Discussion

🤣

Dude, I feel this. Never mention XMR.

you just did

and LN doesn't do what Monero does

Yeah, I was joking about how tenacious monero stans are.

I didn't say it does. It does more useful things.

LN that is.

yeah

nah

monero protects sender receiver and amount by default

LN does...

some stuff the user has no control over and can't predict.

so no

it doesn't do what Monero does and certainly not better.

See, this is what I wanted to avoid. I don't care enough about some random token with some neat tricks that cypherpunks can jerk off to.

well then maybe dont mouth off about what it can and can't do

The neat trick is making sure your transactions are private from malicious entities.

I think it's a little more neat to preserve your purchasing power. Chastising "NGU" is economic illiteracy. Whe n the "Number goes up" it is a silent vote on the future of Bitcoin being the base asset layer. The recapitalization into bitcoin isthee neat trick. The currency layer (not the BTC timechain) is for privacy and belligerent deterrents. But I know, security theater is very fun and cool. I'm glad you guys are having fun with your Neo from the matrix coin. I am just interested in sound money, not hackerman cool feels.

Bitcoin doesn't really preserve your purchasing power, it's heavily volatile (as this week alone has demonstrated).

That being said I do think Bitcoin is an improvement over the current fiat system, at least in regards of monetary value overtime.

I criticize NGU culture because it only focus on one element of Bitcoin, and a fair portion of NGUs are only in Bitcoin because of Speculative Gains, and don't actually understand The Chicago, or Austrian argument for why Bitcoin exists.

Whereas most early cypherpunks who used the Bitcoin system typically tended to focus on both the technology, and economic principles of Bitcoin.

I think Bitcoin can absorb a fair portion of global liquid assets, however I do not think Bitcoin is capable of handling credit, bonds, and unfunded liabilities effectively that currently exist.

Whether that's a good, or bad thing is up for debate, personally, I'd like to see the economy become more de-leveraged overtime as savings are the fundamental building block on an economy.

I am not confident enough in lighting as technology to encourage its use, I would use lightning if necessary but preferably I like to settle transactions on-chain.

That said, I feel both cryptocurrencies are based on sound economic principles, however, I feel like Bitcoin double edge sword is the supply limit, it's both its blessing, and curse.

It makes it more valuable overtime but it prevents it from being spent overtime, so eventually it becomes less of a currency, and more of an investment vehicle, which is not what its intended use case was, is, or should be, Bitcoin should continue to be used as a tool for Medium of Exchange.

