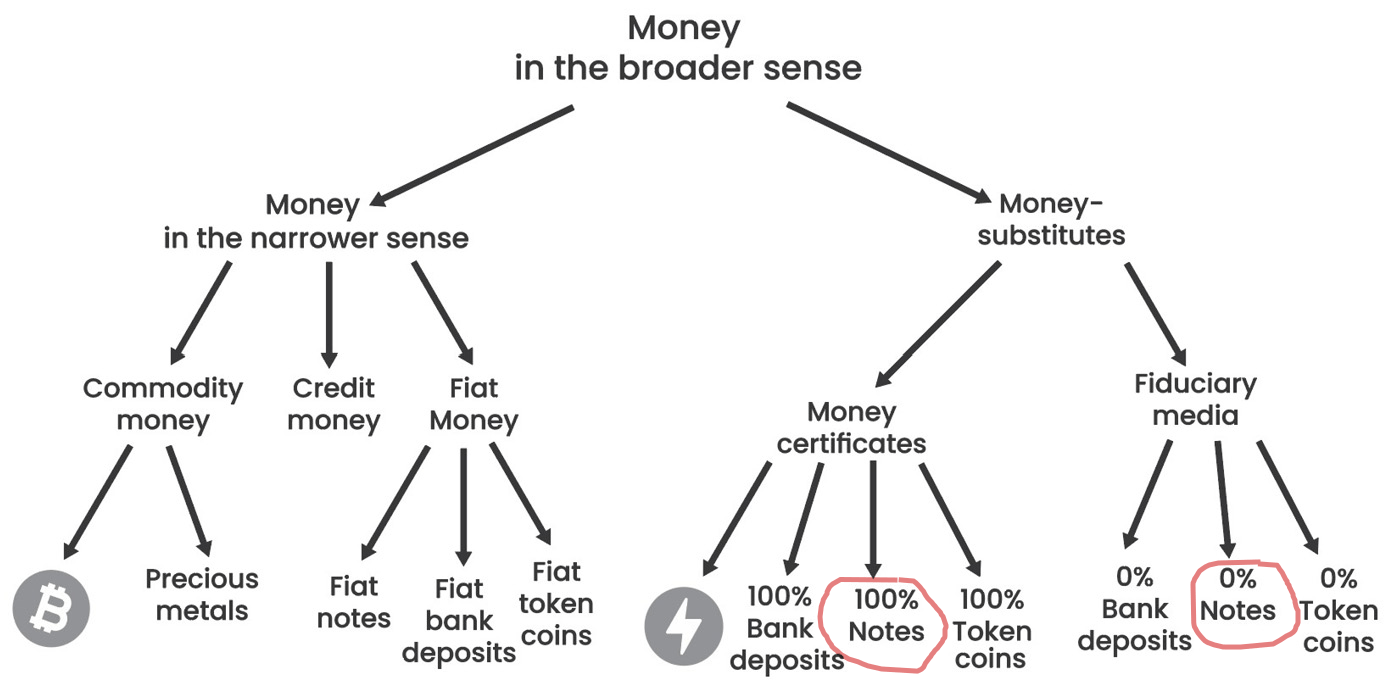

This diagram is from nostr:npub1gdu7w6l6w65qhrdeaf6eyywepwe7v7ezqtugsrxy7hl7ypjsvxksd76nak book Principles of Economics. And the Original definitions are from Mises' Theory of Money and Credit. (My highlights.)

Based on this model ecash would be a bank note - If the Mint is honest and redeems all notes for Bitcoin we'd say it's a 100% Note. If they're dishonest and have less than full backing it's a 0% note.

Circulation credit is when the person issuing a loan pays it out as fiduciary media (i.e. unbacked money substitutes). So they paid you out with money they don't actually have on hand. If the loan is paid out in commodity money, or 100% commodity backed certificates then it's commodity credit.

So in the case of a loan paid out as ecash it depends on it the ecash is fully backed or not - If it is backed then it's commodity credit and if not it's circulation credit.