sounds like we need to reduce our surface area even further.

you are aware that a primary function of money is a store of value, right?

storing value and transacting value are not mutually exclusive, do you agree?

sounds like we need to reduce our surface area even further.

you are aware that a primary function of money is a store of value, right?

storing value and transacting value are not mutually exclusive, do you agree?

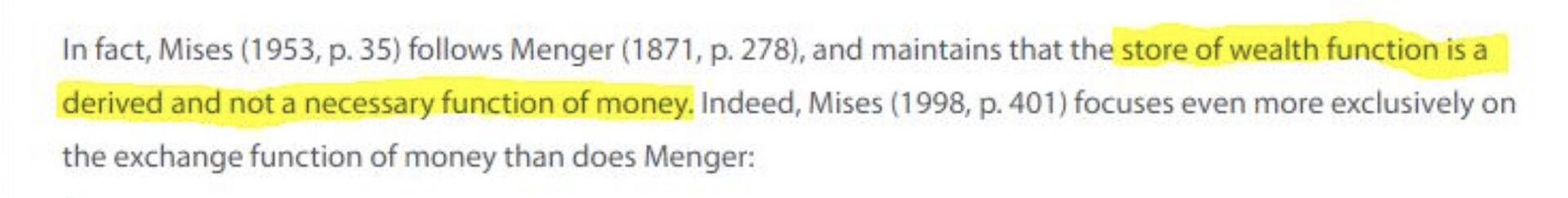

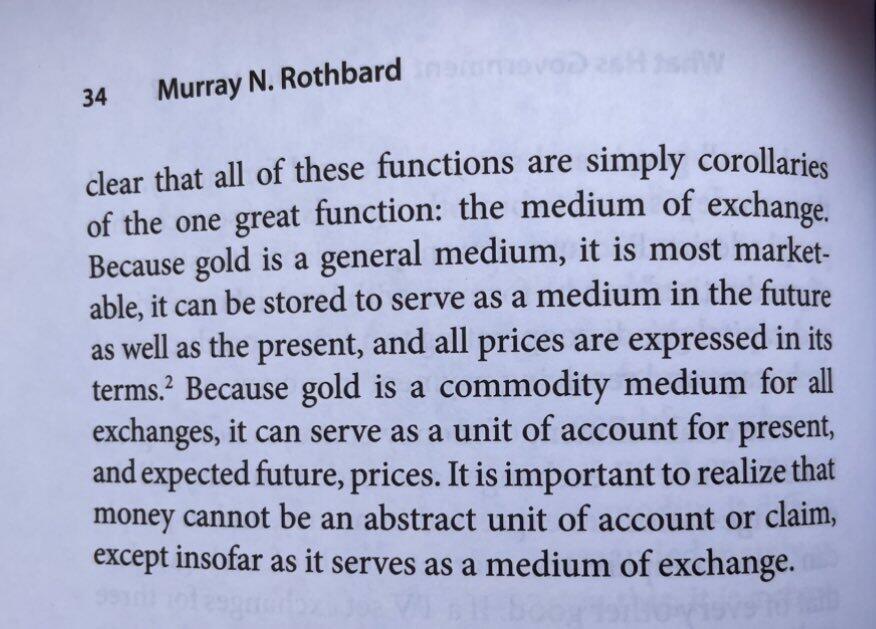

According to the Austrians (Menger, Mises, Rothbard, etc) the primary function of money is MoE. SoV is contingent upon that.

Yes I agree with the last part, but that is separate from the value prop of Bitcoin

i.e. You can hold your Bitcoin with custodians or make permissioned transactions with it. You don't benefit from the core properties of Bitcoin in either case.

So, let's not argue from authority now, that wouldn't be very fun.

Even still, we've accepted the general framework that transacting and storing value are separate acts.

Let's use 'property' in place of money. Or any term you'd like! Asset, currency, what-have-you. I don't mind any of them.

I claim that storing value is an important proposition for any property. Bitcoin clearly stores value orders of magnitude better than Monero, as measured by the market value being 300x.

Hm, wait I'm back to claiming 'market value'. Why is that? Well, we can just exchange Bitcoin for Monero on the market instead of dollars, maybe that will help us understand comparative value better.

But wait, this wouldn't matter if we do the exchange on a permissioned market like you said. So let's compare over a decentralized market instead!

Wait, the prices and relative values that I see from these decentralized markets reflect the same relationship as the permissioned markets.. that's weird.

I wonder if free market value could be seen as an attempted aggregate of the value propositions that individuals claim for themselves when doing their own assessment of their options with their property?

That would make value, and value propositions subjective.

Maybe you are missing something when you say: "the value prop of bitcoin is..."?

Otherwise you surely would expect the value in the dark markets to even out, and even for Monero to overtake Bitcoin, as it clearly is more valuable? Is that what you expect?

Sorry just saw this.

We've now drifted from the original topic up in this thread with this SoV and MoE talk. But ok.

I'm not making an argument from authority. If you don't identify with austrian econ, then my examples will have no weight, and that is fair. And if you are in the austrian econ camp you don't necessarily have to agree with Rothbard/Mises etc, but then I would like to hear why you disagree.

If you adhere to subjective theory of value, scarcity *alone* can't make Bitcoin increase in value. There are many things in this world that are scarce, but have no value (i.e. unique artwork).

The free market is also capricious and never "settled". It is always reevaluating. There are plenty examples of products and companies that were once valuable and now practically worthless or non-existent.

But this all has nothing to do with my original point. The value/market cap of Bitcoin has nothing to do with it's "value proposition" (the market could just prefer speculating to get rich and not care as much about permissionless transactions aspect of it).

Maybe you're confusing it because they both have the word "value" in them. Call it "core proposition" instead of "value proposition" if that helps. The core proposition is the only thing that distinguishes it from everything else. Without that it is just a glorified Paypal.

If the only way you can transact on the white market is by following the rules of a central authority, it doesn't mean that Bitcoin itself isn't permissionless (you can defy the rules aka black market transactions), but it means that any transactions placed on that market ARE PERMISSIONED SO DONT BENEFIT FROM THE CORE PROPOSITION OF BITCOIN.

Sorry for caps. Wanted to make my central point clear because we keep talking in circles.