They are doing worse in the UK.

Discussion

£10,000 is the tax reporting limit here.

We normally work with £9,990 lumps 😂

Oh, okay. Cool.

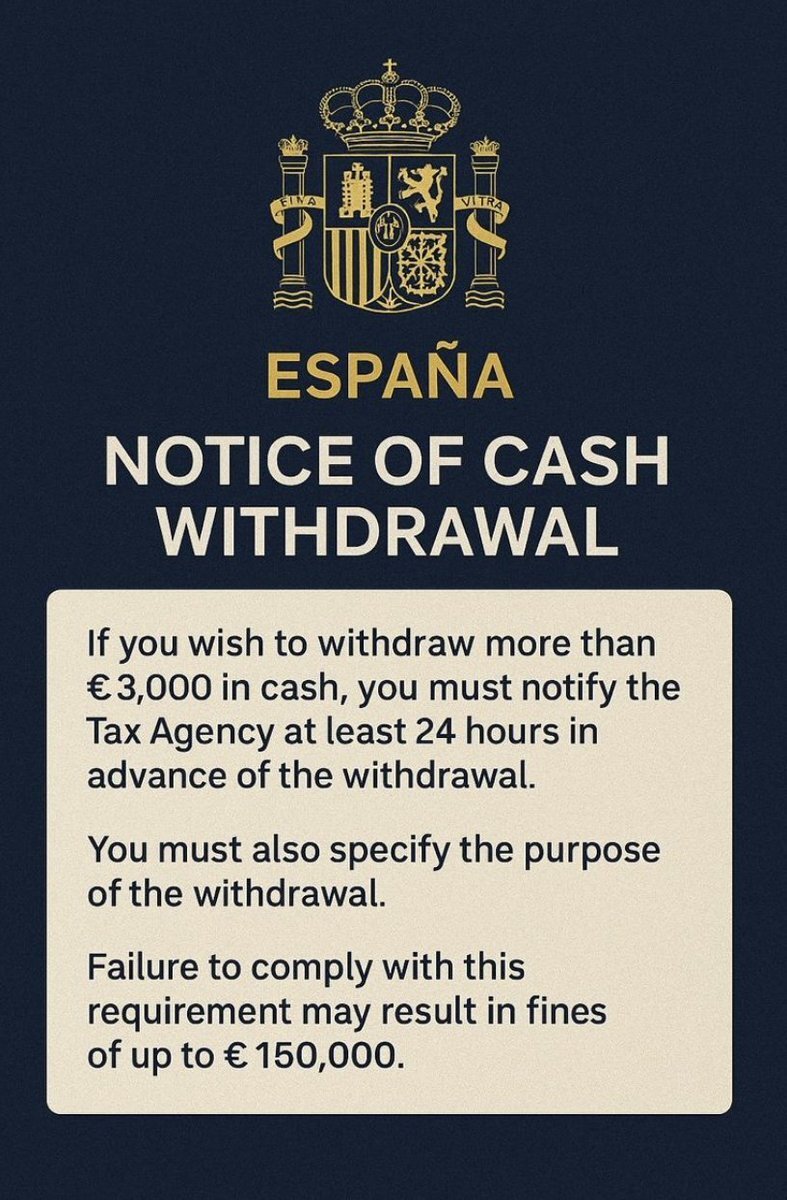

I thought they'd dropped that to 3k?

We're moving just under £10K batches around relatively easily while transferring my wife's pension into Bitcoin.

I just did that for my woman kyc3 of course.

So I just looked it up. Different banks, different amounts in the uk

We’re talking about different things.

All movements of money above £10K have to be reported to the government.

Cash withdrawal limits do differ between banks, but this is nothing to do with tax, that is more to do with money laundering.

Yep, depends on the bank somewhat. I was transferring ISAs around last year and boy did I get grilled. Wasn’t even cash withdrawals (Twas between banks online). Closed the offending bank immediately because the questioning was pure overreach. As for cash, because the “tracking” is lost upon withdrawal, they really make things difficult. Urrgh makes my blood boil. MY MONEY!

Once it's in a bank, it's their money, legally.

£3k is captial gains allowance:

https://www.gov.uk/guidance/capital-gains-tax-rates-and-allowances

My bank goes on high alert if anything more than £200 happens...

Move £250 and they get a SWAT team out.

😂

You are on a watch list, innit

Well an indie music maker with more than £200 is pretty suspicious to be fair…

And you know nostr:npub1c39tdmht8g896hyd3t5z47ksuwtmm77fyqxhmr7rac22d85lwsxqzk2lhm! Proper dodgy