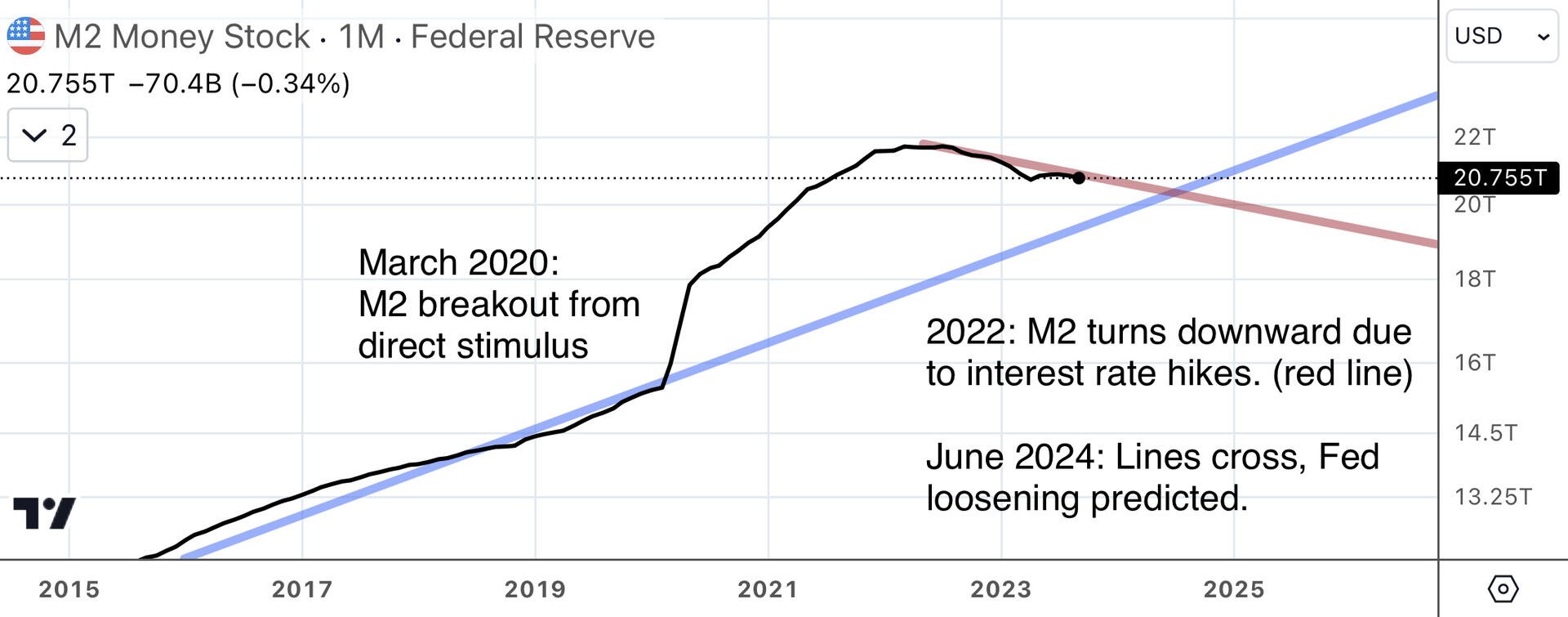

Prediction: Fed will loosen in summer 2024.

Explanation in three parts.

