SUPERBITCOINIZATION IS ALREADY HERE

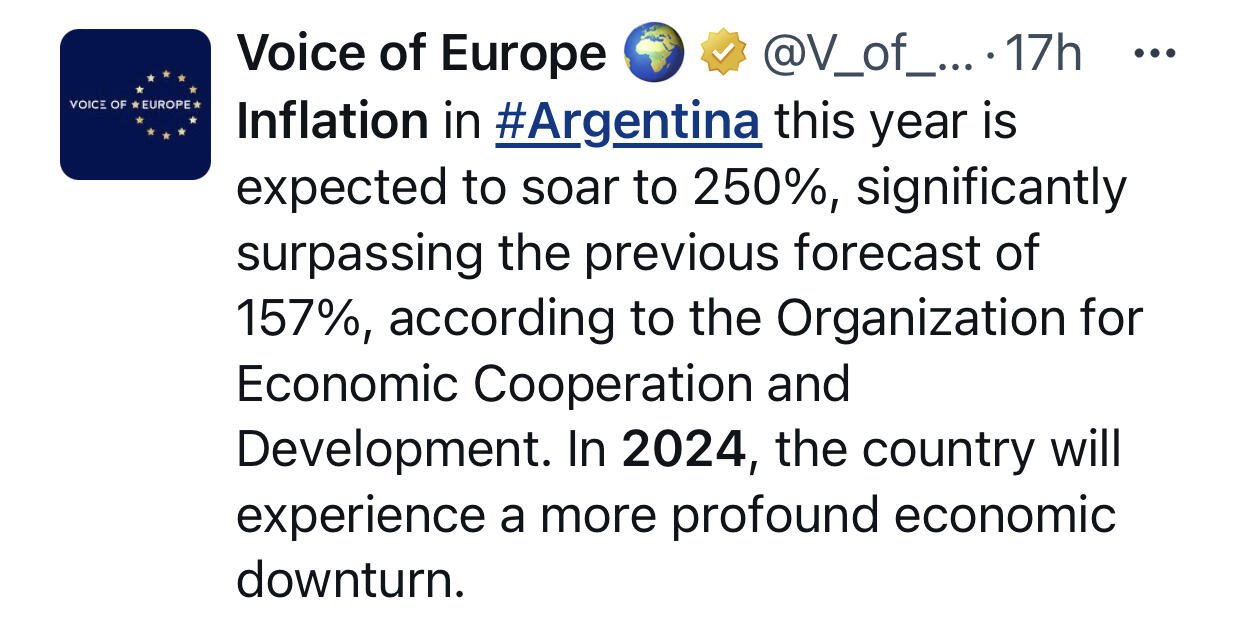

“Normal” inflation is 2% per year.

Or roughly 0.2% per month.

And hyperinflation is 50% per month.

So, we aren’t there yet.

It’s all fine!

But is it?

What if we define something in between?

Call it superinflation.

Say superinflation is 5% per month.

In that case…

BTC has appreciated >20000% vs USD.

Over a ten year period.

That’s a monthly rate of >8.6%.

That means the dollar has devalued against Bitcoin by more than 5% per month on average for ten years.

So: yes, hyperbitcoinization hasn’t hit yet.

But superbitcoinization is already here.

We’ve been living through it.

#m=image%2Fjpeg&dim=1080x530&blurhash=ZjS%3D3YXmuPrYbuWUV%3Ff%25ogoJkqX8aejEjYkCaya%23pdi_VXW.aKogogjGWng4a1jEkVkWbcaekBj%3F&x=6546a66fc7f55257e75b51774393623c55576af531233db9e010ccaea6f279af

#m=image%2Fjpeg&dim=1080x530&blurhash=ZjS%3D3YXmuPrYbuWUV%3Ff%25ogoJkqX8aejEjYkCaya%23pdi_VXW.aKogogjGWng4a1jEkVkWbcaekBj%3F&x=6546a66fc7f55257e75b51774393623c55576af531233db9e010ccaea6f279af