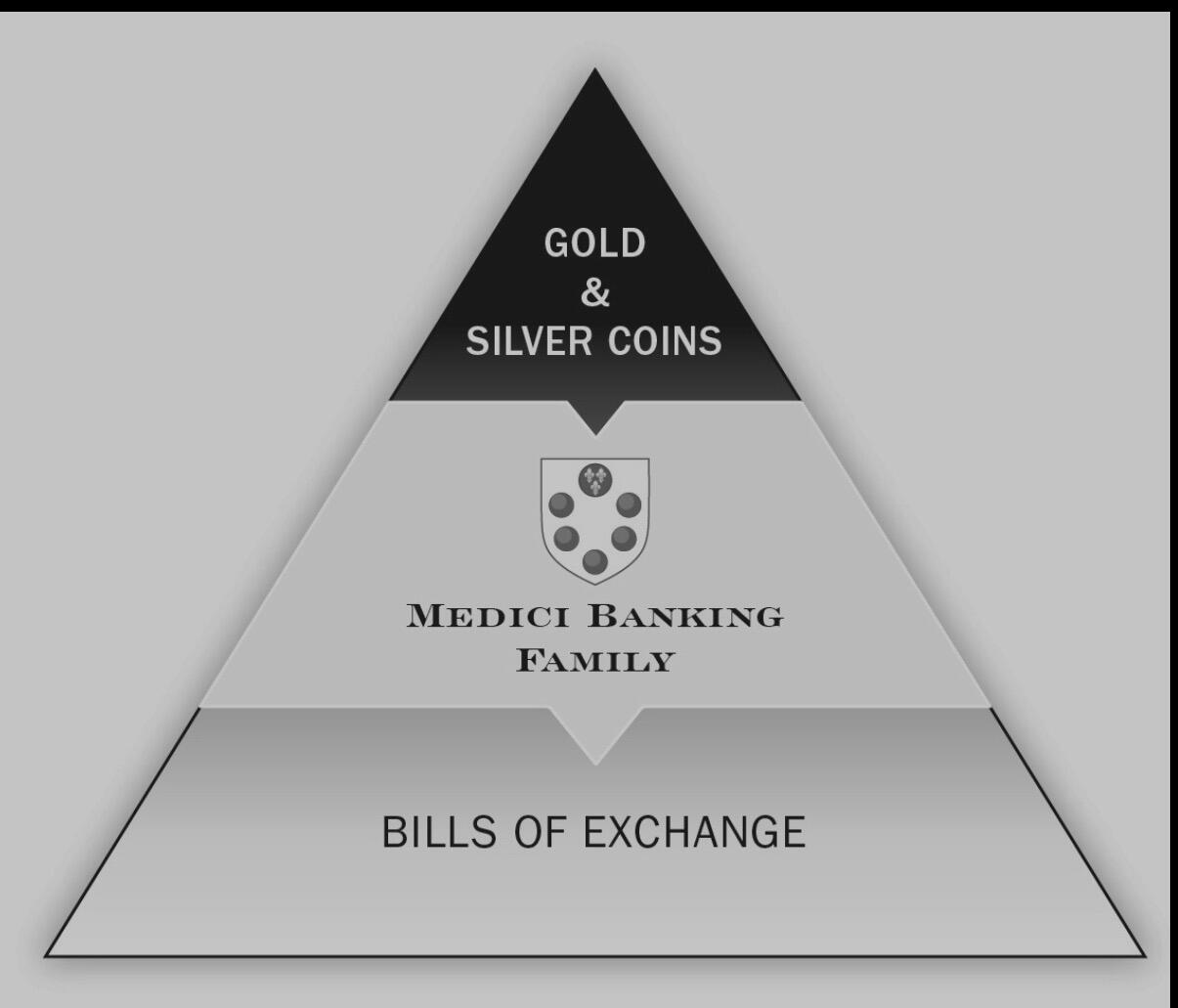

Right now, Cashu is being used as a money warehouse receipt. In history, it actually started that way when people deposited their gold and started to use the receipts as cash. The warehouse operators discovered when holding all that gold, they could issue bogus receipts, so long as they could cover redemptions.

Bills of exchange are a little bit different. If I couldn’t pay for something right away, I could issue a ‘promise to pay’ sometime in the future. This promise could be transferred by endorsing it. When the promise to pay came due, someone else could present the note, I could look at the string of signatures and say, ‘yep, that’s mine, I’ll pay’.

So both are treated as ‘cash’ but slightly different mechanisms. In the end, what is acceptable as ‘cash’ is in the eye of the beholder and whatever is used to facilitate a trade transaction.

Cashu can serve both use cases. The first, you’ll have mint operators that are in the business, the second is a more distributed case where everybody is their own mint. Who knows what will play out? I’m all in for the experimentation.

If we define cash as base money with no counter party risk, then credit money tokens are not cash.

I'm not sure if cashu is the right tech for bill of exchange, as there are strict requirements for a contract to be classified as a bill. For example, a bill cannot be divisible, it requires signatures of both the sender and receiver, it should have an invoice attached etc. I think this can be all done with nostr alone.

This needs more nuance, I prefer a risk view:

1. Ecash gives 'cash' finality on counterparty risk just fine.

2. Yes, there is mints' issuer risk but that's a different matter altogether.

3. Last, sovereign risk on the base denomination, nation states or DAOs whether formalised or informal like Bitcoin.

So better: base money CAN be used as cash – with certain trade offs – but not all cash needs to be base money, it just has other trade-offs.

Thread collapsed

Cash is just a transferable credit note. Cashu is an electronic version of that. ‘Money’ is whatever is acceptable for exchange, Bitcoin, in our case. Cashu is just another transfer instrument - better privacy, but with additional counterparty risk, namely the owner of the mint.

Let’s be precise, it’s easier to write code:

Cashu (and Fedimint) is ‘Issuer Risk’, not ‘Counterparty risk’.

Fair point. I was including issuer risk in a more general definition of counterparty.

Thread collapsed

Thread collapsed

Thread collapsed

Thread collapsed