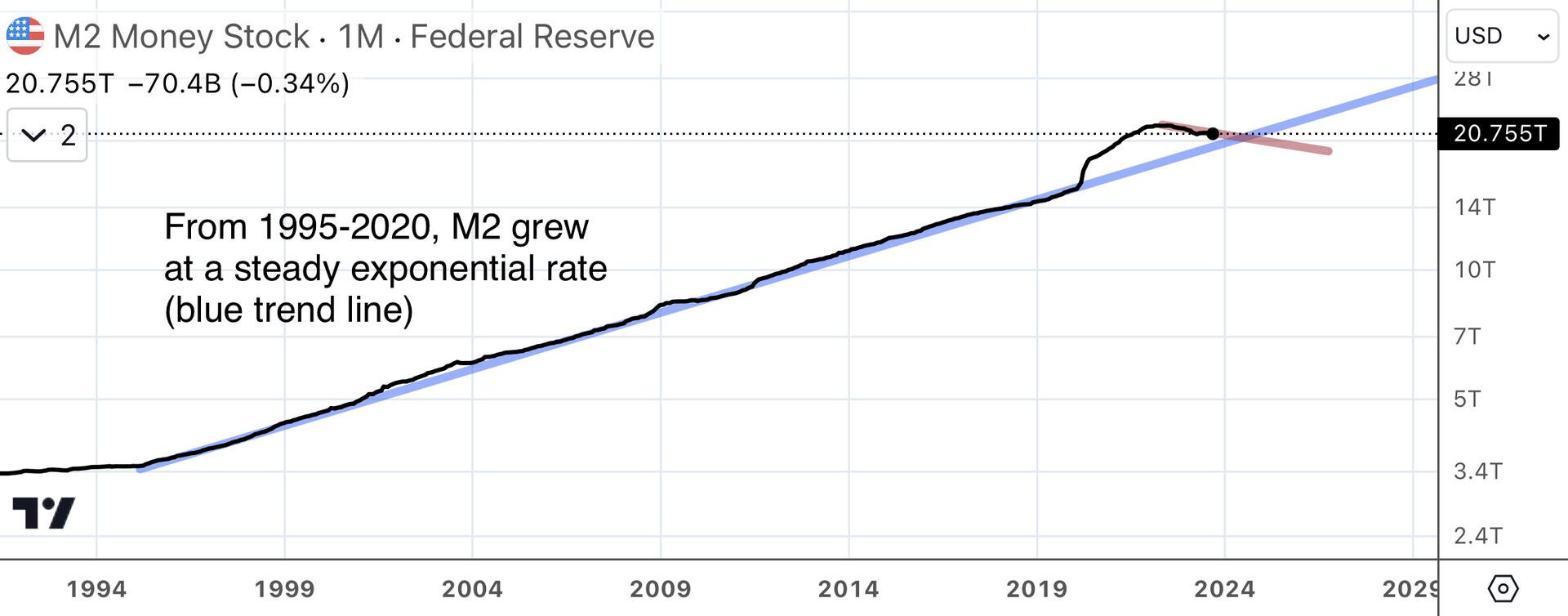

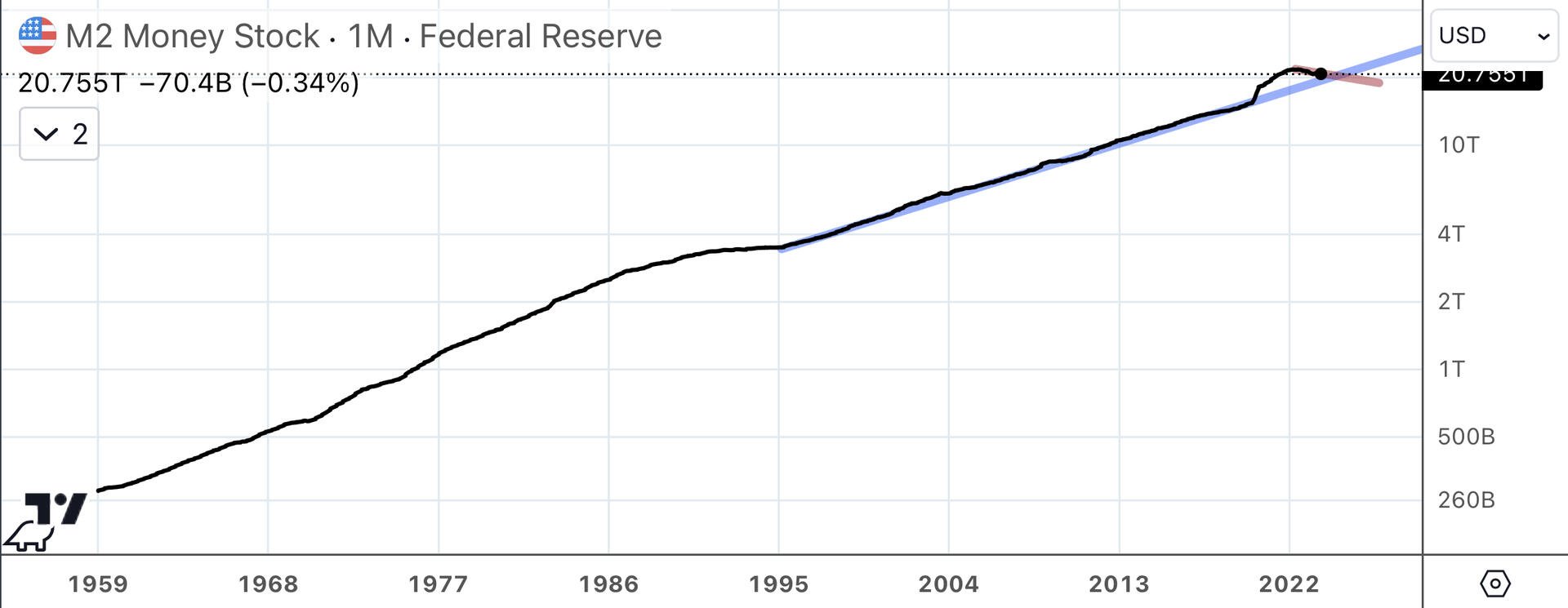

1) From 1995-2020, M2 grew at a steady exponential rate, shown as a straight blue line on the first chart. The dot com bubble/bust, September 11, the global financial crisis of 2008–none of these caused a meaningful deviation from trend.

2) March 2020 broke the trend. M2 shot up due to direct stimulus checks. This caused price inflation.

3) The Fed’s 2022 tightening caused M2 to trend downward, shown as a red line on the second chart. The red line intersects the blue in June/July 2024.

Conclusion: In summer 2024, the Fed will have succeeded in bribing M2 money supply growth back to the 25 year trend and will resume their loose, expansionary monetary policy.