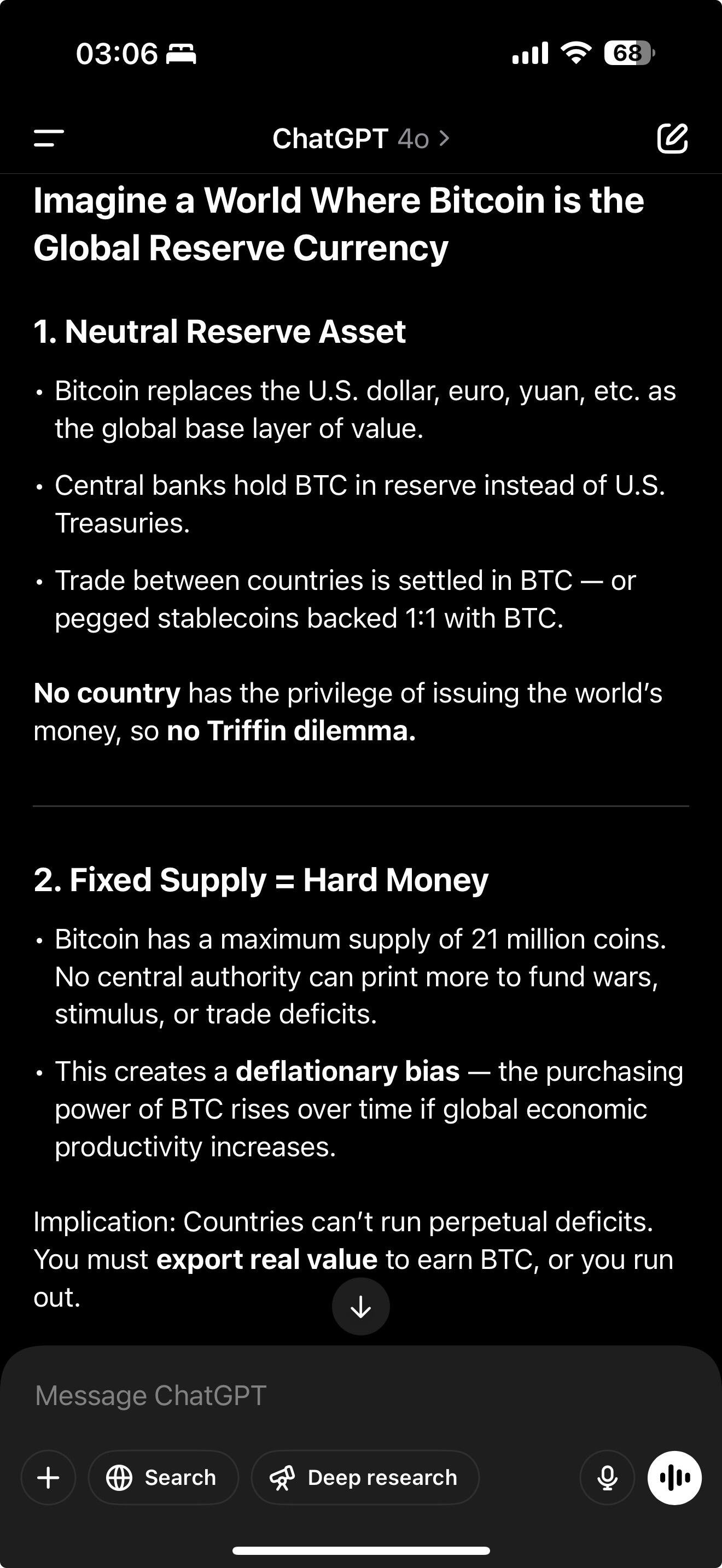

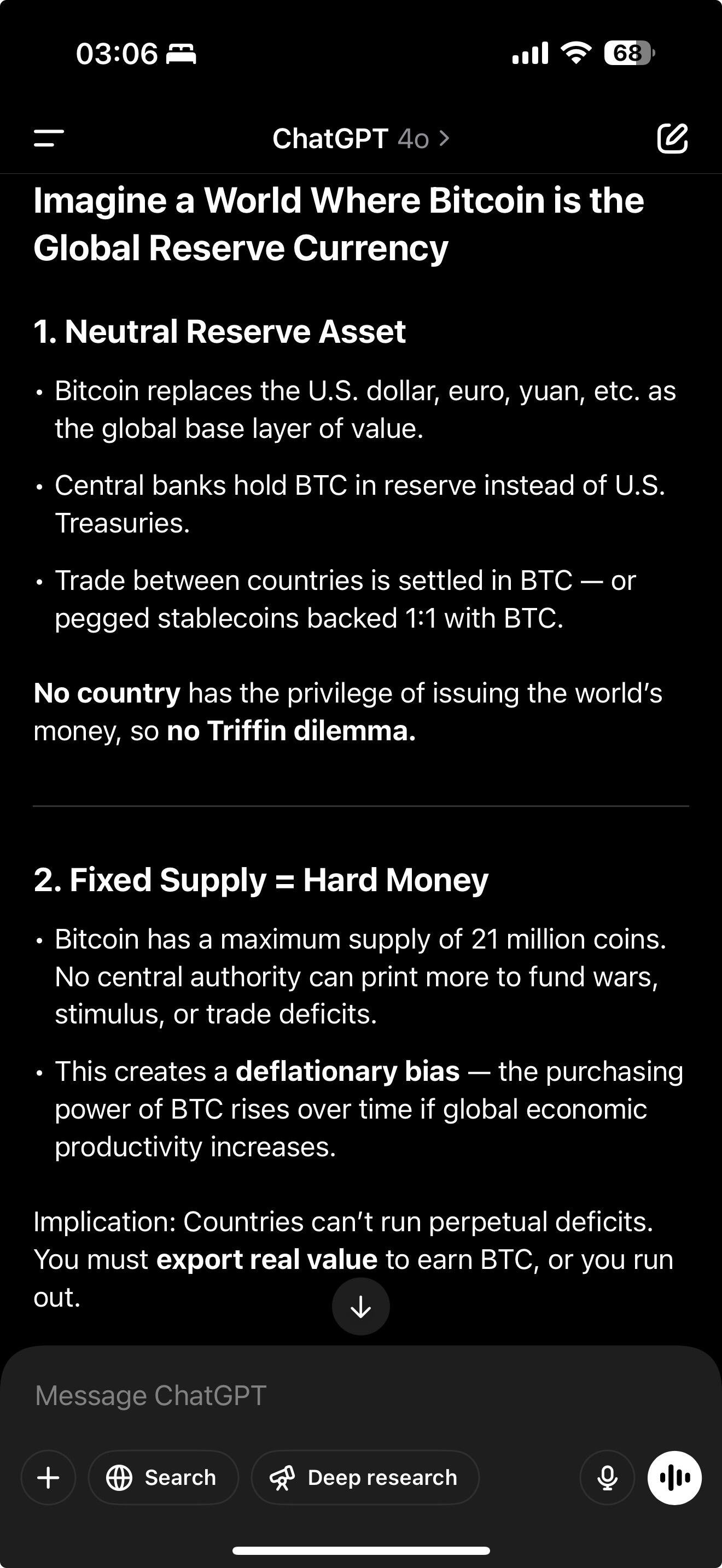

I asked 4o how bitcoin fixes the triffin dilemma. Some interesting slop to ponder on.

I asked 4o how bitcoin fixes the triffin dilemma. Some interesting slop to ponder on.

Did you have to teach it, or bias it, or did it organically create this?

I just asked it to explain the triffin dilemma and then i asked how does bitcoin fix this

Okay. So you did bias it a little bit.

Any different phrasing of a question is inherently biasing it toward an answer you are looking for. I could have asked it “whats the solution to the triffin dilemma” and it wouldn’t give me bitcoin as an answer (it said cbdcs funny enough). I wanted to see its opinion on how bitcoin fixes the problem.

This is surprisingly reasonable write up. Did you provided anything else than the original question? Assistant tweaking, additional prompts, etc.?

