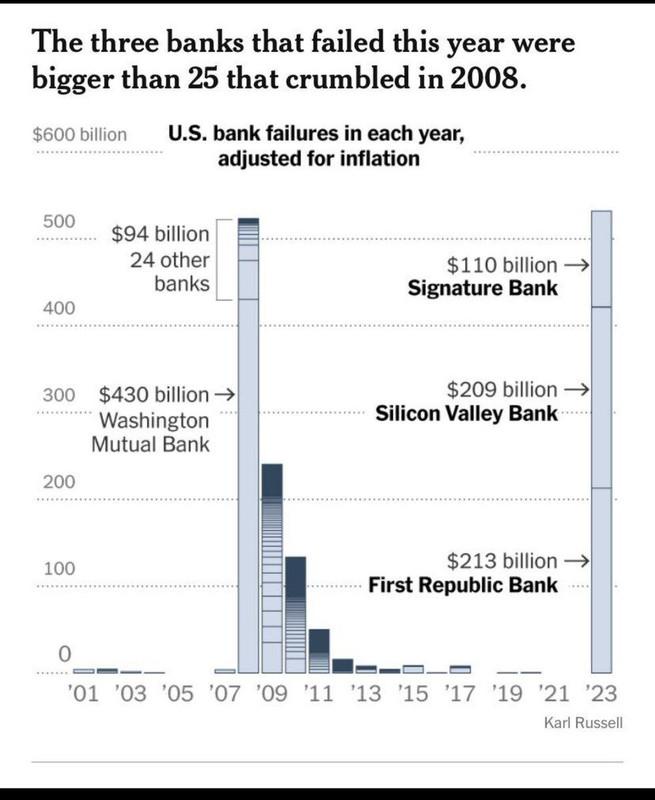

Keep seeing this same comparison to 2008 repeated and it’s super misleading.

Where is Bear Stearns?

Where is Lehman Brothers?

Where is Fannie Mae + Freddie Mac?

Where is AIG?

Where is RBS?

You have less than 15% of 2008’s big failures in this data set. Why?