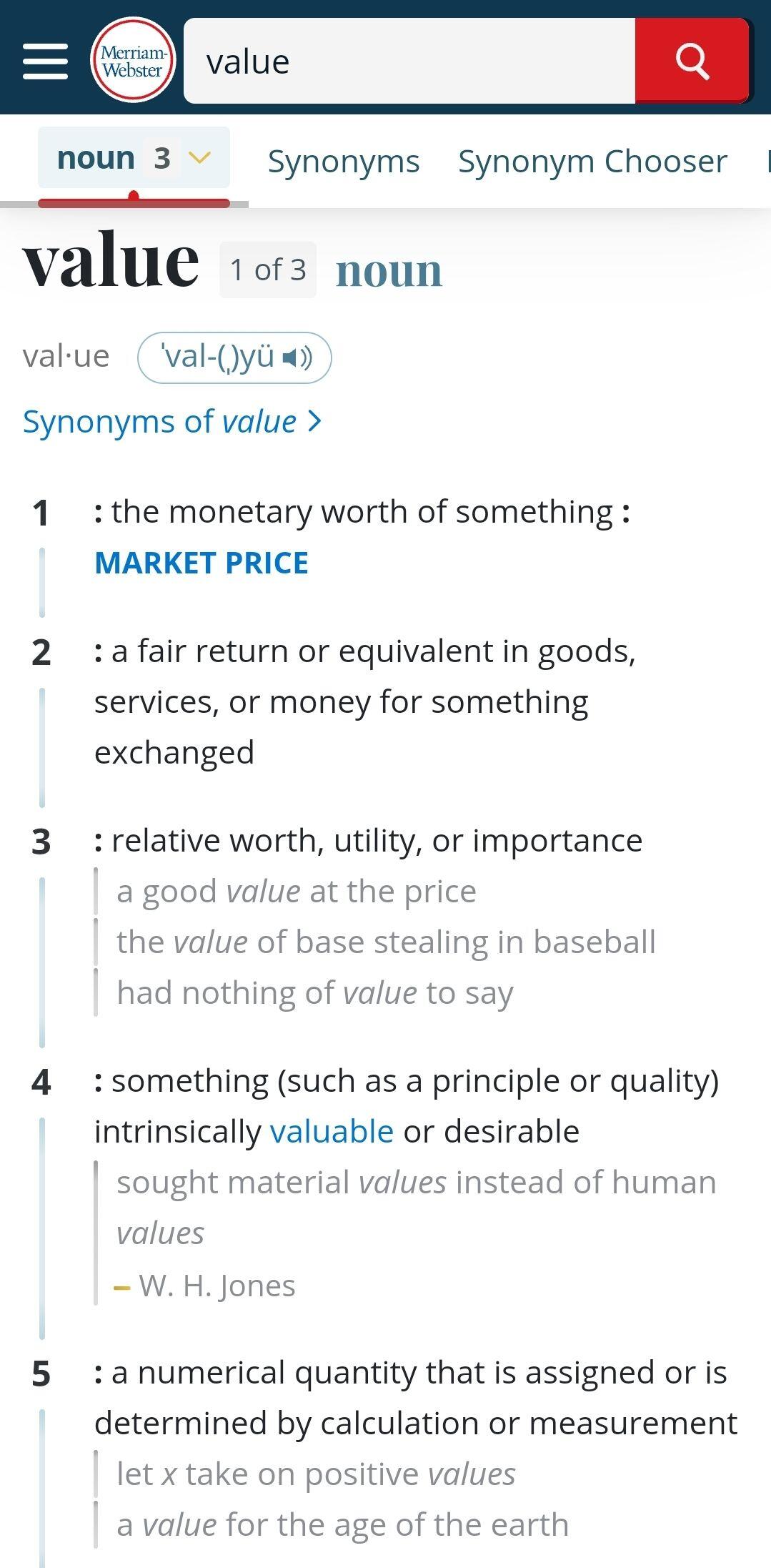

Okay there's really a lot to tackle here but I'll start with some definitions.

Money- an asset used to solve the coincidence of wants problem.

Currency- an abstraction of money to facilitate the frequency of trade necessary to keep up with the velocity of commerce.

Value- a heirarchical system to organize speculation on the importance of one thing over another.

Volatility- rapid change in value usually due to either supply economics or demand economics.

So, with those definitions, I will sort of unravel what I see to be misapprehensions and/or inaccuracies.

"Bitcoin doesn't preserve purchasing power" because it's volatile.

This has a smuggled assumption: The ruler by which you measure value is stable. If you price everything in bitcoin, it is stable. The price of everything has steadily declined in a very predictable way. It is inversely correlated to the inflation of your measuring stick, The Dollar. The dollar is the volatile aberration that distorts the prices of everything else.

The reason for this can be summed up like this: If I asked you to build a house and the measuring tape increased the distance a foot was every few days. How would you be expected to have an accurate way to build? The "Unit of Account" inflating distorts one's idea of what is stable.

As far as NGU speculating, literally all valuation is speculation. By holding any asset for any amount of time you are speculating that it will hold more value later than if you sold, or consumed it right now. The number going up is reassurance that your speculation was correct.

Bitcoin "handling credit, bonds, and unfunded liabilities" is kind of confusing. By recapitalizing into bitcoin, all that happens is that the true cost of those goods and services emerges and market actors will decide if they want to continue funding those things. Bitcoin doesn't consume other assets. It just demonetizes them consuming their monetary premium. In a Bitcoin standard no one will buy a house just to sell it. No one will buy gold for it's monetary value, only it's utility value. Bitcoin can't consume a negative monetary value (unfunded liability).

