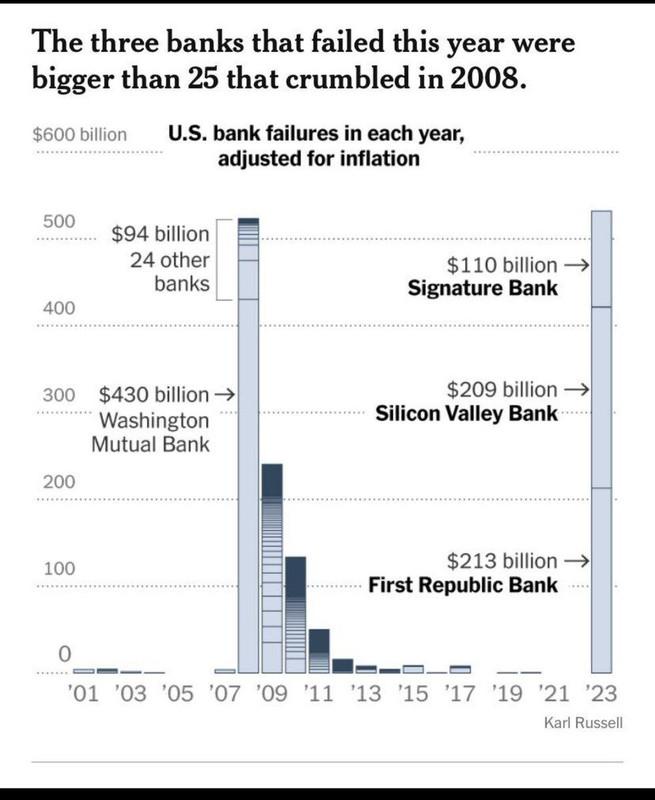

Would be good to have inflation between 2008 and 2023 factored in to make it more apples to apples. But still wow.

Discussion

Would that be better? This also helps illustrate just how much bigger banks have become, due to inflation. Normalizing for inflation would hide the bigger picture, IMO

This is adjusted for inflation.

Right, missed that first time. I’m now curious these failures as % of total banking industry yr over yr. Basically is it more or less serious what’s happening now vs then?

Still don’t think it’s comparing apples to apples though. Commercial banks’ combined balance sheets are now 3x-4x what they were in 2008.