The cloud is someone else’s computer because they control the software that is installed.

Hardware wallets are someone else’s computer because they control the software that is installed.

#wallet #bitcoin

everyday is coffee... wow

tiada hari tanpa bitcoin.

otw 1 juta us dollar. 10x dari sekarang adalah kepastian

finally, the german government can breathe a sigh of relief; there is another government that is more retard than they are.

btc meroket, tapi mempool sepi. anomali.

REMINDER:

NEVER SELL YOUR BITCOIN TO INDIA. NEVER..

#BITCOIN #NEVERSELL #HODL

India Calls for Strategic Bitcoin Reserve Pilot

#bitcoin #india

When you hold bitcoin, and do not move it, you actively attack and destroy your enemies.

It’s the most aggressive and impactful thing happening in the world today.

#HODL #bitcoin #NEVERSELL

🍿

?name=small&format=webp

?name=small&format=webp

“The difference between Bitcoin and a Ponzi scheme is that in a Ponzi scheme, the early adopters benefit by cashing out. With Bitcoin, there is no reason ever to cash out.”

dont allow them to exist, so just HODL bitcoin.

BITCOIN HOLDER / HOARDER IS THE REAL HERO

The Only Winning Move is Not to Spend

We live in a state of total war. Everyone who holds bitcoins is trying to get more by scamming others out of theirs or convincing others it’s not worth trying to get into. Everyone who does not hold bitcoins was either scammed out of them or was scammed from getting into it. Having bitcoins takes the knowledge and will to know and desire its future, while not having or spending them is lacking one or the other. If you hold bitcoins, you must take a breath every time you wish to send any to another person. Ask yourself if that person truly deserves untold amounts of your future wealth for pouring you a beer. You may just find the will to hodl more.

every bitcoiner should run a node an sell their bitaxe gamma to stack more bitcoin. this is financial advise.

your IT guys advise: "sell your computer, buy bitcoin"

#hodler

NEVER SELL YOUR #BITCOIN RETARD!

?name=small&format=webp

?name=small&format=webp

#bitCOrN

Totally Ineffective Not Advisable

financial advice, sell your iphone, sell your grapheneos phone, sell everything. buy bitcoin.

bayangkan, mulai tahun depan, tinggal tersisa 1 juta bitcoin yang belum ditambang untuk 1 abad kedepan.. wow

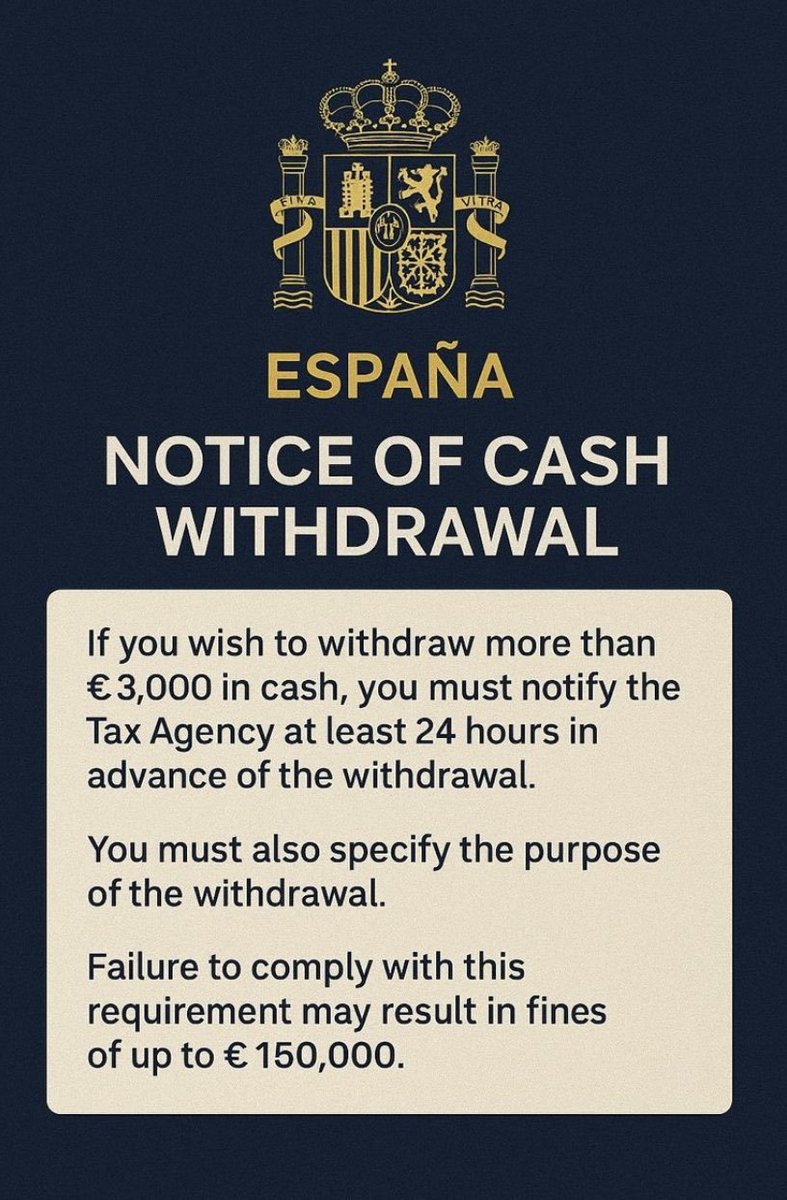

aturan baru di Spanyol, WTF

If you want to withdraw €3,000 or more in Spain, you must notify the tax authorities at least 24 hours in advance and provide a stated reason for the withdrawal. The bank will only process the request once this notice has been given. So you cannot withdraw the money immediately unless you had already informed them beforehand.

"not your keys, not your money"

source: https://fintechnews.ch/fintechspain/spain-strict-cash-withdrawal-rules-fines/76051/

?name=small&format=webp

?name=small&format=webp

minimal kita sudah pernah menyampaikannya pada mereka.