Now we come to lightning. People don't realize this but Lightning is a currency token. The sats you send over lightning are not real sats. They are a claim (programmatically enforced) upon real sats locked in an HTLC on the BTC Timechain. Bitcoin is money, not currency. Lightning is currency, not money. They are used in collaboration to facilitate this digital age commerce. Assets/money are generally inefficient at being mediums of exchange. Gold coins had very little verification when used as currency. Hence all the chicanery of coin clipping, alloy mixing, weight dilution and so on. Gold was best used as the reserve asset/money behind a currency. MANY countries in the past 5000 years have done this. Bitcoin can't get around the Monetary trilemma: Speed vs Security vs Scale. You can only have two of the three in any monetary network. So what a currency does is cover the missing piece. Fast and secure FINAL settlement is what Bitcoin offers. Scale however is not. Lightning solves this by having Speed and Scale. The security is wholly dependent on the BTC Timechain verifying the Final channel states.

This is how ALL money scales.

Layer 1- Asset

Layer 2- Coupon

Layer 3- Credit

And a final point on Time preference. The Bitcoin's value growth prevents it's expenditure, point. This is simply not true. The more valuable it becomes the less of it you will have to spend to acquire everything you need to live. No one can sustain themselves with money alone. Especially not digital money. Having money is not a good unto itself. You have it for the sole purpose of spending it on goods and services you need and want. The amazing thing is that the more valuable a money becomes over time, The lower your time preference becomes. Frivolity and decadence fall dramatically with sound money. I myself find this to be a good thing. I don't exactly understand the mindset that it is bad if people don't throw their money away frivolously.

Anyway, I hope this elucidates you upon my perspective and why Bitcoin is THE tool have a sound economy.

As far as the primary debate goes I agree that Fiat is a poor tool to use as a measure of value.

Secondary side debate replies

Value - The inherit worth, or utility use case of something to the individual acquiring the asset, or commodity.

Value isn't speculative as most things have a baseline value, however the prices which reflect the value changes, prices don't always reflect value properly but they do tend to be correlated.

I don't think Bitcoin will stop asset speculation like house purchases to use for financial appreciation/gains, or gold as a hedge against inflation, however I will agree that bitcoin might slow down the rate at which both of these behaviors occur.

My argument of negative value being "absorbed" by Bitcoin may have not been the most flushed out since few if anyone appears to mention the theory of current debt under a Bitcoin standard since the current economy is bigger than its actual liquid value.

Bitcoin is hard money, and I agree with that, lightning is not hard money as its not secured by The Blockchain, Lightning is a collaterized debt backed by Bitcoin, luckily the protocol functions but to me, it's not how I want to build an economy.

Monero has all three, speed, total confirmation, and settlement on blockchain takes 20 minutes, security you're unable to spend funds until 10 blocks have been unlocked, & scalability since block size is adaptive.

I will reiterate, my definition of value is the correct one. There is no such thing as inherent value. Every value is the speculation upon it by a human. Water is inherently valuable? How much would a drowning man pay for a bottle? How about a man in the desert? No good or service has intrinsic value. I emplore you to read Human action by Ludwig Von Mises or if you REALLY want to break it down as far as possible read Man, Economy, and State by Murray Rothbard. All of your analysis hinges on that fact being untrue.

I agree that Lightning isn't hard money because it's not money, angain it's a currency.

The problem of a trilemma is that choosing more than 2 options of a trilemma is like choosing both options in a dilemma... It's logically impossible. Monero is dynamic in that it's two changes as the block changes. Its dynamic blocksize diminishes its security proportional to its scale. The security is based on its auditability not the signatures. The ability to audit and verify is what secures any blockchain.

So, anyway I am not really into debating definitions. I am glad we agree that Fiat is destructive. I think bearing down on what makes sound money sound, is what really reveals what properties are important.

Can we agree that number 3 is a valid definition of value?

Yes, value can be subjective, and the subjective aspects of value are measured in price.

I have read Austrian theory, and heavily lean towards it, however, I would say I'm closer to Chicago as it seems more practical, and realistic, Austrianism is idealism, and I agree with that ideal but I don't think we'll feasibly achieve that ideal in our lifetimes but we should build up the infrastructure for an Austrian principle.

