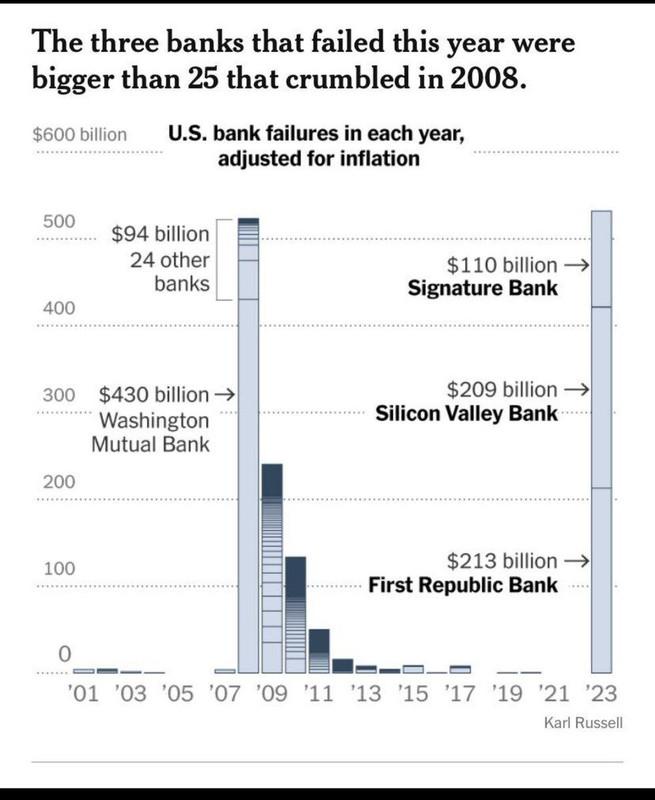

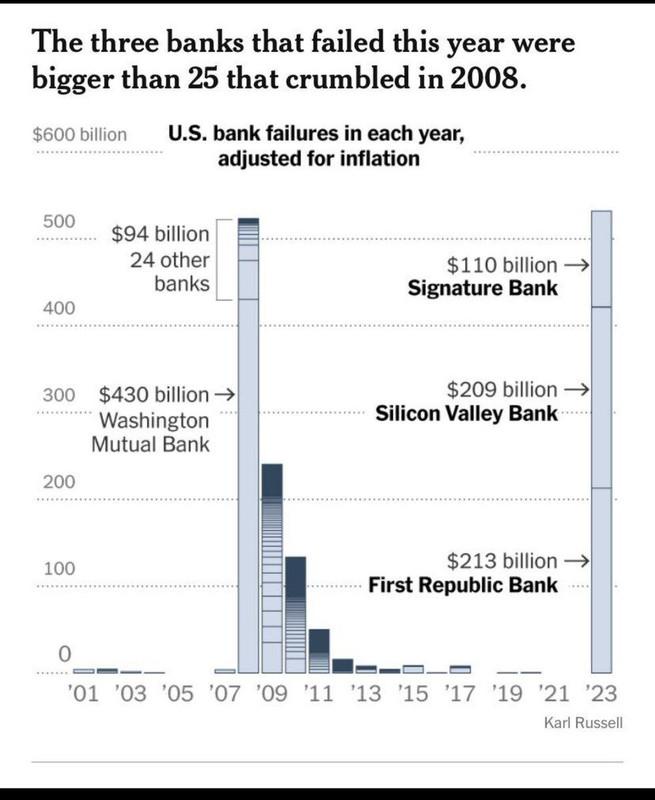

Silicon Valley Bank, Silvergate, and First Republic Bank were larger than the 25 banks that failed in 2008...

Silicon Valley Bank, Silvergate, and First Republic Bank were larger than the 25 banks that failed in 2008...

Wow!

Would be good to have inflation between 2008 and 2023 factored in to make it more apples to apples. But still wow.

Would that be better? This also helps illustrate just how much bigger banks have become, due to inflation. Normalizing for inflation would hide the bigger picture, IMO

This is adjusted for inflation.

Right, missed that first time. I’m now curious these failures as % of total banking industry yr over yr. Basically is it more or less serious what’s happening now vs then?

Still don’t think it’s comparing apples to apples though. Commercial banks’ combined balance sheets are now 3x-4x what they were in 2008.

It's fair to say that the billions in 2008 bought more than the billions today.

My guess is 480 billion in 2008 is buying 4.8 trillion today.

And today's 280 billion was buying 28 billion in 2008.

The inflated money supply is nothing to measure against except in what it could buy then and now.

This is adjusted for inflation.

Damn

Keep seeing this same comparison to 2008 repeated and it’s super misleading.

Where is Bear Stearns?

Where is Lehman Brothers?

Where is Fannie Mae + Freddie Mac?

Where is AIG?

Where is RBS?

You have less than 15% of 2008’s big failures in this data set. Why?

this is not 2008 despite a lot of the comparisons because --->2008 was bad loans destroying credit via defaults

this is duration mismatch with illiquid banks that are solvent on a very long timeframe.

banks become insolvent when loans are defaulted but since no one is defaulting it is nowhere near as bad as 2008.

when defaults happen then we are in trouble

This smells like crypto fud

I'd start using "Nominally solvent".

ha great term. "nominally solvent"

bank runs could happen anytime on any bank pre 2008 and post 2008 so this is nothing new it is just that high interest rates that get high quickly made this very bad for fractional reserve banks

in 2008 bad loans were made and bad loans destroy bank assets

right now banks have plenty of assets but no client cash (hence the bank run)

we will see a 2008 crisis once defaults on loans (cars, houses, small business) start occurring due to a poor economy

We need to ask Karl Russell.

I also find it disingenuous for bitcoiners to keep talking about “bitcoin on exchanges” getting lower when they zoom in on the chart instead of starting at zero. Why? 🤷♂️

Bear and Lehman were investment banks; not retail banks. AIG was an insurer and the others you list are overseas entities.

It's a like for like retail bank comparison (or intended to be)

New record

To be fair they printed a fuck ton of dollars since 2008

This chart more than most would benefit from adjusting for *monetary inflation* and not just *CPI inflation.*

More MeRgErS on the way.

But why compare values across time using shitcoins like USD?