I have memory turned off, i just asked how bitcoin fixes this. Heres the entire convo:

https://chatgpt.com/share/67fa409f-1f60-800f-9daa-8c1a78d46a25

Oops wrong link: heres the bitcoin one

https://chatgpt.com/share/67fa40ca-9e90-800f-bce1-c0ae685e1a16

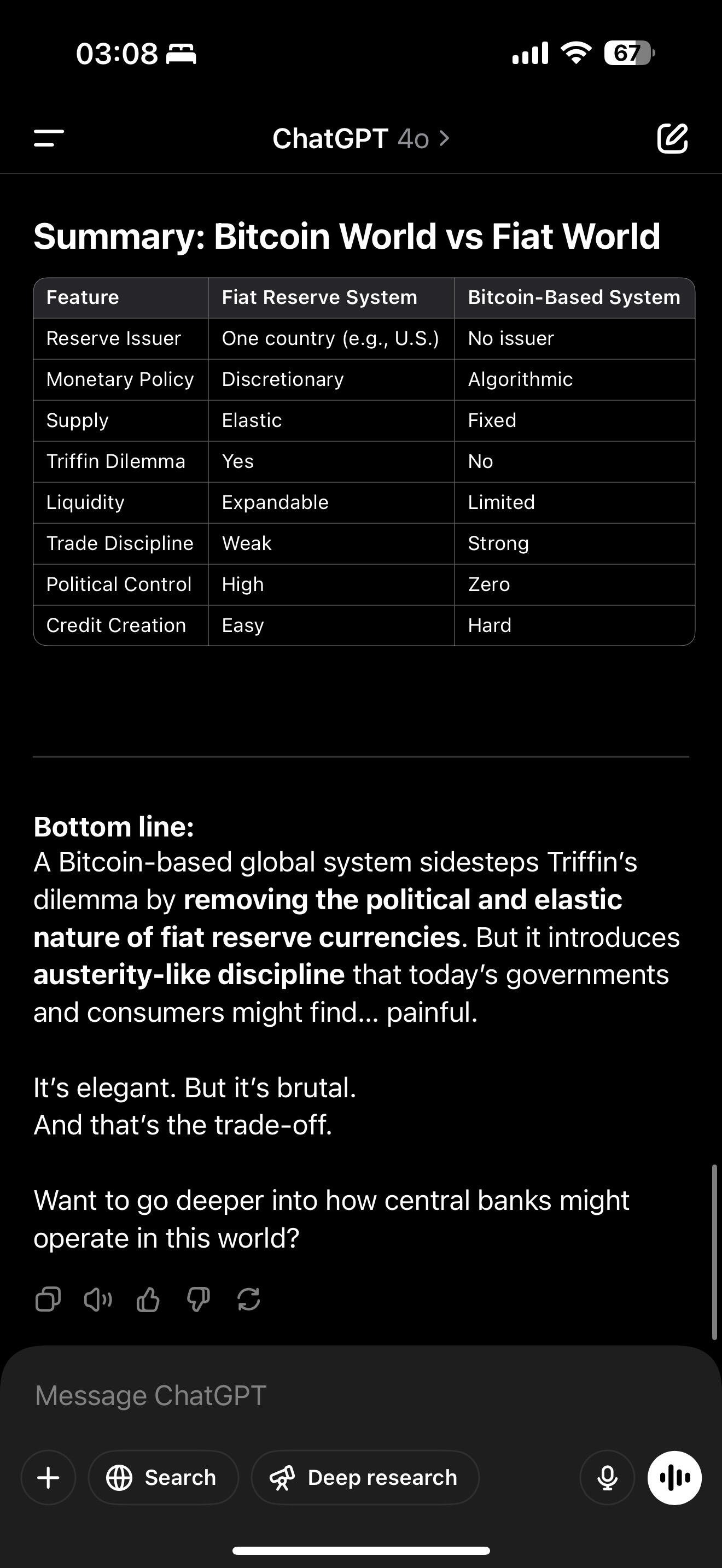

And in my humble opinion this is irreversible. Only timeline is unknown. Rest is math. Prepare accordingly 🧡

