Thanks for the reply. Regarding 51% attack, you say half of all cpus, but that would only be true if everyone was being used to mine today. Wouldn't a more realistic possibility be an attack deployed at some sort of data center/server farm or multiple ones? Basically, how large is the existing mining network is the concern, no?

Discussion

Doggie coin and Monero have both had 0 successful 51% attacks in their times, just like Bitcoin

Bitcoin is the biggest target and gets its security from the strongest defense

Doggie coin and Monero are smaller targets and get their security from proportional defense

Being profitable to mine with a cpu or gpu (instead of an asic) also helps ensure an unknown number of miners can be waiting to join the network at any time

That's a pretty good answer.

I wonder what the cost actually would be. Arguably it's easier to mount a surprise attack on networks not using asics. For example, when doge went wild a few years ago, I have to imagine the mining took some time to catch up, and there might have been a window where a large actor on sideline might find it profitable to surprise attack while shorting it...

Doge network is pretty huge. The market cap of the coin was in the millions of grams of gold that whole time. I don't know what that means for how many mining rigs are running it at a given time, but it's also been one of the most popular coins to mine over the time it's existed

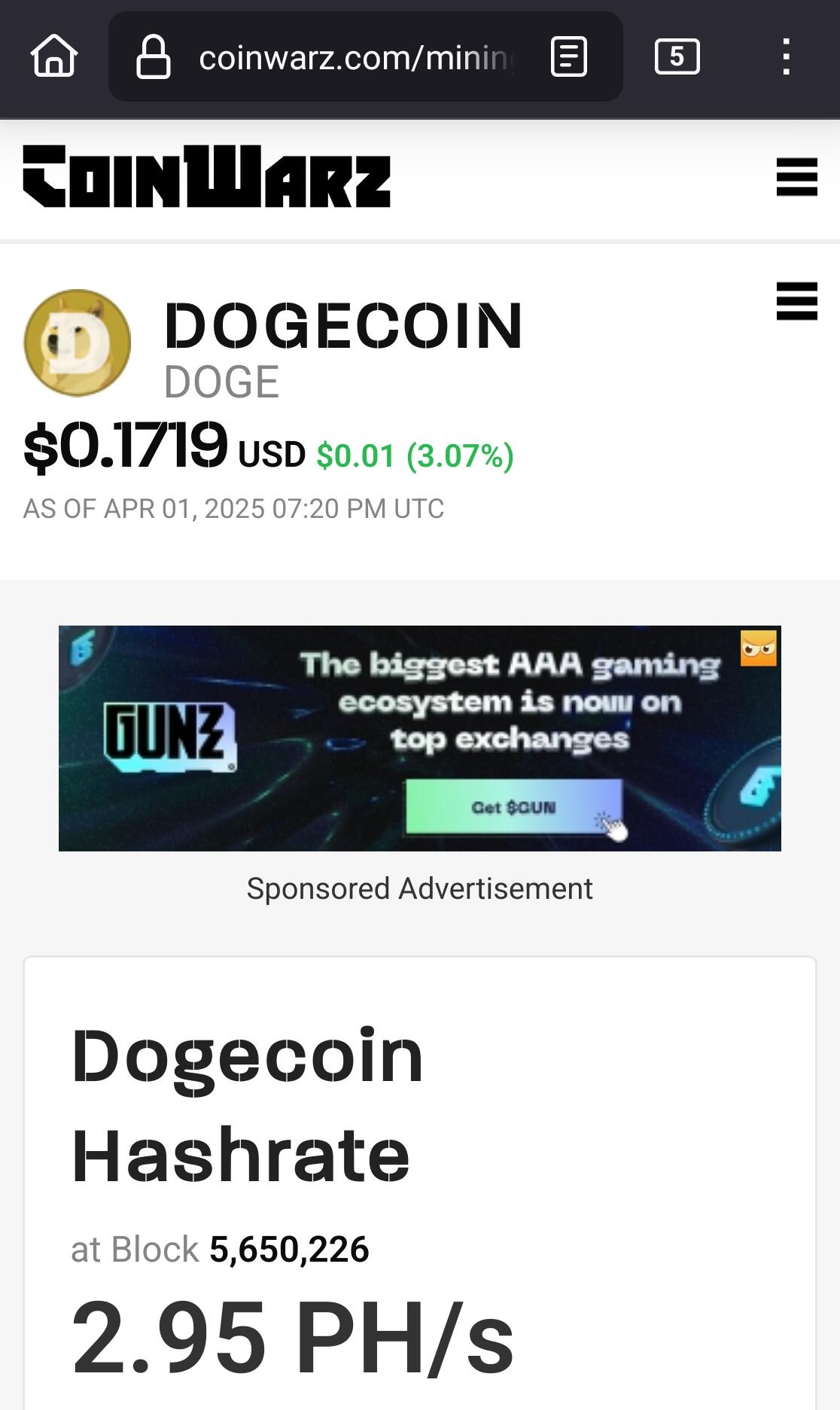

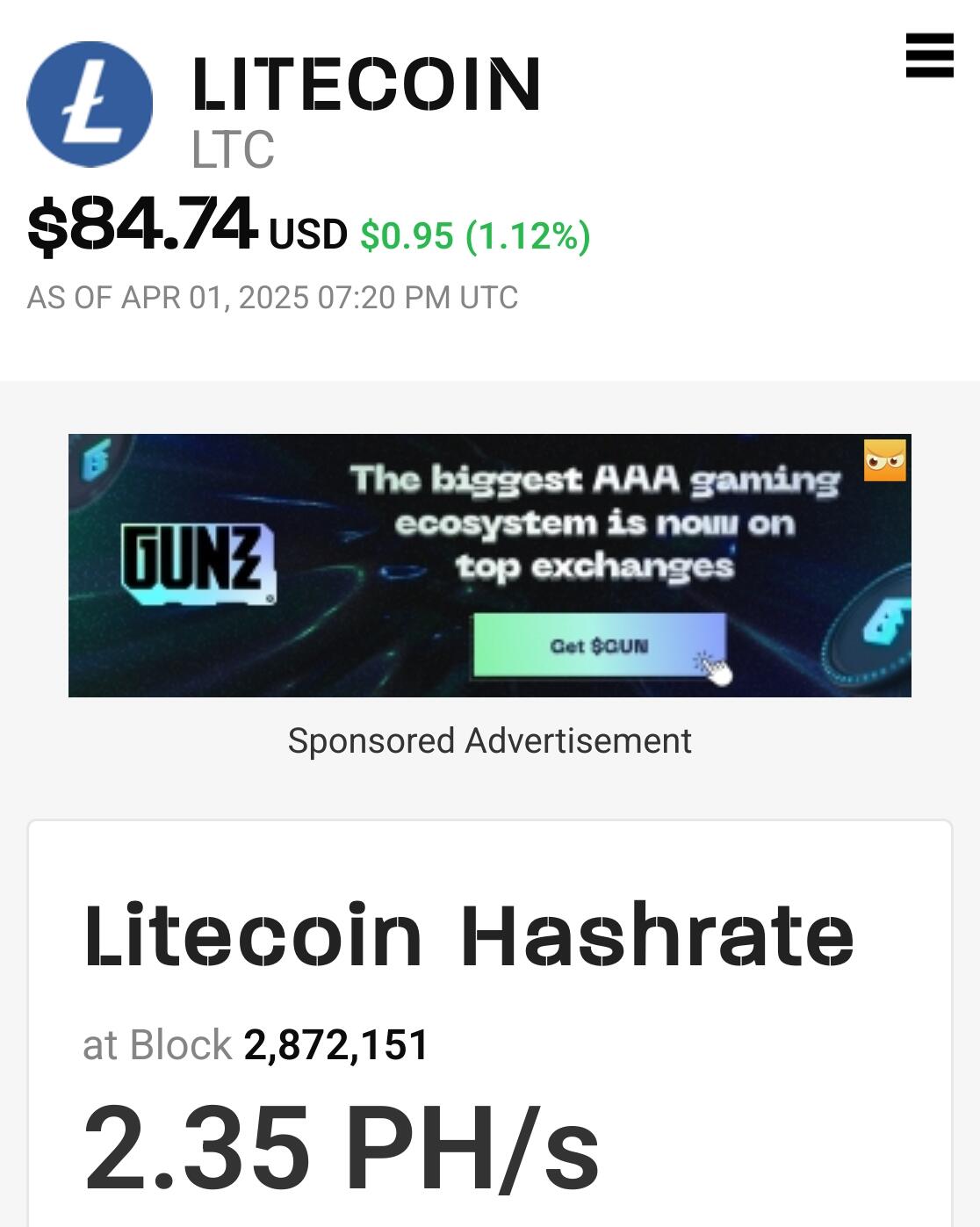

Rough numbers, BTC about 67x market cap of doge. According to Google BTC network 580,000x more hash than lite coin (as of may 2024). I might be wrong to use litecoin hashrate, but my understanding is its merge mined and so litecoin mining is what secures it.

That feels like a juicy target to me, and I'm sure it's been discussed before, I just don't know the argument(s).

Not expecting you to research and answer for me or anything, just thinking aloud

You sent me down a bit of a rabbit hole.

I read a bit about merge mining and I still have no idea what it means.

However,

Sorry about that haha

Close hash rates but not enough to be considered identical, so perhaps there's more to it.

