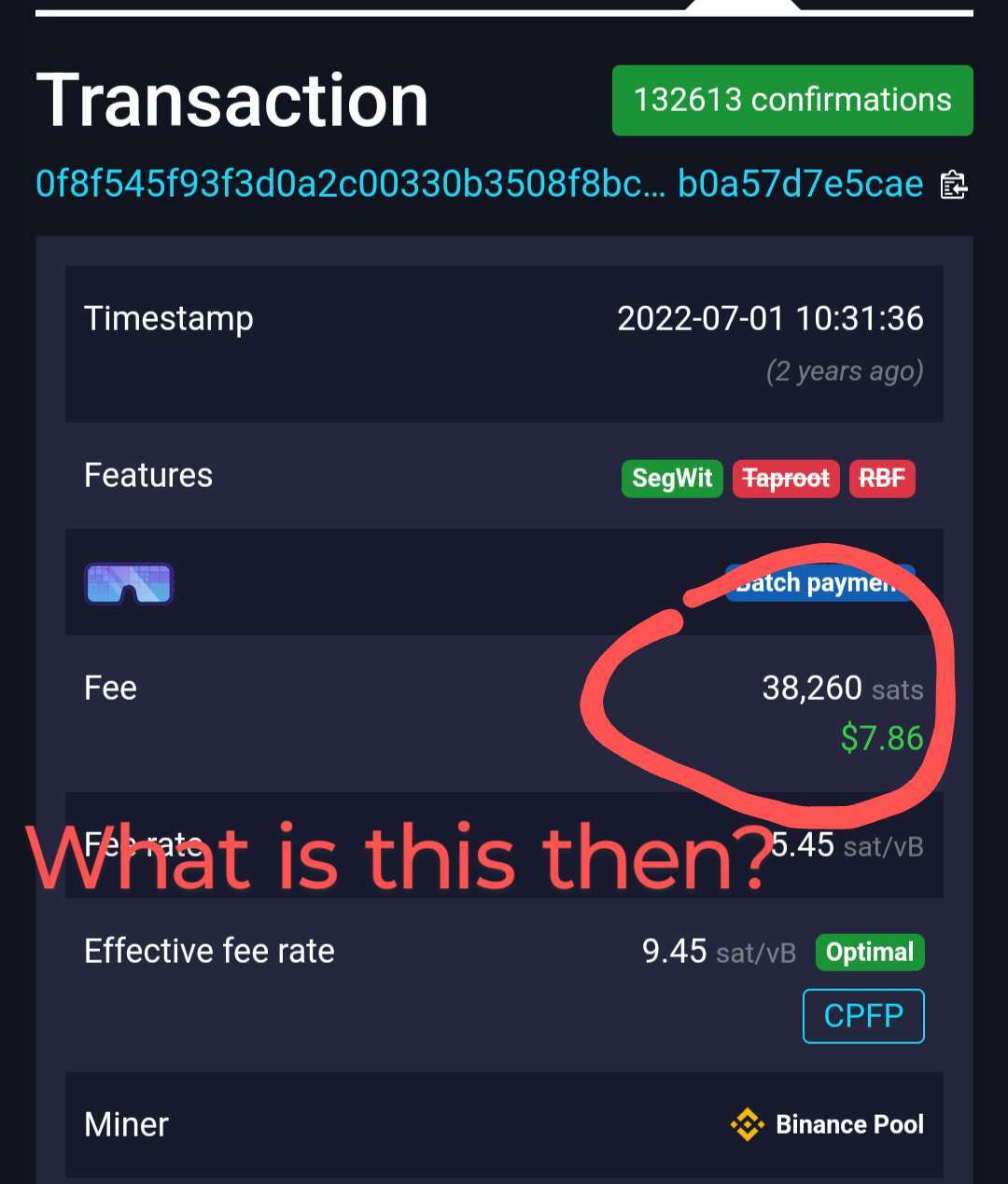

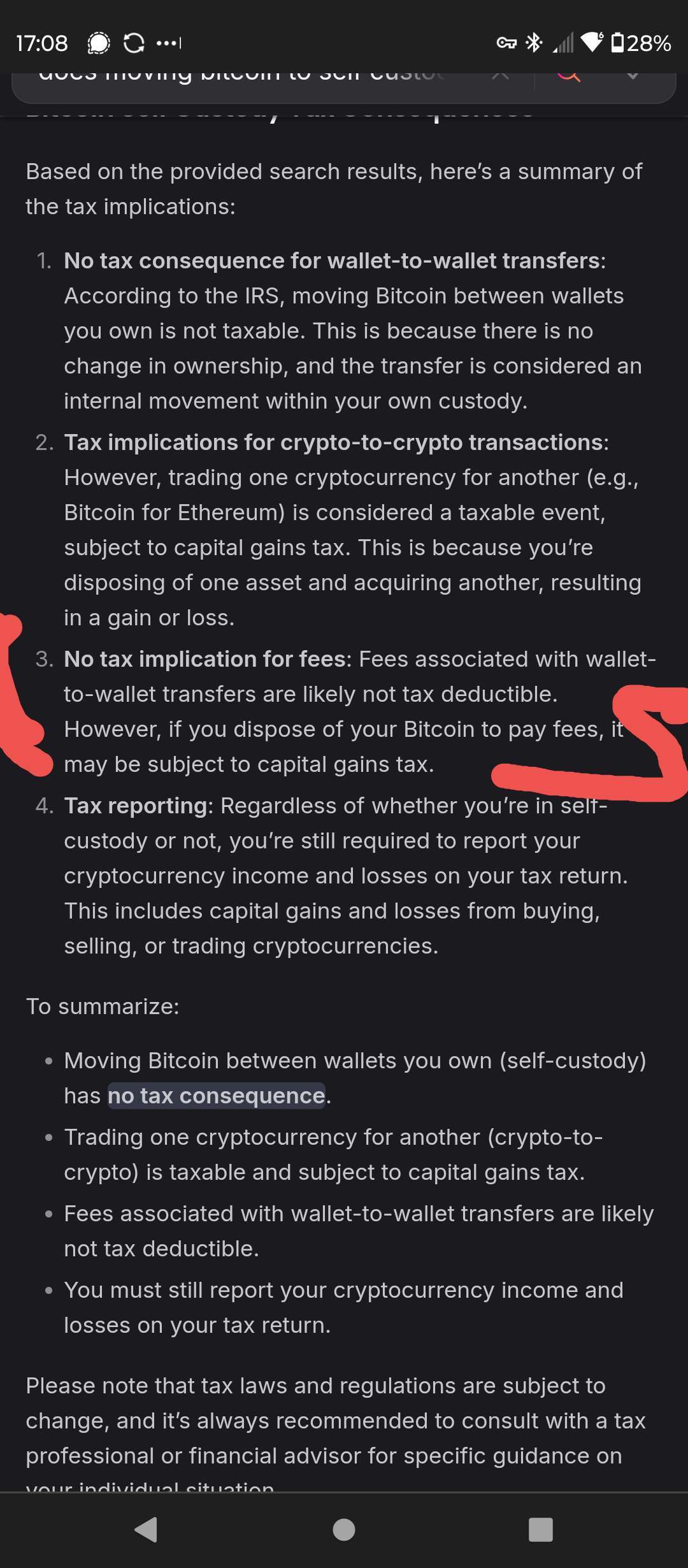

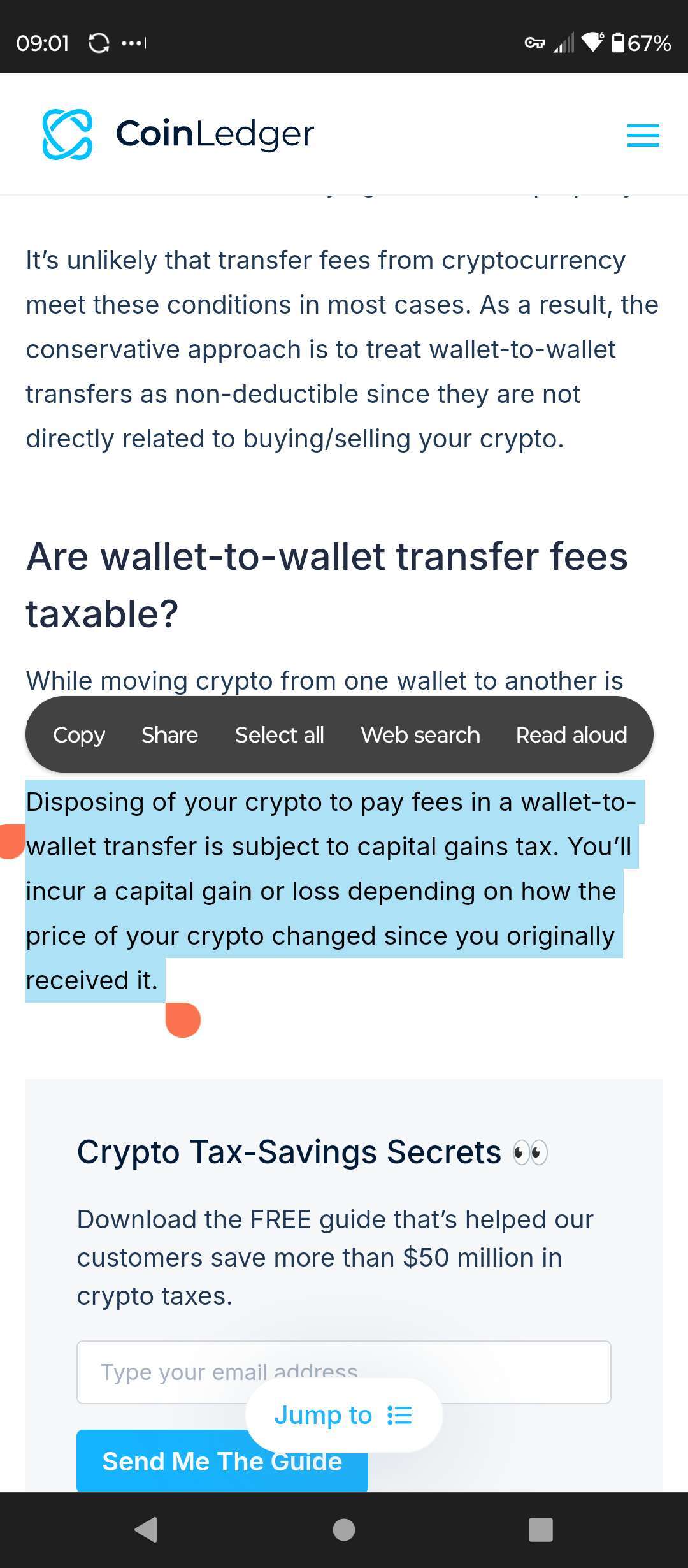

Moving bitcoin from exchange to self custody, accounting for the fee (sale of bitcoin)say you decide to move your btc. You pay a fee to do so. In the case below the fee is 38,260 Sats. This would be considered a sale of those Sats, therefore you will have to determine the cost basis of those Sats (what you paid for them) in order to calculate your tax consequence...

Am I right or wrong?