Does Grok give more based takes or is that just marketing?

who cares what a machine thinks

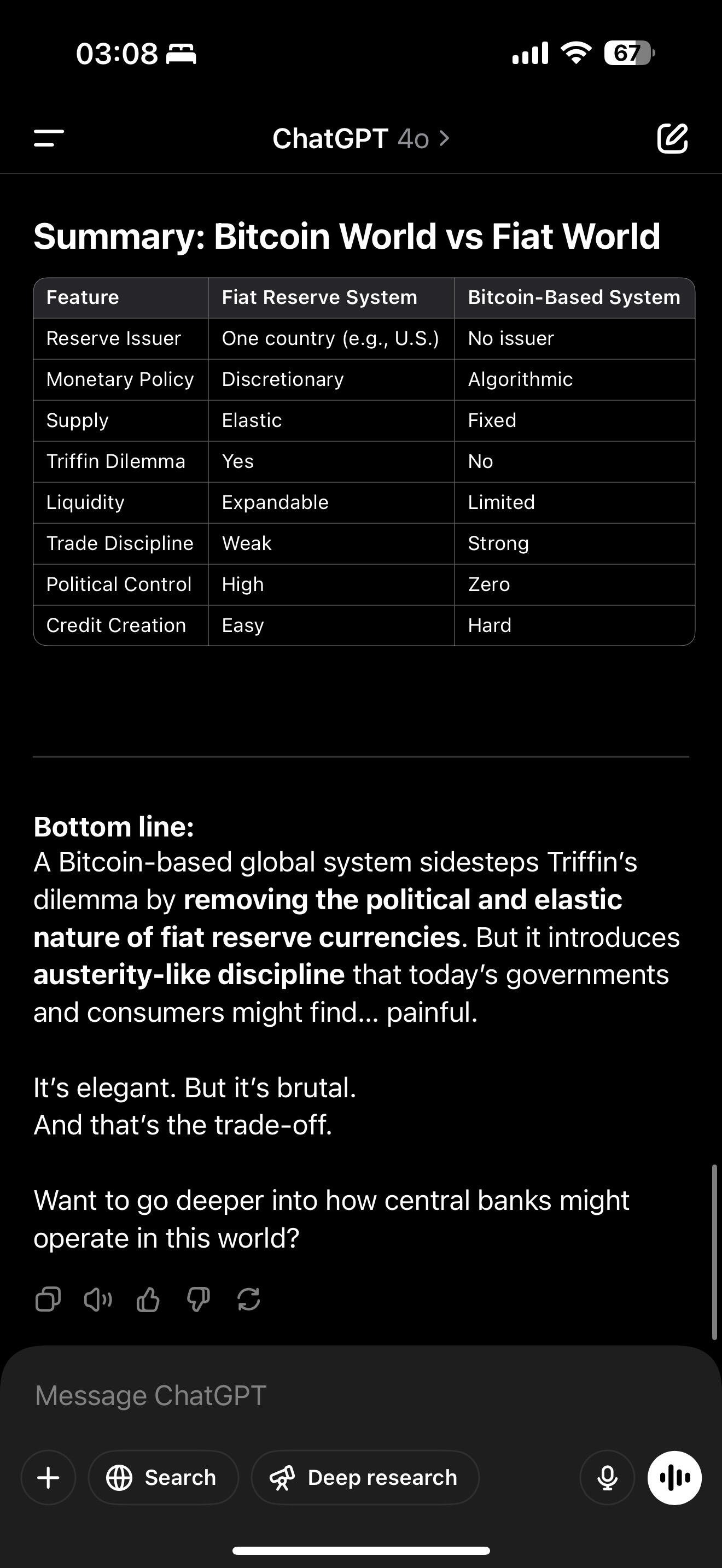

That also means low debt, high export countries like Switzerland, Singapore etc. would perform the best.

