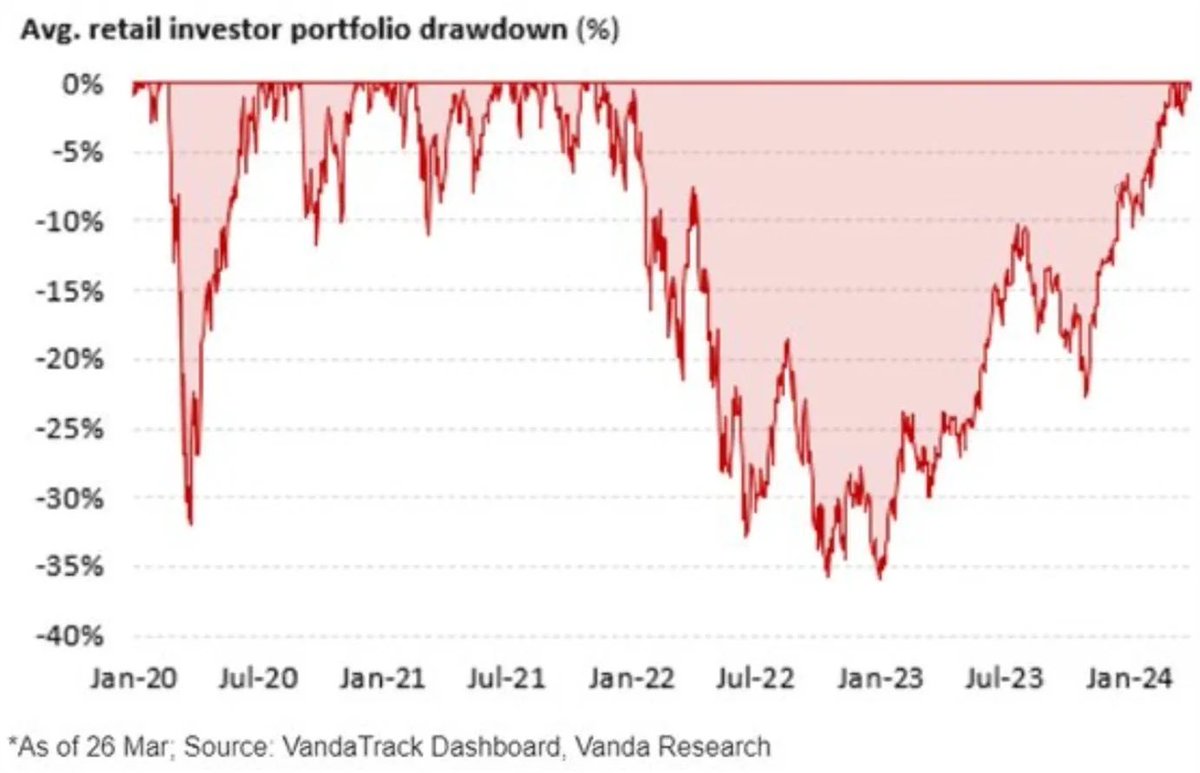

金融教育是关键。事实上,5月份美国交易量最大的10只股票中有7只都是低价股,而且这些公司没有一家实现盈利。从2012年到2021年,标普500指数的平均回报率为16.6%,几乎是平均投资者回报率8.7%的两倍。2022年,散户投资者平均亏损35%,需要1.5年时间才能挽回损失。这比标普500指数下跌25%还要糟糕。

Financial Education is KEY. In fact, 7 of the top 10 most traded US stocks in May were penny stocks and none these companies are profitable. From 2012 to 2021, the S&P 500 average return of 16.6% almost doubled the average investor of 8.7%. In 2022, the average retail investor lost 35% and it took 1.5 yrs to recover the loss. This is way worse than the S&P 500 drawdown of 25%.