Because ultimately you have to steal more people's money and inflate it to pay for the incentives, which makes them less likely to have kids because they have to work harder.

Discussion

I'm not sure if I follow the logic. So if couple A starts a family and receives a tax credit, the state gets less money, which causes it to raise taxes on everyone. Now, couple B is taxed more with no kids, so they don't start a family? But you're saying they would’ve otherwise if there were no subsidies because taxes would be lower? But hypothetically, if they did start a family and receive the subsidy, wouldn't they be in the same position as if there were no subsidy with lower taxes?

It seems to me if everyone has a family, the outcome will be the same, so I don't see the disincentive. Obviously, there can be a big difference between people who choose to have a family and those who don't, but isn't that the point?

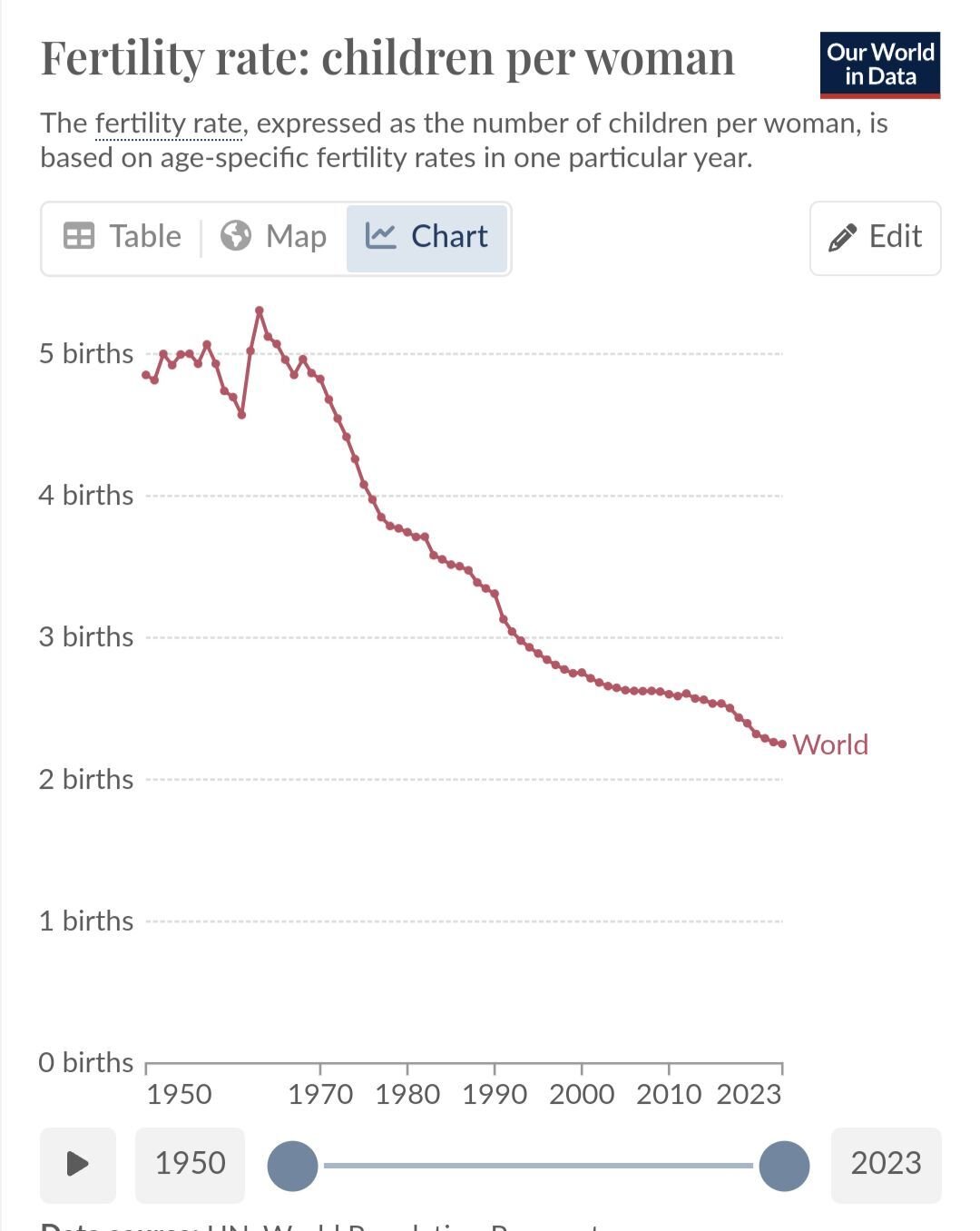

I'm not arguing from a position that the government can create an effective tax policy. However, I think people generally underestimate how dire the birth rate situation is. Even if we had the perfect policy to turn it around, I'm not sure if we have enough time, so anything is better than nothing, it seems—just my 2 sats.

I do understand, and notice that it started dropping at an alarming rate after 1971 (surprise)

So my argument is if the government was smaller, more uninvolved and didn't create so much inflation, it would go back up

Yes there is additionally inflation. May even be a worse beast than taxes. Handing people at the top the most and by the time it "trickles down" the prices of everything has gone up before the scraps reach the people that actually needed it the most.

If you start closing the moneyprinter valve people get fired and when you open it up more they might get a job and still can't afford anything.

💯 completely agree

So say your couple A gets $100. But that $100 had to come from the bureaucratic machine that is the government. They had to hire extra people to deal with that incentive. This $100 that you get probably costed taxpayers $200 so if you scale that up somewhere people fall below a reasonable treshold where they were pondering to have children but decided to not do it because even though they get $100, they are charged $200 extra in taxes so they are still $100 short.

Taxes always weigh heaviest on people just entering the job market for minimum wages and these are the people that have to make the children.

Even with a 1:1 relation where you get taxed $100 and somebody else receives that exact amount without intermediaries taking cuts it would still make no sense. You are quite literally destroying capitalism and the free market right there.

Maybe that factors into people's decisions, but the data suggest it's mainly a personal opinion rather than economic: https://www.pewresearch.org/social-trends/2024/07/25/the-experiences-of-u-s-adults-who-dont-have-children/.

Given that most people's opinions are shaped by their culture, we should do as much as we can to promote a culture of strong families. But it's also fair to say the government is a terrible allocator of resources.

Sure, I never said it's the only factor. Take for example this clusterfuck in south korea: