You don't know anything about Monero's history. Your adversarial thinking skills are lame.

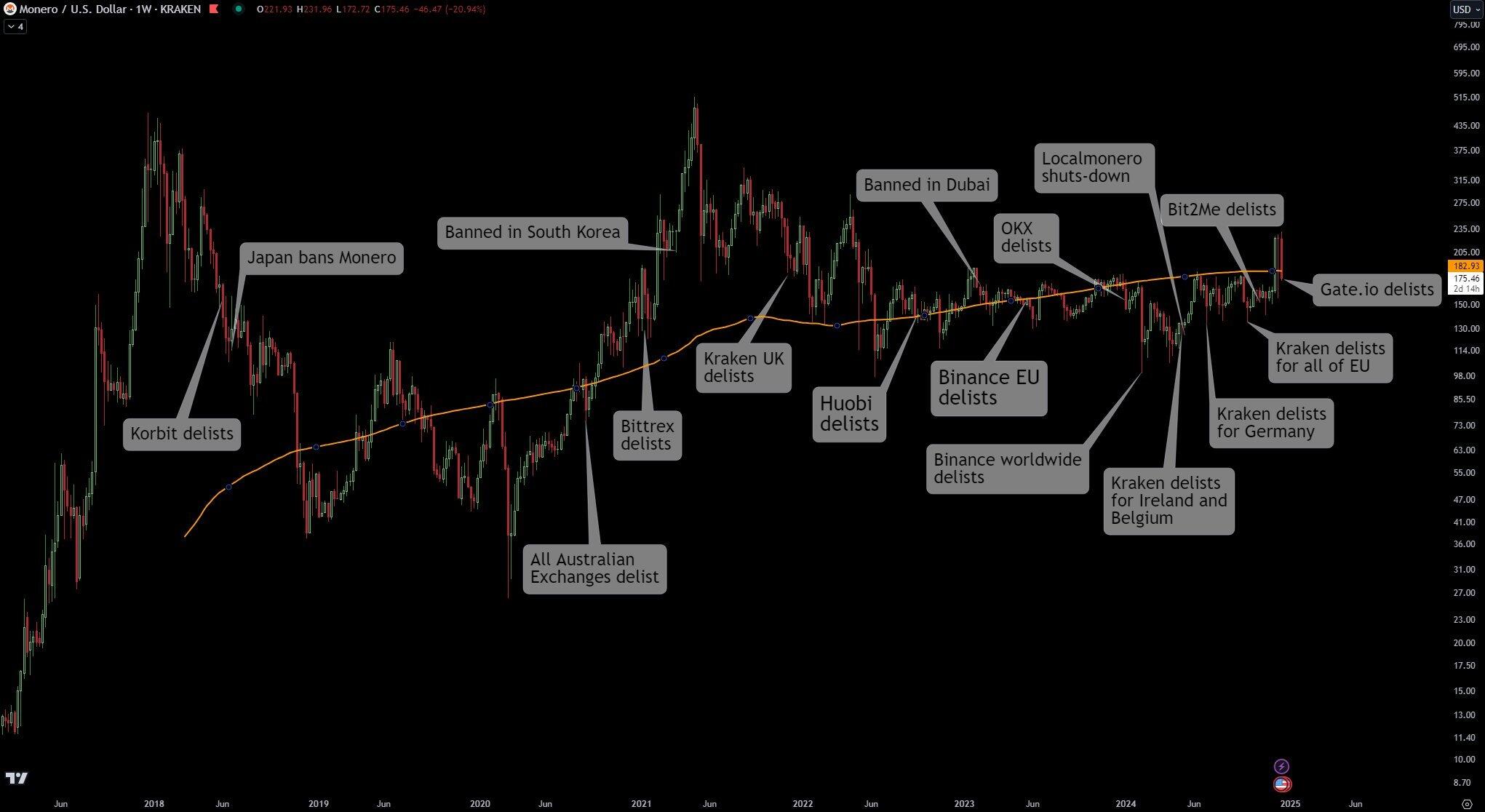

State agencies/deep state have Monero on the radar since 2018, when it ranked #4

Since then they used every possible means to suppress its price while they pumped the hell out of shitcoins (unfortunately including BTC, where they identified a psychological weakness (superiority) of holders, that now believe into store of value and NGU instead of a private medium of exchange better than fiat or gold.

They fully neutralised its impact. 99% of all new speculators are now onboarded through KYC and the only thing they will ever use is BTC IOUs through a fullyvstate compliant custodian. It's a huge fail.