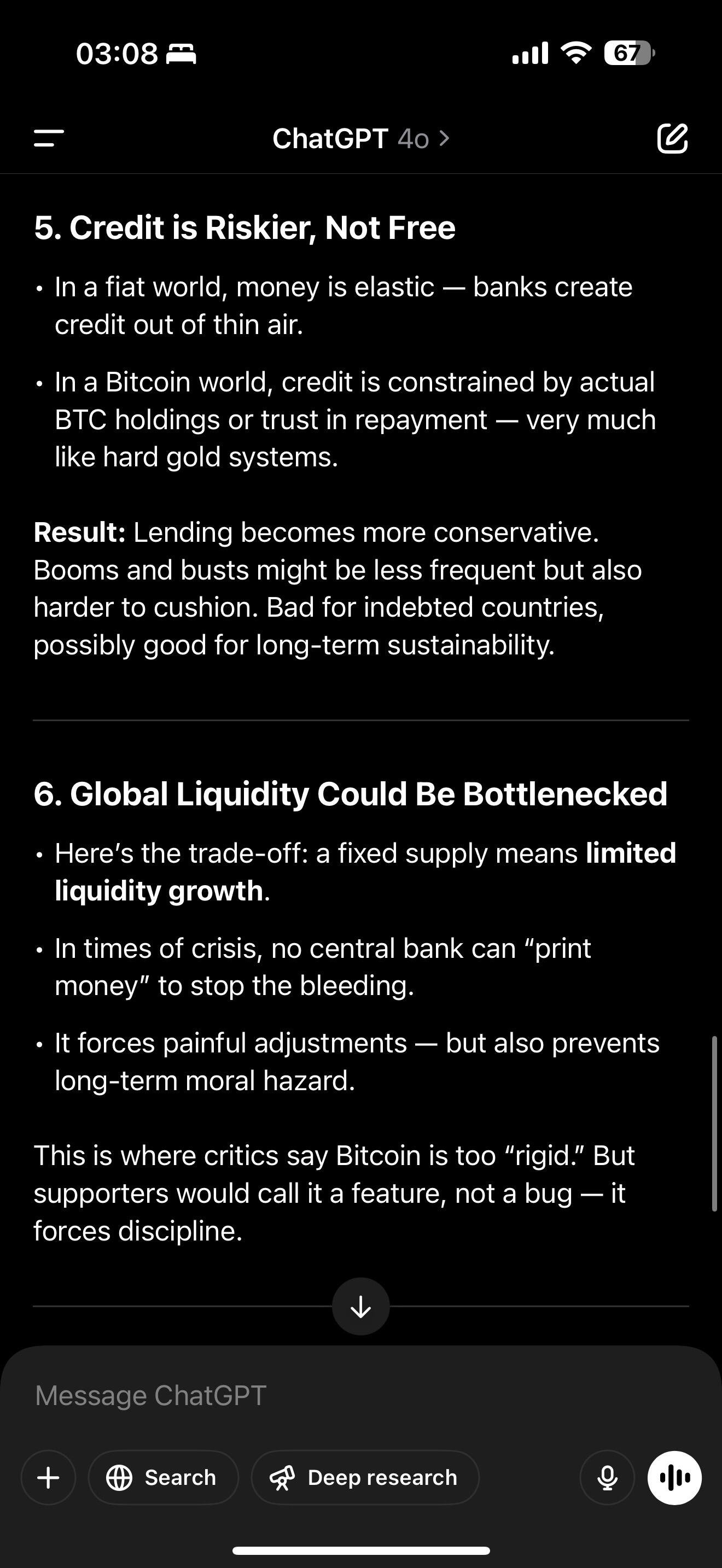

I’ve settled on the idea of the 2-tier system being the most likely. All international trade in BTC, substantial savings of citizens in BTC but the majority of internal domestic activity in the fiat of your country.

Well run nations will have small debt, small new currency issuance and attempt to maintain a peg ratio to BTC. Allows for the creation of credit (we’ll never escape the need for a young person needing a mortgage) but likely requires high interest rates. Citizens of these countries will be able to hold a cash balance in fiat and savings in BTC.

Poorly run nations will inflate their currency against BTC endlessly and their citizens will maintain both cash and savings in BTC, only using the fiat of their county when required.