Michael Saylor: "Soon every billionaire will buy a billion dollars of #Bitcoin and the supply shock will be so great that we will stop measuring $BTC in terms of fiat."

Discussion

He sounds to be on the bullish side of the argument. Good to hear his perspective to balance all the pessimism. Good luck to him.

All $6 Billion dollars worth of platinum is mined each year. Only 2,700 billionaires in the world. It would take a few centuries to to supply each billionaire with a billion dollars worth of platinum.

There is an infinite supply of platinum. There are only 21m bitcoin. Platinum requires armed guards and vaults and boats and trucks to be moved. Any amount of Bitcoin can be sent across the globe in 10 minutes for pennies without permission and is more secure than all the global armies combined. Bitcoin can be stored in your head. Bitcoin can can transfer value in micropayments on superconducting frictionless network. Bitcoin it the world only hope for imposing physical constraints on digital machines like a.i, and all digital security and elections. Bitcoin is an immutable data storage ledger that can record true history regardless of who the winner is. Enjoy your shiny grey rocks. Have fun staying poor.

All the platinum that has been mined in the world would fit in an olympic pool and it would only be an ankle deep.

In a world of infinite platinum, what would be the price of that platinum need to be to mine all this platinum? The price would have to be exponentially higher.

If you are simply wanting to moving money. You could replace the word bitcoin for Zcash, Monero, or Bcash. You take your pick. Simply moving money over the internet securely and quickly can be done with any one of those three.

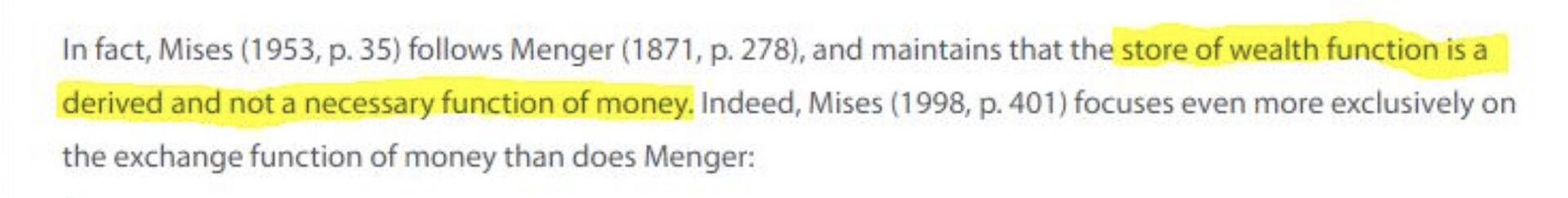

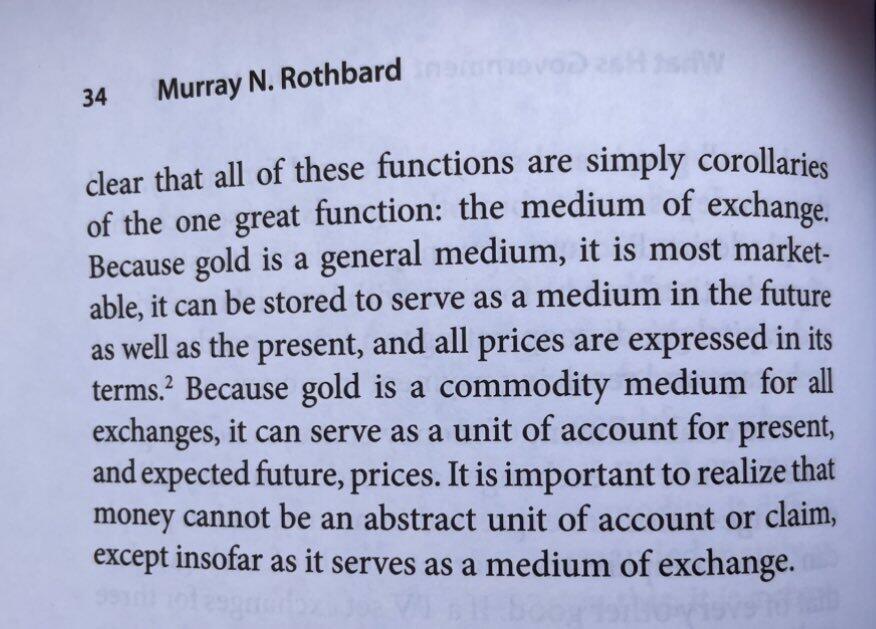

But zcash, monero and bcash are trending to zero and cannot work transfer value because they are worthless, they hold no value. Remember the fact that money is a store of value first, then medium of exchange, then a unit of account. Platinum gets exponentially easier and cheaper to mine with technological advancement and energy capture. The production of a commodity like platinum always fall to its marginal utility value, zero in other words. Bitcoin mining difficulty scales with technology and energy, it is therefore the hardest most value preserving money possible, the only option for value transfer and its marginal utility always remains on par with the price of the best money because its utility is money.