I started a prediction 303 days ago that I’m eager to see take shape. I believe diminishing returns will be invalidated this cycle.

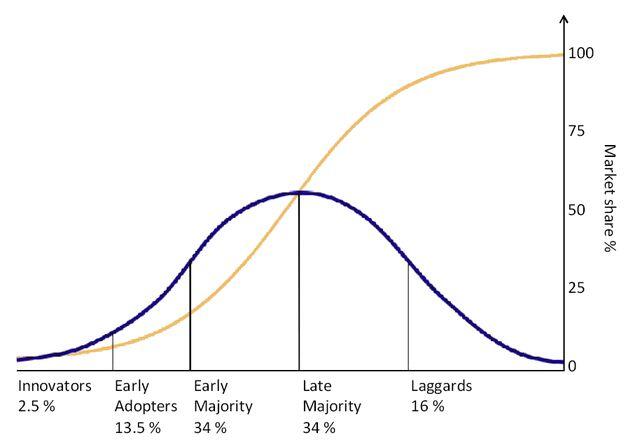

I believe that we are too early in #Bitcoin to see it. So early that what has seemed to be diminishing returns will turn out to be the small group of retail who were intelligent enough to stack and hodl without institutional endorsement reaching its saturation point.

I don’t believe these individuals are done stacking, rather they have increased their exposure significantly and need to generate more fiat/value to get more #BTC.

I believe the people who have reached their saturation point when it comes to #Bitcoin is less than a percentage of the global population. Most people who hold #Bitcoin don’t have a majority of their wealth in it and will probably sell before that changes.

However, the tables are turning and it’s becoming more and more socially acceptable to have increasing exposure to #BTC. (Not that it made a difference to us in the first place)

My current prediction that I’m sticking with and am curious to find the real number is a 14.1x from halving to a year after halving.

I’m not predicting the peak just what I expect to see if my thesis is correct. It’s basically my fasten seatbelt sign. It’s my winter ISN’T coming sign.

I think supercyclors were a cycle early, we didn’t have the demand, but now? Oh baby!

Imagine the Gold ETF if supply was truly fixed and predictable… if that lasted a decade, then #Bitcoin’s rise could last well beyond 2140.

With current prices my prediction would be $985k+, but I’m waiting until the exact point of halving to get my real number.

Surprisingly, this isn’t the most bullish prediction, and I wouldn’t be surprised if it’s too bearish. We will hit supply shocks that will boost demand and snowball into something never witnessed before.

Absolute scarcity is still a brand spanking new phenomenon to experience. We know closer to nothing than something about it and this will become blatant as time progresses.