Or use the inverse of the emotion to be added to your personal profitability guide. If you feel positive about something, odds are that others do too. The asymmetrical bet is to choose the opposite. Like: "bitcoin price must go up when the ETFs are approved"

Best is to leave emotions out, but the decision making is done in the emotional region of the brain. So just be aware that there is some research and rational thoughts done before it starts to "feel good" to make a decision. And always consider the option of not having to decide anything at all, as we humans are very prone to "having to do something", where afterwards most profit would have been made if we didn't do anything at all and would just have let our investments ride...

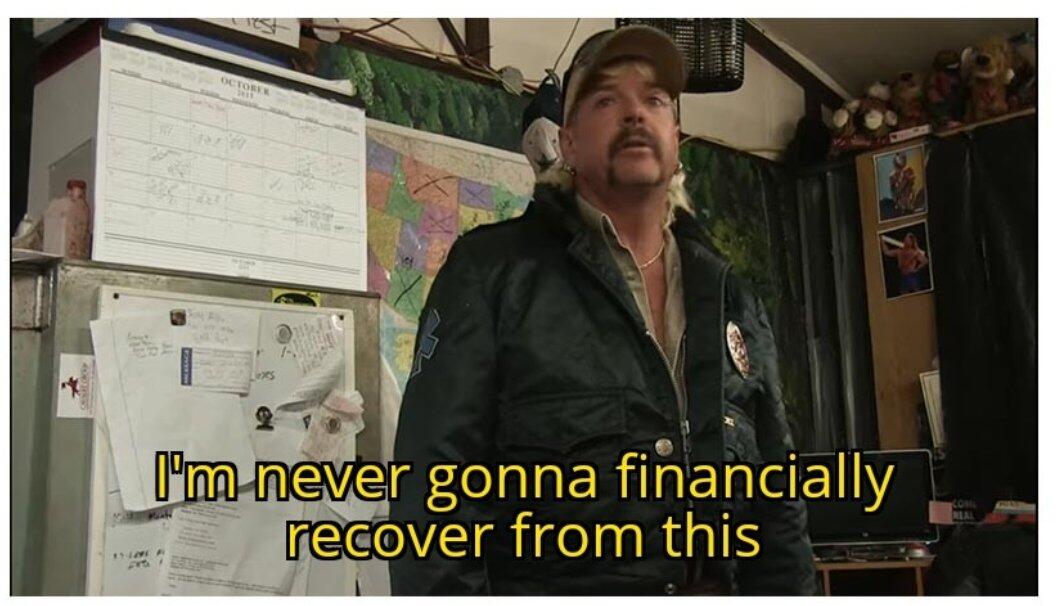

Most money is made when an investment goes up from "horrible" to "bad" vs. "good' to "euphoric" (to end with emotional indicators)