To me, Bitcoin is Both Money, and Currency, lightning to me is more like of a type of collaterized credit that functions like a currency, or as you say coupon, it's a proxy for Bitcoin in the lightning network, and only becomes actual money once finalized on the blockchain with the channel closing.

Monero can be audited albeit much more difficult than conventional currencies.

Yes #3 but I completely reject #4.

By the Austrian logic, nothing is intrinsic, which was the basis for most of the previous post.

Currency IS collateralized credit. That's what it is. Money is an asset that solves the coincidence of wants. It is a good not meant to be consumed. The 5 attributes of sound money are:

Scarcity

Verifiability

Divisibility

Portability

Durability

Currency is a technology that makes better the transactional functions of a money that has these attributes. The sole attribute of currency is that it is collateralized by the money. Bitcoin (like gold) is highly inefficient as a currency. I say Bitcoin is money not currency because it doesn't collateralize itself. All assets can be traded for goods or services, that does not make it a currency.

Subjective theory of value means even something less scare can be more valuable

Directly contradicts the "absolute scarcity" fallacy that Bitcoin maxis always bring up

https://github.com/libbitcoin/libbitcoin-system/wiki/Scarcity-Fallacy

So, no those two things aren't contradictory. Absolute scarcity is not a measurement. It is a true/false attribute. Scarcity in general has degrees yes. Corn for instance, there is a number of corn kernels on the planet. It's probably unknowable but there is a number. The problem is corn is a produceable good meaning even the last kernel on earth can be reproduced. Absolute scarcity means the number of something in existence is fixed. Such as the number of authentic Monet paintings, or Bitcoin. Subjective value theory has no qualms with this for goods because goods can be scarce but not absolutely scarce. A Monet painting being finite means it is technically priceless not because it is valuable but because it cannot be reproduced (authentically).

Bitcoin's value is derived from the human valuation of the 5 properties I expounded upon earlier (Scarcity, Divisibility, Durability, Verifiability, and Portability). Scarcity is merely one of the five but the point is that it's scarcity is absolute or finite meaning it is perfectly scarce compared to all physical assets. It is all of the attributes combined with a human want for a neutral money that derives the value we see today.

What is contradictory is the common claim that a fixed supply is *necessarily* more valuable when value is subjective. That's often a point Bitcoin maxis always try to make to dismiss anything without fixed supply.

If no one demands even a fixed supply, then it is worthless. A fixed supply *alone* means nothing.

Yes, I agree with the last part though you're forgetting fungibility which Bitcoin is a weaker property of Bitcoin.

No, that's not the claim. Fixed supply is necessary for a money to not be debased. That's all. That has proven to be a valued feature.

As far as fungibility goes what is the argument? Either a bitcoin is a bitcoin and is worth the same or it's non-fungible because it's auditable or verifiable which one?

Dollars have serial numbers and mints.

Gold has specific molecules that CAN be serialized and verified as gold.

If an asset is "Fungible" to the point of being indistinct, how does one verify supply?

Beside ALL of that, fungibility is not an important attribute of a monetary asset. It is superfluous to the function of money. Like the money having a dead president on it or being a rectangle.

Ideal fungibility would mean any unit is indistinguishable from another. Bitcoin has unique transaction histories making it's fungibility worse than Monero.

They can be priced differently based on that. They already are with freshly mined Bitcoin and "tainted" histories.

Dollars are more fungible because it's full history of ownership and transactions aren't visible despite being serialized.

Gold can be serialized, but can be melted back down.

In the crypto world through ZKPs

You can argue the importance of fungibility vs the other qualities of money, but an ideal money would be perfectly fungible and have all the other properties you listed.

Fungibility is superfluous. It has no bearing on the perfect money. This is akin to saying the perfect money would look like a pear or would be able to bounce off of a steel table. Fungibility is unimportant because the previous owners of a money is irrelevant. An ounce of gold owned by a king is not a more or less perfect money because he can have been proven or not to have owned it.

Fungibility has always been a property of money. A quick search would show you this. It does matters for crypto because it's a public ledger. You can say all you want that it doesn't matter but there are countless examples of tainted Bitcoin affecting users and it's price. A simple example is ordinals. That was only possible because of Bitcoins transparency.

It seems that at every turn you would like to debate facts. I am not really interested in doing that.