However, either one, or even the combined amount is waaay less than bitcoin even though market cap is relatively speaking a lot closer.

Maybe monero a better example to look, even though the profit by shorting mechanism is probably less available since it's not traded on places like RH.

Anyway, prob enough talking out of my ass for one day 😶🌫️

Would there be any profit from shorting and destroying the network though? If you suddenly control the ledger and you can set balances to whatever you want, your trading firm might connect your position to you, freeze your accounts, and sue you or something

I think the real motivation for an attack would be to protect the dollar, but if you take down #2 you'd only make #1 stronger, and so 67x market cap ends up being proportional enough for 580,000x more hash

I assume it's legal to attack network. If successful price should crash. Shorts become profitable, and could in theory cover cost of attack.

I know such things have been discussed before, but never read any details.

And yeah, state attack to protect dollar is the real concern.

Not sure about reasoning that taking down doge would make BTC stronger (if that's what you're saying). Unclear to me, not disagreeing

I don't think there's a law against a 51% attack, but a trading firm could still just say they're not allowing short positions to be closed because fuck the law

They'd only let you do it if they're in on it, which they would be because they love dollars lol

And taking down doge with a 51% attack would make Bitcoin stronger against 51% attacks in particular, because more like the whole cryptocurrency industry would be focused on making sure it can't happen to Bitcoin

Yeah, agree now that you put it so simply

You also just made me realize something

I thought it was suspicious how I couldn't find any publicly traded companies that are confirmed to mine & hold dogecoin last I checked

But a 51% attack for someone shorting mining stocks would be profitable - brokerages can't just refuse to let you close short positions on stocks

Maybe it's just not quite big enough for that risk yet

I mean, for that risk to be taken by a publicly traded company