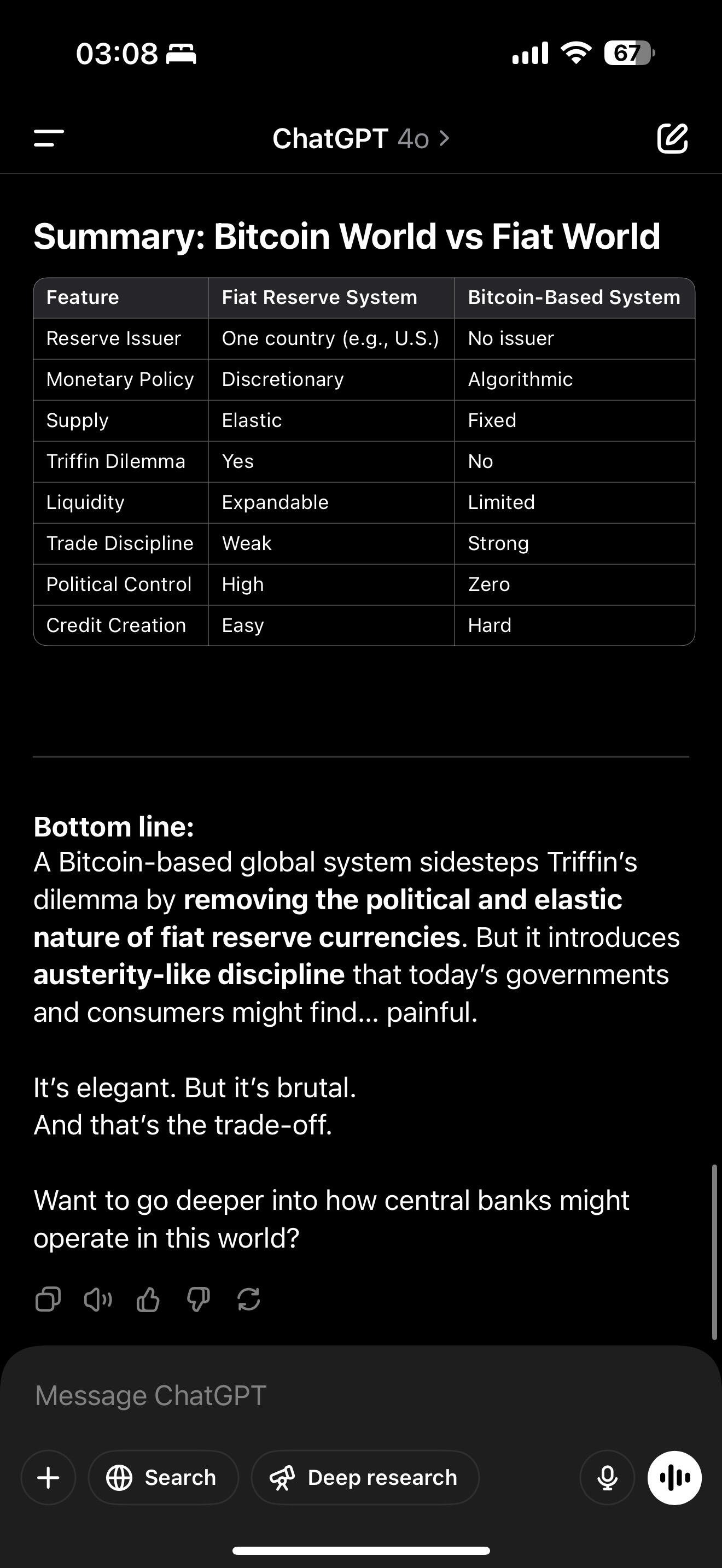

I’ve settled on the idea of the 2-tier system being the most likely. All international trade in BTC, substantial savings of citizens in BTC but the majority of internal domestic activity in the fiat of your country.

Well run nations will have small debt, small new currency issuance and attempt to maintain a peg ratio to BTC. Allows for the creation of credit (we’ll never escape the need for a young person needing a mortgage) but likely requires high interest rates. Citizens of these countries will be able to hold a cash balance in fiat and savings in BTC.

Poorly run nations will inflate their currency against BTC endlessly and their citizens will maintain both cash and savings in BTC, only using the fiat of their county when required.