And you dont? What are we going to debate non-facts? Or should I just accept something that is blatantly false? Fungibility is a property of money. It's kind of ridiuclous I even have to debate that fact for someone who claimed to be an economics expert.

You don't debate facts. You debate opinions.

As to fungibility you are making a classification error. I can say: "All mammals have a nose."

This however does not mean that if an animal has a nose, that it is a mammal. The same goes for money. Many monies have a fungible nature. Not having this feature does not preclude it from being money. However if it is not:

Scarce, durable, divisible, verifiable, and portable, it can not be money.

Something can't be money without being fungible to at least some degree. There is no such thing as non-fungible money. Fungibility is a pre-requisite. Ideal money would be perfectly fungible.

I think you're confusing a medium of exchange with money. Money implies it's a MoE, but an MoE is not necessarily money.

Agree with the last part, but I've never heard "verifiability" as being required in the classic definition of money, although that makes sense to me (recognizeable maybe?)

I don't think we'll agree though, so not sure if there is any point in continuing. Agree to disagree, but appreciate the back and forth anyway.

Yeah, I think a lot of people use recognizable instead of verifiable. It just always sat with me as too ambiguous.

That's the whole reason debates exist.

And yes you're right, you don't like facts because the fact is people use monero as a form of peer 2 peer electronic cash but you don't care about that because it doesn't pump your fiat bags.

You don't debate facts. You debate opinions. Facts are things that exist in reality. Opinions are interpretations of reality. I am fine with facts. I don't care what people use as money. If you look through the thread I spend about 99% of it defining terms that seem to not be clear to the counterpart. I have no Ill will nor do I have an incentive to pump any bags, I am doing just fine with my own financial strategies. I find monero memes funny and you guys fairly smart and privacy conscious people.

That being said, I do think that several factors like first mover advantage, network multiplier effects, absolute scarcity, adoption, auditability, and invested capital put Bitcoin in a better position to be a global reserve currency. I've said many times monero is neat. It is just in a very disadvantaged position to become a global reserve. That's all. That last bit is my speculation read: opinion. So you can debate that all you'd like.

We don't Bitcoin, or Monero to become a global reserve asset, Gold, and The U.S. Dollar both facilitate those roles just fine.

We want cryptocurrencies like Bitcoin, and Monero to become tools for medium of exchange to transmit value digitally around the world, if that requires it to become a "Global Reserve Assets" to do so then fine but I don't think so since Bitcoin was working just fine 10 years ago without Institutions, and governments hoarding it.

I mean, I hate to be pedantic yet again(sike I love this shit) but, a reserve asset is just an asset that is the preferred collateral for financial use. Global would be preferred by the world. If either weren't a global reserve asset they, by definition, wouldn't be preferred by the world and thus unimportant.

You do want monero to be important as I want bitcoin to be important. Reserve status is kind of the goal of all monies.

Cryptocurrency aims to solve two problems found in fiat, The Value Problem, and The Technology Problem.

Bitcoin was an over correction to the first problem, a supply cap doesn’t solve the issues with fiat, because the problem with fiat isn’t supply, the issue is at which rate supply is generated, in the fiat world fiat is created in excessive amounts.

In a way Bitcoin is the opposite of MMT.

Bitcoin also seeks to improve the technology problem by making value transmission faster, and more effective, and Bitcoin does solve that over the current system in most aspects, it transmit value faster, and more effectively than fiat systems, however the fiat systems are delayed intentionally to stop terrorism, money laundering, and double spending, etc., whether that’s a good thing, or bad thing is up to debate.

That being said Bitcoin is more effective than the current fiat system at maintaining value, and transmission of value, however based off of economic principles such as velocity, and supply, Bitcoin fails, since Bitcoin becomes too valuable to use as a Medium of Exchange, and while Bitcoin solves the technology problem, other technologies like XRP, and Monero solve it better but yes the counter argument could be that lightning is also sufficient as a global transmission layer.

I think the practicality of Lightning will be used as custodial services if adopted by the masses but that is counter intuitive to money which is developed to be against centralized entities (malicious or not).

Bitcoin is too valuable, Monero is valuable enough to spend but not so valuable that it can be replaced.

If I lost 1 Bitcoin I would be devastated due to the absolute scarcity, however if I lost 1 Monero I could easily recoup that in 4 minutes of mining (assuming I hit two blocks successfully solo mining).

My debate is focused around Medium of Exchange, not assets, or global reserves, and while money may benefit from that, I think Bitcoin is a sort of stand in/proxy for cryptocurrency at large.

I acknowledge Monero will not become a global reserve assets in publicly audited ledgers, however I assure you the Department of Defense will utilize Monero for their Black Budgets.

But we can argue semantics, it appears we have two different reasonings/logics, which is why our disconnect in debate keeps occurring.

How funny would it be if I just said "K"

To be honest, a lot of what you said is kind of gobbledygook. The bitcoin/ monero comparison is just kind of opinion stuff that we just simply disagree. Monero has all the 5 attributes of money I have stated before, no contention there.

As for assets, mediums of exchange, and a money being TOO valuable, I dunno it's a lot to kind of break down and there are again definitional issues.

Assets are goods, objects, or just property in general. Saying you are focused on medium of exchange not assets is kind of misunderstanding what the difference between a monetary assets and currencies are. The medium of exchange is a currency that is redeemable for the reserve asset. Focusing on a medium of exchange without establishing the reserve asset is exactly what fiat currency is. Gold not being redeemable for dollars is what makes dollars not a medium of exchange. It is the misapprehension that dollars are backed by an asset that keeps everyone in this delusion.

Also the problem isn't the rate of currency expansion, it is the mere ability to increase it arbitrarily.

As for bitcoin being too valuable, the fact that it is divisible kind of makes that a non issue. It's not as if you have to use bitcoin in whole numbers. So, I'm not really sure what that issue is. I mean "losing a bitcoin" is kind of a "well, don't do that" type situation. If you lost your car somewhere that isn't an argument against using a car.

As to your assertion that cryptocrurrency's (a moniker I despise BTW) goal is to solve a value problem, I don't see that as the issue exactly. Value is subjective so it's a very difficult thing to "solve" I think bitcoin, lightning specifically solves the debasement problem. (The arbitrary expansion of currency supply). The prominent currency of bitcoin, (not bitcoin itself) lightning, is smart contract tied in a 2/2 multisig contract. It is programmatically assured to be redeemable for bitcoin on chain. This is the solution to the fiat problem. Bitcoin is the solution to the technological problem of having the reserve asset be gold. Gold is heavy, not infinitely divisible, and can be hard(expensive) to verify with certain metallurgical tricks.

As far as the custodial nature of Lightning, it's just not true. People are lazy but it is not a barrier to entry to not have a custodian. You literally just run a computer. It's not insurmountable.

Boy, these discussions are a slog. I swear Mises and Rothbard wrote a lot of this stuff down already. (Minus the bitcoin that is) They might have mentioned Monero though.

"Given that non-decreasing demand is not assured the theory is invalid"

That's rock solid logic right there, the demand for money will decrease therefore the subjective value of an absolutely scarce money will not sustain. Lol, just let me know when you walk up to a person and ask "Do you want some money?" And they say "Nah, I have enough."

Makes perfect sense. You can fix supply all you want, you can't control demand, both are a function of value.

"Bitcoin cannot increase in value only because of absolute scarcity."

...demand for money is infinite because it's the most saleable good. That should be obvious. Like I said, ask someone if they want some money, they won't refuse.

Bitcoin isn't money. It's not the most saleable good...

Money, the class of good, is the most saleable not a specific money... This is like saying Gold isn't money because it isn't the most saleable. I mean, either you are being purposefully obtuse or you don't understand what you are saying.

Is money the most saleable good or not? If the definition doesn't matter then the word money means nothing.

Okay so, you don't understand the phrase "Money is the most saleable good"

It means things that are money are more saleable than nonmonetary goods like soy beans. Money is a classification of goods that are used, not to be consumed but, primarily to be traded for consumable goods and services. This is called monetary premium.

we like the coin 😂

Wait until they hear about zaps

NOoooOoOO LIgHtnInG dOesNt woRk

So very true.

🤣🤣🤣🤣